Would Shareholders Who Purchased CONSOL Energy's (NYSE:CEIX) Stock Year Be Happy With The Share price Today?

Even the best investor on earth makes unsuccessful investments. But it would be foolish to simply accept every extremely large loss as an inevitable part of the game. So spare a thought for the long term shareholders of CONSOL Energy Inc. (NYSE:CEIX); the share price is down a whopping 73% in the last twelve months. That'd be enough to make even the strongest stomachs churn. Because CONSOL Energy hasn't been listed for many years, the market is still learning about how the business performs. The falls have accelerated recently, with the share price down 27% in the last three months.

View our latest analysis for CONSOL Energy

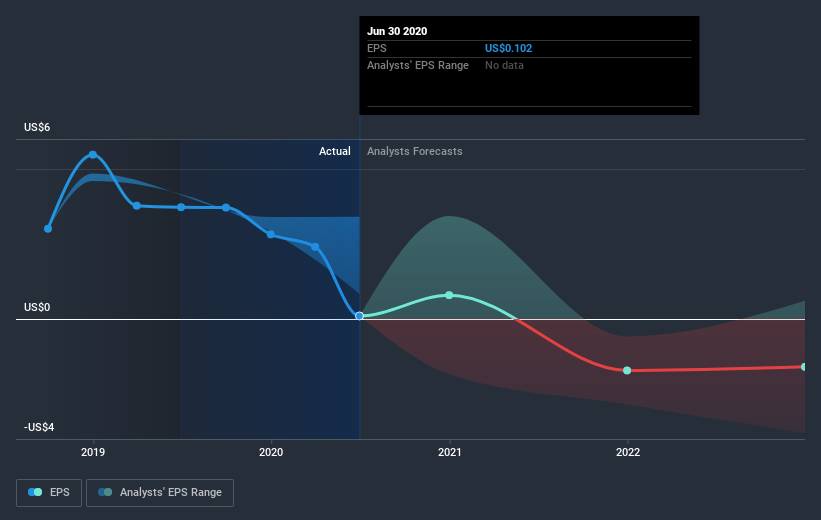

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Unhappily, CONSOL Energy had to report a 97% decline in EPS over the last year. This fall in the EPS is significantly worse than the 73% the share price fall. So the market may not be too worried about the EPS figure, at the moment -- or it may have expected earnings to drop faster.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

It might be well worthwhile taking a look at our free report on CONSOL Energy's earnings, revenue and cash flow.

A Different Perspective

While CONSOL Energy shareholders are down 73% for the year, the market itself is up 21%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. The share price decline has continued throughout the most recent three months, down 27%, suggesting an absence of enthusiasm from investors. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should learn about the 5 warning signs we've spotted with CONSOL Energy (including 2 which is are a bit unpleasant) .

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo News

Yahoo News