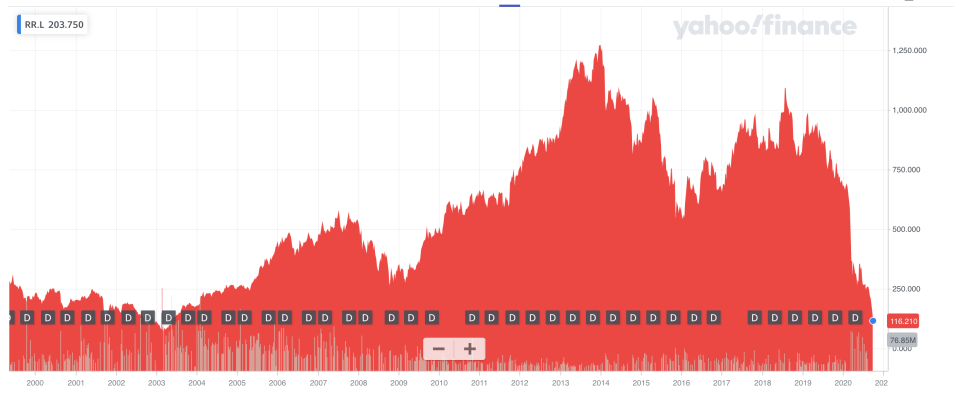

Rolls-Royce shares hit 17-year low on £5bn fundraising plans

Watch: Rolls-Royce asks shareholders for £2bn to deal with COVID-19 blow

Shares in struggling engine maker Rolls-Royce (RR.L) hit a 17-year-low on Thursday after the company announced plans to raise £5bn ($6.5bn) in debt and equity to shore up its balance sheet.

Rolls-Royce announced the plans, which include a highly discounted share issue, in a statement on Thursday. The funds will be used to repair the company’s balance sheet from the blow dealt by the COVID-19 pandemic.

Rolls-Royce is seeking to raise £2bn by selling new shares to investors in a 10-to-3 rights issue. The issue, which comes at a 41% discount, is fully underwritten.

Separately, the company plans to raise up to £3bn in debt. Rolls-Royce is planning to issue a new £1bn bond, has negotiated a new £1bn term loan, and has support from the government’s Export Finance to extend an existing five year loan by a further £1bn.

Rolls-Royce said the fundraising measures were necessary to reduce balance sheet leverage and improve liquidity. The additional cash should help the business “weather macroeconomic risks.”

“We are undertaking decisive and transformative action to fundamentally restructure our operations, materially reduce our cost base and improve our financial position,” chief executive Warren East said.

“The capital raise announced today improves our resilience to navigate the current uncertain operating environment.”

Shares in the business slumped over 10% on the announcement, falling to their lowest level since mid-2003.

The COVID-19 pandemic has devastated Rolls-Royce’s business. Much of its revenue comes from making engines for aeroplanes but the collapse of aviation since the pandemic struck has led to collapsing sales.

Rolls-Royce lost £5.4bn in the first six months of the year and has announced plans to cut 9,000 jobs globally in response. The company does not expect air travel to bounce back for several years and is forecasting a return to positive cash generation only by 2022.

“The sudden and material effect of the COVID-19 pandemic has had a significant impact on the commercial aviation industry, resulting in a sharp deterioration in the financial performance of our Civil Aerospace business and, to a lesser extent, our Power Systems business,” East said on Thursday.

READ MORE: Boris Johnson warns further restrictions to fight COVID possible

Susannah Streeter, senior investment and markets analyst, Hargreaves Lansdown said the rights issue was the “least worst option to help it deal with the crushing impact the pandemic has inflicted on its core business.”

“The aircraft manufacturer is in a bleak position given the collapse in international air travel,” Streeter said.

“There is little end in sight for the falling demand for new planes and it’s already shed assets and announced mass job losses.”

Investors will vote on whether to approve the rights issue at a meeting on 27 October.

Yahoo News

Yahoo News