Shareholders Are Raving About How The Intellicheck (NASDAQ:IDN) Share Price Increased 595%

We think all investors should try to buy and hold high quality multi-year winners. While not every stock performs well, when investors win, they can win big. To wit, the Intellicheck, Inc. (NASDAQ:IDN) share price has soared 595% over five years. And this is just one example of the epic gains achieved by some long term investors. It's also up 8.1% in about a month. But the price may well have benefitted from a buoyant market, since stocks have gained 5.8% in the last thirty days.

It really delights us to see such great share price performance for investors.

See our latest analysis for Intellicheck

Given that Intellicheck didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

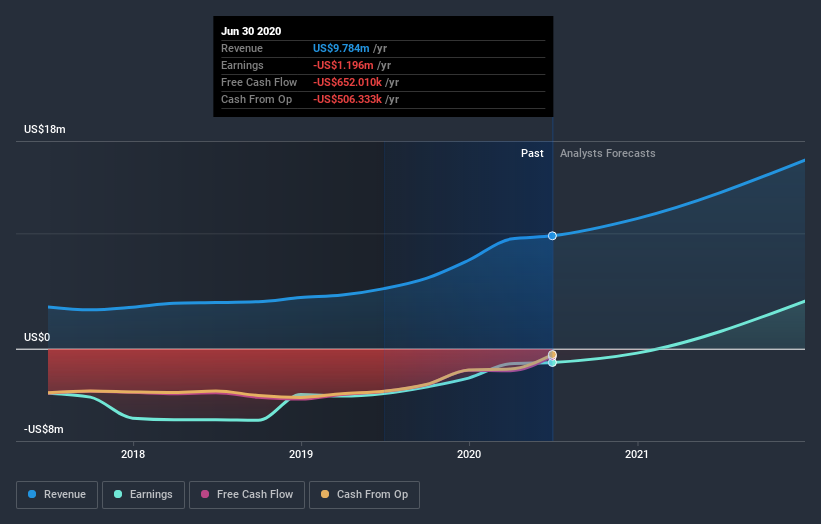

In the last 5 years Intellicheck saw its revenue grow at 4.7% per year. That's not a very high growth rate considering the bottom line. Therefore, we're a little surprised to see the share price gain has been so strong, at 47% per year, compound, over the period. We don't think the growth over the period is that great, but it could be that faster growth appears to some to be on the horizon. It's not immediately obvious to us why the market has been so enthusiastic about the stock, but a more detailed look at revenue and profit trends might reveal why shareholders are optimistic.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

If you are thinking of buying or selling Intellicheck stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

We're pleased to report that Intellicheck shareholders have received a total shareholder return of 34% over one year. Having said that, the five-year TSR of 47% a year, is even better. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 1 warning sign for Intellicheck that you should be aware of before investing here.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo News

Yahoo News