Our railways don't require renationalising – they just need a little Japanese thinking

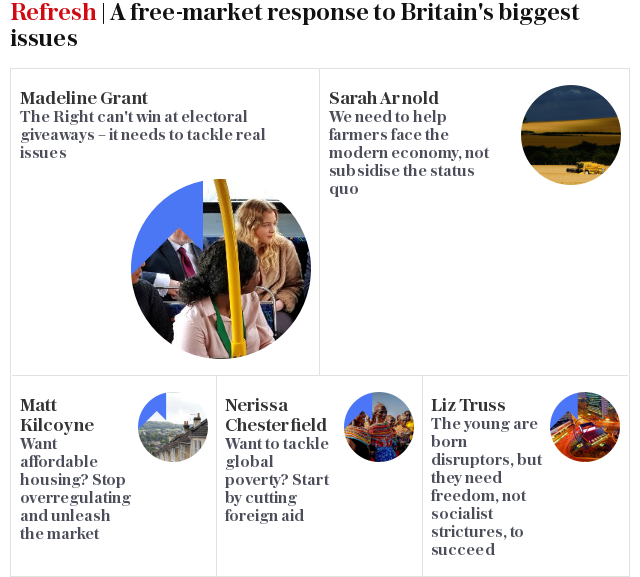

Welcome to Refresh – a series of comment pieces by young people, for young people, looking for a response to Britain's biggest issues

Britain’s privatised train companies are struggling, nevertheless, renationalisation may not be necessary in the future if we can learn from the Japanese.

In 2015, Jeremy Corbyn observed that there is “overwhelming support from the British for a ‘People’s Railway’.” This is understandable, given that a YouGov poll in 2013 found that 66 per cent of people advocated for publicly owned railways, including 52 per cent of Conservative voters.

Those who want nationalisation argue that privatised train companies have not performed as well as they were supposed to in theory. With poor service, rising prices, and frequent delays and cancellations, it’s an argument that looks impossible to win.

However, there is still time to reverse the calls for nationalisation and staunch the haemorrhaging losses of Network Rail, but only if the right solutions can be prescribed.

To find a cure to the UK’s struggling train operators, one need only look as far as Japan, one of the most successful rail privatisation projects ever.

Japanese National Railways (JNR) was privatised in 1987, with formation of 3 regional companies, along with 15 more that cover rail networks in large urban communities, and around 100 smaller entities that combine public and private ownership.

The failure of British rail franchises to operate without subsidy should be deeply troubling

Since then, the three main regional operators have not only remained profitable, but have been able to pay off their construction debts while carrying out capital improvements within their networks. One of the largest regional companies, JR East, doesn’t depend on any kind of state subsidy.

The success of Japan’s train companies offers proof that operators are capable of being financially independent.

Indeed, the failure of British rail franchises to operate without subsidy should be deeply troubling, and not just because of the pressure on an already overstretched public purse.

Michael Moran, one of the authors of a report on rail privatisation in the UK argues that British train companies have been in need of “large, hidden and indirect” subsidies from the semi-public Network Rail (NR), which runs rail infrastructure.

He argues that as a result, NR suffers from huge debts (£30bn), making it “increasingly unsustainable”. This poses the risk that they will need an eventual government bailout, in which case privatisation will simply not have served its purpose.

To prevent such a catastrophe from happening, it is necessary to look at the main factors that have made Japanese train companies more financially independent and profitable than their British counterparts.

The first is the lack of separation between the train operations and infrastructure management. Unlike the UK, where the train operators and NR are separate entities, the Japanese railways own all the stations, rolling stock and tracks, meaning that the management of both are not duplicated as they are in the UK, and that communication between operators and infrastructure are seamless.

As a result, operating costs are lower, and confusion over new timetables, which have caused enormous disruption in the UK, is less likely. Rail managers in Japan point to this as being one of the most critical reasons for their efficiency.

Owning all the infrastructure, while not receiving state subsidies also forces the private operators to be more creative in increasing profitability.

A third of JR East’s revenue comes from shopping malls, blocks of offices and flats with all the proceeds being reinvested into their rail network

In Japan, this took the form of strong diversification, which involved train companies playing a large role in developing housing areas, retail outlets at, or in the vicinity of train stations in order to boost their profitability. In fact, a third of JR East’s revenue comes from shopping malls, blocks of offices and flats with all the proceeds being reinvested into their rail network.

As a result of higher profitability and large-scale investment, it is much less likely that an operator will just walk away when they are not making enough money – a concern raised by some in the wake of the early termination of the East Coast franchise this year.

Matching the success and standards of Japan’s railway companies will require both time and some initial support, but as Japan has proved, it is workable.

The transfer of all railway infrastructure into the hands of privatised train companies would help improve efficiency, while allowing commercial developments alongside the railway lines and stations would both, boost revenue, and provide an alternate source of income other than railway fares.

For this to work in the UK, some easing of the much tougher planning regulations would almost certainly be necessary in order to speed up planning applications and quickly enable privatised rail companies to enjoy a return on their investment.

Compared to the failed nationalised and privatised models that have been tried in the UK, the Japanese solution seems a far more attractive and credible alternative. However, for it to work, the Government must show courage and clear-sighted determination.

For more from Refresh, including debates, videos and events, join our Facebook group and follow us on Twitter @TeleRefresh

Refresh | |

Facebook Group · 475 members | |

Join Group |

______________________________________________________ What is Refresh? Refresh is a policy discussion forum with the express aim of reinvigorating s...

Yahoo News

Yahoo News