A Quick Analysis On Real Matters' (TSE:REAL) CEO Compensation

Jason Smith is the CEO of Real Matters Inc. (TSE:REAL), and in this article, we analyze the executive's compensation package with respect to the overall performance of the company. This analysis will also assess whether Real Matters pays its CEO appropriately, considering recent earnings growth and total shareholder returns.

See our latest analysis for Real Matters

How Does Total Compensation For Jason Smith Compare With Other Companies In The Industry?

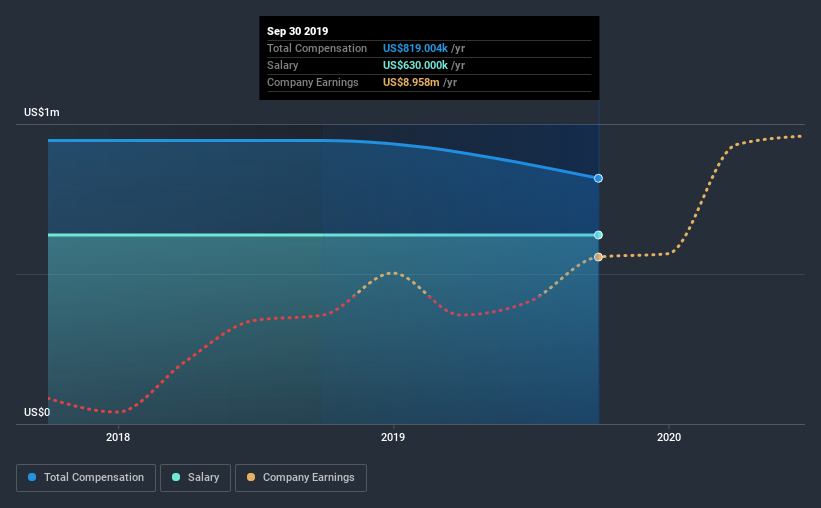

According to our data, Real Matters Inc. has a market capitalization of CA$2.7b, and paid its CEO total annual compensation worth CA$819k over the year to September 2019. We note that's a decrease of 13% compared to last year. We note that the salary portion, which stands at US$630.0k constitutes the majority of total compensation received by the CEO.

For comparison, other companies in the same industry with market capitalizations ranging between CA$1.3b and CA$4.3b had a median total CEO compensation of CA$3.9m. Accordingly, Real Matters pays its CEO under the industry median. What's more, Jason Smith holds CA$129m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

Component | 2019 | 2018 | Proportion (2019) |

Salary | CA$630k | CA$630k | 77% |

Other | CA$189k | CA$315k | 23% |

Total Compensation | CA$819k | CA$945k | 100% |

On an industry level, total compensation is equally proportioned between salary and other compensation, that is, they each represent approximately 50% of the total compensation. According to our research, Real Matters has allocated a higher percentage of pay to salary in comparison to the wider industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Real Matters Inc.'s Growth Numbers

Real Matters Inc. has seen its earnings per share (EPS) increase by 125% a year over the past three years. In the last year, its revenue is up 55%.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's great to see that revenue growth is strong, too. These metrics suggest the business is growing strongly. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Real Matters Inc. Been A Good Investment?

We think that the total shareholder return of 279%, over three years, would leave most Real Matters Inc. shareholders smiling. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

In Summary...

As we touched on above, Real Matters Inc. is currently paying its CEO below the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. Since earnings growth is heading in a positive direction; many would agree with our assessment that the pay is modest. Given the strong history of shareholder returns, the shareholders are probably very happy with Jason's performance.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. We did our research and spotted 2 warning signs for Real Matters that investors should look into moving forward.

Important note: Real Matters is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo News

Yahoo News