Sensex down 300 points as Asian markets tumble, FTSE 100 dragged down by consumer stocks

The Indian equity benchmarks declined on opening on Wednesday morning, mirroring losses in other Asian markets. The Sensex fell nearly 300 points to hit an intraday low of 52,281.14 and Nifty 50 index fell below 15,700.

Asian shares stayed stuck at seven-month lows on Wednesday, as markets continued to digest a storm in Chinese equity markets, while a mixed response to major US technology earnings spurred caution.

US stocks also declined on Tuesday, retreating from all-time highs achieved in the previous session, as investors digested the latest batch of corporate earnings reports and await results from tech heavyweights including Apple Inc and Microsoft Corp, while also bracing for the Federal Reserve meeting.

The tech-heavy Nasdaq 100 tumbled as much as 2.1 per cent, while the S&P 500 declined 0.5 per cent. The Dow Jones Industrial Average ended 0.2 per cent down.

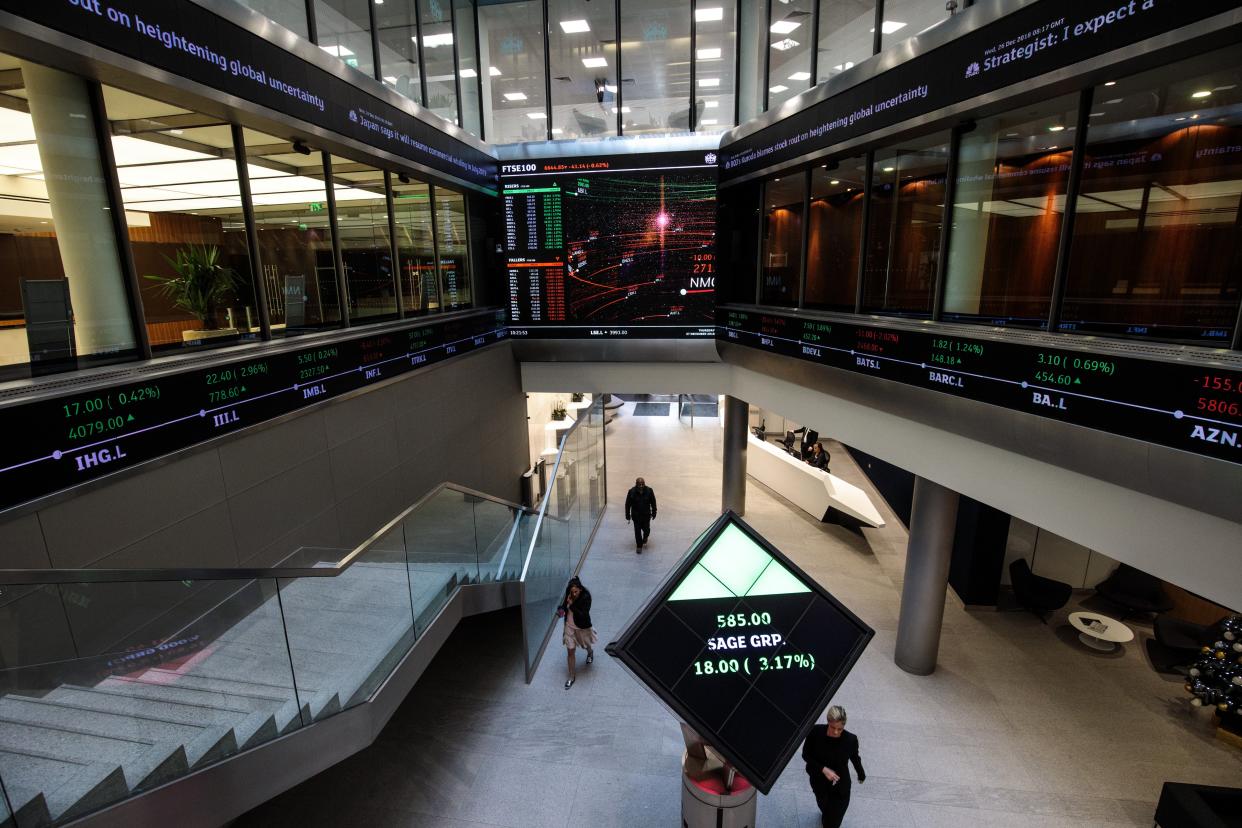

London’s FTSE 100 fell on Tuesday, weighed by insurance and consumer staple stocks, with Lysol maker Reckitt Benckiser adding to the pressure as it missed quarterly sales estimates.

The blue-chip index ended down 0.4 per cent down, with life insurers and consumer staple stocks down 1.8 per cent and 1.4 per cent respectively.

Reckitt dropped 8.4 per cent, marking its worst day since February 2003, after missing sales growth estimates and warning on margins as costs rise and easing lockdowns slow demand for products such as Lysol disinfectants.

Other consumer staple stocks, including Imperial Brands, British American Tobacco, and Associated British Foods, fell by between 0.1 per cent and 1.1 per cent.

Meanwhile, the domestically focused FTSE 250 ended 0.2 per cent down.

Yahoo News

Yahoo News