Shopify (SHOP) Stock Down Despite Q3 Earnings & Revenue Beat

Shopify Inc. SHOP reported third-quarter 2020 adjusted earnings of $1.13 per share significantly outpacing the Zacks Consensus Estimate of 50 cents. The company had reported adjusted net loss of 29 cents per share in the prior-year quarter.

Total revenues improved 96% from the year-ago quarter’s figure to $767.4 million, which beat the Zacks Consensus Estimate by 16.97%.

COVID-19 pandemic has altered consumer spending behavior considerably and triggered online store creation. The top line benefited from growth in the number of merchants as more of them joined the Shopify platform due to COVID-19 induced shelter-in-place guidelines. Moreover, growth was driven by e-commerce boom and increased buying of essentials in the third quarter on account of the pandemic.

Quarter in Detail

Subscription Solutions revenues surged 48% to $254.3 million driven by persistent growth in Monthly Recurring Revenue (MRR) due to the addition of new merchants. Moreover, strong app growth and conversion from free trial to paid members were positives.

As of Sep 30, 2020, MRR was $74.4 million, up 47% from the year-ago quarter. Shopify Plus accounted for $18.7 million, representing 25% of MRR compared with 27% in the quarter ended Sep 30, 2019.

Management noted that although demand remains higher for subscriptions compared to pre-COVID-19 levels, the company does not anticipate MRR growth rate in fourth quarter to match that of the third quarter. This is likely to have hurt investor sentiments.

Despite strong performance, shares of Shopify fell 8.4% following third-quarter 2020 results on Oct 29, eventually closing at $977.

Notably, in the year-to-date period, the company’s stock has skyrocketed 131.3%, significantly outperforming the industry’s rally of 21.5%. Currently, Shopify carries a Zacks Rank #3 (Hold). You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

Merchant Solutions revenues advanced 132% to $522.1 million, primarily on growth in Gross Merchandise Volume (GMV) that improved 109% from the year-ago quarter’s figure to $30.9 billion.

Gross Payments Volume (GPV) was $14 billion, accounting for 45% of GMV processed in the third quarter and up from $6.2 billion (42%) in the prior-year quarter.

Shopify Capital advanced $252.1 million cash (and loans) to merchants in the reported quarter, surging 79% compared with $141 million in the year-ago quarter. Since the launch of Shopify Capital, cumulative merchant cash advances have increased to $1.4 billion, out of which $248 million was outstanding as of Sep 30, 2020.

Shopify Shipping witnessed robust adoption in the third quarter. The offering is being leveraged by 51% of total eligible merchants across the United States and Canada, compared with 45% in year-ago quarter.

Notable Points

More new merchants signed to Shopify Fulfillment Network in third-quarter 2020 compared with previous quarters since its launch in June 2019. Increasing investments on expanding robotics and fulfillment technology capabilities hold promise.

Further, the company’s strong partner referral system is anticipated to boost merchant base that will drive the top line in 2020. More than 37,400 partners referred merchants to Shopify in the past 12 months.

Shopify is banking on its new mobile shopping app — Shop, and applications like Shopify Email, Shopify Plus Admin, Shopify Flow and Shopify Balance to bolster customer engagement in the days ahead. Notably, Shop app integrates features from both Shop Pay and Arrive and enables customers to easily discover local businesses, receive relevant product recommendations, check out effortlessly, and track all of their online orders.

Notably, the company introduced Shopify Payments in Belgium, facilitating iDEAL as a local payment method, and supporting Bancontact debit payments, marking the availability of Shopify Payments to 17 countries.

Besides, the company is well poised to capitalize on e-commerce boom via rapid uptake of its new point of sale software — Shopify POS. The software’s enhanced features are likely to drive its adoption among brick-and-mortal retailers.

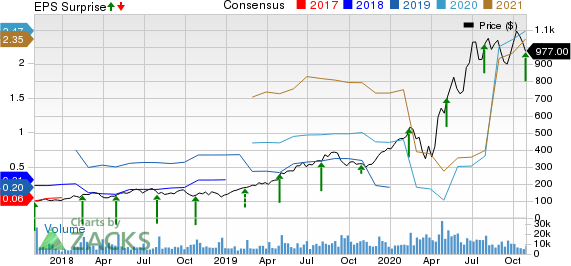

Shopify Inc. Price, Consensus and EPS Surprise

Shopify Inc. price-consensus-eps-surprise-chart | Shopify Inc. Quote

Moreover, integrating Shopify platform with sales channels from TikTok, Facebook’s FB Facebook shops, Walmart’s WMT Walmart.com and Pinterest PINS, to enable merchants expand sales and broaden business avenues, is expected to drive new buyer traffic to their stores. This favors Shopify’s prospects over the longer haul.

Operating Details

Non-GAAP gross profit (adjusted for amortization of acquired intangibles) surged 88.1% year over year to $412.6 million. This can be attributed to higher mix of Merchant Solutions revenues.

Nevertheless, non-GAAP gross margin contracted 200 basis points (bps) from the year-ago quarter’s level to 54%.

Non-GAAP operating expenses surged 34.9% year over year to $281.7 million.

Non-GAAP operating expenses, as a percentage of revenues, contracted to 37% from 53% in the year-ago period.

Shopify reported adjusted operating income of $130.9 million compared with operating income of $10.5 million in the year-ago quarter. The increase was driven by robust revenue growth.

Balance Sheet & Cash Flow

As of Sep 30, 2020, Shopify ended the reported quarter with cash, cash equivalents and marketable securities balance of $6.12 billion compared with $4 billion as of Jun 30, 2020. The increase can be attributed to net proceeds worth $2.03 billion from offering of Class A subordinate voting shares in the reported quarter and $1.46 billion of net proceeds from the company’s offering of Class A subordinate voting shares in the second quarter.

Shopify generated net cash flow in operations of $179.6 million for nine months ended Sep 30, 2020 compared with $17.7 million for nine months ended Sep 30, 2019.

Refrains From Providing Guidance

Management believes that coronavirus crisis led e-commerce boom, and momentum in online retail spending will continue. However, Shopify refrained from providing any guidance for fourth quarter or 2020 due to COVID-19 induced uncertainties prevailing in the market pertaining to unemployment, fiscal stimulus, and the magnitude and duration of adverse business impacts, which may affect new shop creation on Shopify platform.

Have You Seen Zacks’ 2020 Election Stock Report?

The upcoming election could be a massive buying opportunity for savvy investors. Trillions of dollars will shift into new market sectors after the election. The question is, which sectors will soar for each candidate? Zacks has put together a new special report to help readers like you target big profits.

The 2020 Election Stock Report reveals specific stocks you’ll want to own immediately after the results are announced – 6 if Trump wins, 6 if Biden wins. Past election reports have led investors to gains of +71%, +83%, even +185% in the following months. This year’s picks could be even more lucrative.

Check out Zacks’ 2020 Election Stock Report >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Walmart Inc. (WMT) : Free Stock Analysis Report

Facebook, Inc. (FB) : Free Stock Analysis Report

Shopify Inc. (SHOP) : Free Stock Analysis Report

Pinterest, Inc. (PINS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo News

Yahoo News