Santander UK boss on the fate of bank branches

Rapid innovation in financial technology in an increasingly digitised world has led to a furious debate over the death of cash and bank branches staffed by real people.

As fintech companies and challenger banks are offering easier ways to make payments, budget, and do day-to-day banking without interacting with a person, bank branches have been facing the chop across the country.

Data from Which? found 3,312 bank and building society branches have closed in the UK since January 2015 – or about 55 per month. Another 100 branches are already scheduled to close in 2019.

Over the weekend, reports surfaced that UK bank TSB, owned by Spanish lender Sabadell (SAB.MC), may close up to 100 branches, putting 400 jobs at risk. In January, Santander announced that it would close 140 branches in the UK, putting more than 1,200 jobs at risk.

READ MORE: Hundreds of jobs at risk as TSB 'may close up to 100 branches'

However, speaking on stage at the FinTECH Talents conference in London, during the session ‘Where we are going, will we need banks?,’ a Santander UK chief emphasised that bank branches are still very much part of the bank’s strategy for the future.

“Santander UK is a product of previous brands so almost 100% of those closures where there was due retention. We are committed to having a multi-channel operation because they are different — not by segment but by experience and what they are going through at the time,” said Ceri Godwin, Director Growth & Advisory, Emtech, Santander UK.

“I actually think multichannel operations is absolutely key going forward because for different products and services, you want a different touchpoint. Sometimes you genuinely want to talk to a person other times you just want to be on the phone. So I actually think full financial services require a full service operation.”

The death of cash?

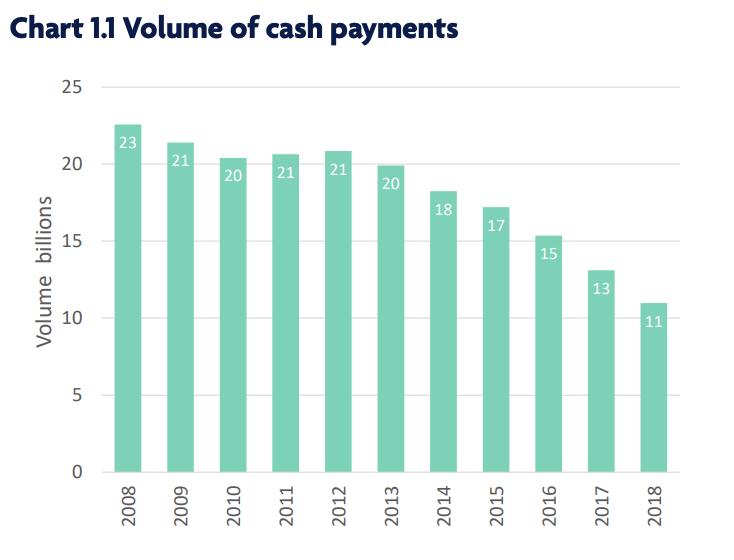

Major trade association UK Finance, which represents around 300 firms in Britain providing credit, banking, markets and payment-related services, pointed out in a recent report that cash payments have been declining in the UK for many years.

“This trend continued in 2018, with cash payments falling by 16% to 10.9 billion payments. As cash payments declined debit card payments continued to grow. Debit cards overtook cash as the most frequently used payment method in 2017 and their use increased again in 2018,” it said.

Meanwhile, there was a 9% decline in cash machines in the UK from the end of 2018, compared to the previous year. The total volume of cash machine withdrawals also fell by 7% to 2.4 billion while the value withdrawn declined by 6% to £193bn ($248.6bn). In other words, fewer people were taking out money and when they did, the amount they took out was a lower value than before.

But there is a societal danger to moving towards a full cashless society.

In December, the group Access to Cash said that Britain risks “sleepwalking” into becoming a cashless society and that, in turn, creates huge problems for the millions of people who live in rural areas or are in a lot of debt.

“We haven’t taken a view in this report about the merit of a cashless society,” said the author of the report Natalie Ceeney, who was also the UK’s former chief financial ombudsman.

“We haven’t concluded that it’s impossible, or even undesirable. But our research does show that if we fail to plan and prepare for it properly, a cashless society would do significant harm to the millions of people who would be left behind.”

Yahoo Finance UK is proud to be a media partner for FinTECH Talents — the ultimate global fintech festival in London 11-13 November 2019. There are 3,000 festival-goers + 1,500 innovators representing over 400 different financial services institutions + Rockstar speakers & steering committee members + Over 50 hours of content sessions + Game changing tech companies + The talent of tomorrow + Craft beer and live music sessions.

Yahoo News

Yahoo News