Reflecting on ReadyTech Holdings' (ASX:RDY) Share Price Returns Over The Last Year

It's easy to match the overall market return by buying an index fund. While individual stocks can be big winners, plenty more fail to generate satisfactory returns. Investors in ReadyTech Holdings Limited (ASX:RDY) have tasted that bitter downside in the last year, as the share price dropped 15%. That's disappointing when you consider the market declined 4.1%. ReadyTech Holdings hasn't been listed for long, so although we're wary of recent listings that perform poorly, it may still prove itself with time. It's up 7.1% in the last seven days.

View our latest analysis for ReadyTech Holdings

We don't think that ReadyTech Holdings' modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. It would be hard to believe in a more profitable future without growing revenues.

ReadyTech Holdings grew its revenue by 23% over the last year. We think that is pretty nice growth. Unfortunately that wasn't good enough to stop the share price dropping 15%. This implies the market was expecting better growth. But if revenue keeps growing, then at a certain point the share price would likely follow.

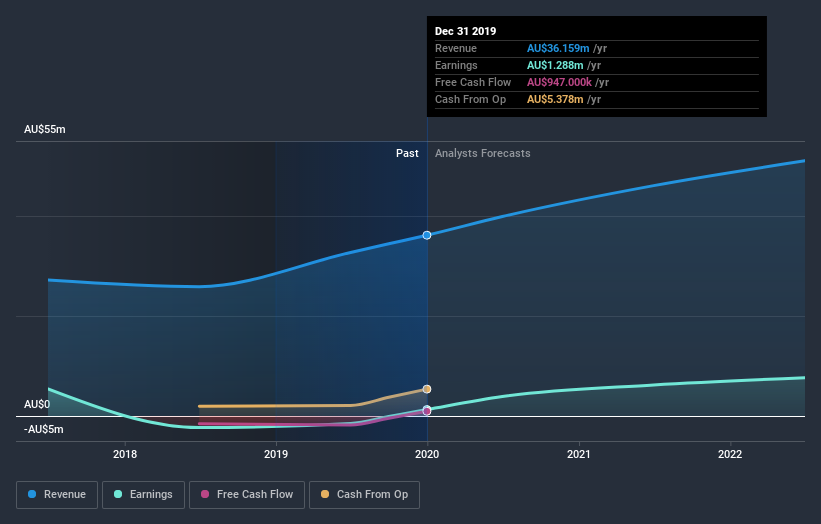

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We know that ReadyTech Holdings has improved its bottom line lately, but what does the future have in store? So we recommend checking out this free report showing consensus forecasts

A Different Perspective

We doubt ReadyTech Holdings shareholders are happy with the loss of 15% over twelve months. That falls short of the market, which lost 4.1%. There's no doubt that's a disappointment, but the stock may well have fared better in a stronger market. With the stock down 2.0% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. It's always interesting to track share price performance over the longer term. But to understand ReadyTech Holdings better, we need to consider many other factors. Even so, be aware that ReadyTech Holdings is showing 2 warning signs in our investment analysis , and 1 of those can't be ignored...

Of course ReadyTech Holdings may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo News

Yahoo News