Shareholders in FansUnite Entertainment (TSE:FANS) are in the red if they invested a year ago

It's not a secret that every investor will make bad investments, from time to time. But it should be a priority to avoid stomach churning catastrophes, wherever possible. So spare a thought for the long term shareholders of FansUnite Entertainment Inc. (TSE:FANS); the share price is down a whopping 74% in the last twelve months. That'd be a striking reminder about the importance of diversification. FansUnite Entertainment hasn't been listed for long, so although we're wary of recent listings that perform poorly, it may still prove itself with time. Even worse, it's down 18% in about a month, which isn't fun at all.

So let's have a look and see if the longer term performance of the company has been in line with the underlying business' progress.

View our latest analysis for FansUnite Entertainment

Because FansUnite Entertainment made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

FansUnite Entertainment grew its revenue by 441% over the last year. That's well above most other pre-profit companies. So on the face of it we're really surprised to see the share price down 74% over twelve months. Something weird is definitely impacting the stock price; we'd venture the company has destroyed value somehow. What is clear is that the market is not judging the company on its revenue growth right now. Of course, markets do over-react so share price drop may be too harsh.

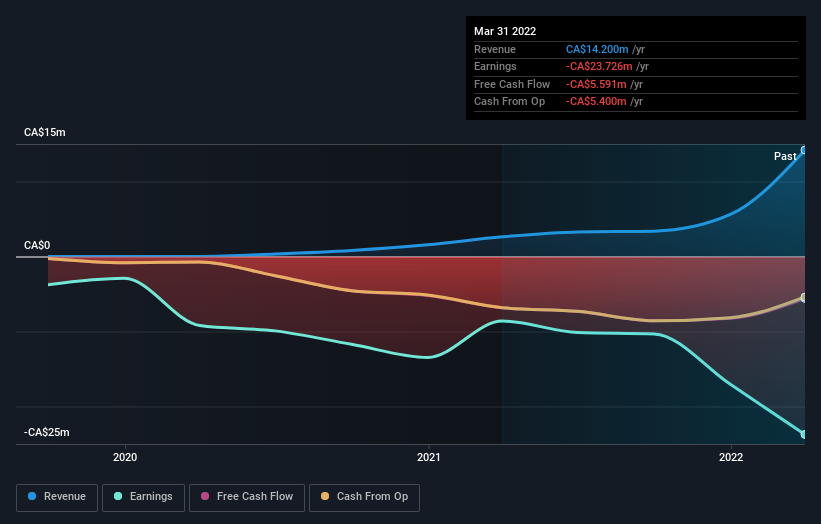

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. This free interactive report on FansUnite Entertainment's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

While FansUnite Entertainment shareholders are down 74% for the year, the market itself is up 0.8%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. The share price decline has continued throughout the most recent three months, down 15%, suggesting an absence of enthusiasm from investors. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that FansUnite Entertainment is showing 4 warning signs in our investment analysis , and 2 of those are significant...

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo News

Yahoo News