Silver Elephant Mining (TSE:ELEF) shareholders have earned a 60% CAGR over the last five years

Silver Elephant Mining Corp. (TSE:ELEF) shareholders should be happy to see the share price up 22% in the last month. While a drop like that is definitely a body blow, money isn't as important as health and happiness.

Since shareholders are down over the longer term, lets look at the underlying fundamentals over the that time and see if they've been consistent with returns.

View our latest analysis for Silver Elephant Mining

Silver Elephant Mining hasn't yet reported any revenue, so it's as much a business idea as an actual business. This state of affairs suggests that venture capitalists won't provide funds on attractive terms. So it seems shareholders are too busy dreaming about the progress to come than dwelling on the current (lack of) revenue. It seems likely some shareholders believe that Silver Elephant Mining will discover or develop fossil fuel before too long.

Companies that lack both meaningful revenue and profits are usually considered high risk. There was already a significant chance that they would need more money for business development, and indeed they recently put themselves at the mercy of capital markets and raised equity. So the share price itself impacts the value of the shares (as it determines the cost of capital). While some such companies do very well over the long term, others become hyped up by promoters before eventually falling back down to earth, and going bankrupt (or being recapitalized). Silver Elephant Mining has already given some investors a taste of the bitter losses that high risk investing can cause.

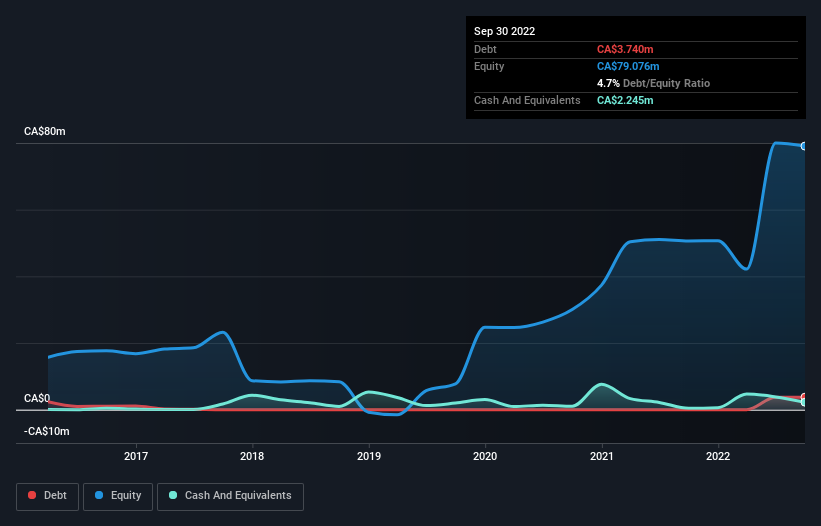

Silver Elephant Mining had liabilities exceeding cash when it last reported, according to our data. That made it extremely high risk, in our view. But since the share price has dived 31% per year, over 5 years , it looks like some investors think it's time to abandon ship, so to speak, even though the cash reserves look a little better with the capital raising. You can click on the image below to see (in greater detail) how Silver Elephant Mining's cash levels have changed over time.

In reality it's hard to have much certainty when valuing a business that has neither revenue or profit. What if insiders are ditching the stock hand over fist? It would bother me, that's for sure. It costs nothing but a moment of your time to see if we are picking up on any insider selling.

What About The Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Silver Elephant Mining's total shareholder return (TSR) and its share price return. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. We note that Silver Elephant Mining's TSR, at 947% is higher than its share price return of -84%. When you consider it hasn't been paying a dividend, this data suggests shareholders have benefitted from a spin-off, or had the opportunity to acquire attractively priced shares in a discounted capital raising.

A Different Perspective

Investors in Silver Elephant Mining had a tough year, with a total loss of 73%, against a market gain of about 3.4%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn't be so upset, since they would have made 60%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should learn about the 3 warning signs we've spotted with Silver Elephant Mining (including 1 which is a bit concerning) .

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo News

Yahoo News