Would Shareholders Who Purchased Steamships Trading's(ASX:SST) Stock Three Years Be Happy With The Share price Today?

Investing in stocks inevitably means buying into some companies that perform poorly. But long term Steamships Trading Company Limited (ASX:SST) shareholders have had a particularly rough ride in the last three year. So they might be feeling emotional about the 57% share price collapse, in that time. And over the last year the share price fell 39%, so we doubt many shareholders are delighted.

View our latest analysis for Steamships Trading

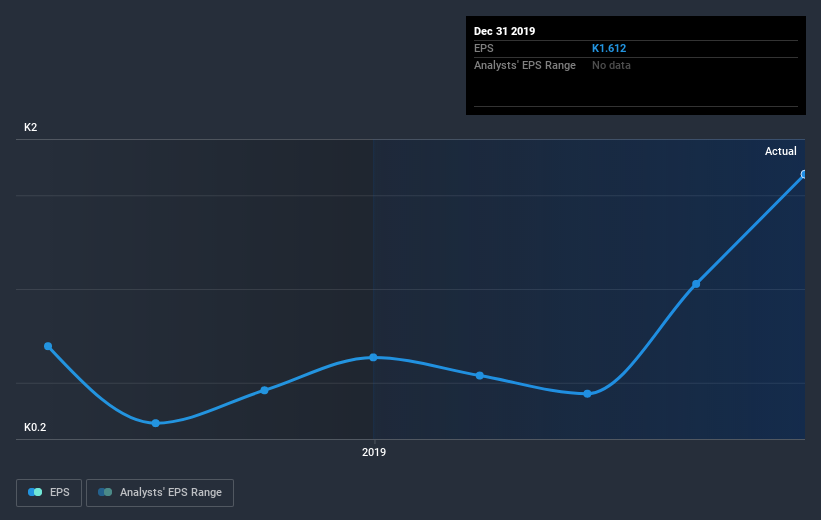

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Steamships Trading saw its EPS decline at a compound rate of 16% per year, over the last three years. This reduction in EPS is slower than the 25% annual reduction in the share price. So it's likely that the EPS decline has disappointed the market, leaving investors hesitant to buy.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

Dive deeper into Steamships Trading's key metrics by checking this interactive graph of Steamships Trading's earnings, revenue and cash flow.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. In the case of Steamships Trading, it has a TSR of -53% for the last 3 years. That exceeds its share price return that we previously mentioned. This is largely a result of its dividend payments!

A Different Perspective

While the broader market lost about 4.3% in the twelve months, Steamships Trading shareholders did even worse, losing 37% (even including dividends). Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 7.0% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 2 warning signs for Steamships Trading (1 is a bit unpleasant!) that you should be aware of before investing here.

We will like Steamships Trading better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo News

Yahoo News