Snapdeal’s board approves Flipkart offer

BI Intelligence

This story was delivered to BI Intelligence "E-Commerce Briefing" subscribers. To learn more and subscribe, please click here.

Flipkart, the current e-commerce leader in India, appears to have finally come to a purchase agreement with domestic competitor Snapdeal, Reuters reports.

Talk of a merger began in April, but stalled over the parties' differing valuations of Snapdeal. The two sides have now reportedly settled on a $900 million to $950 million price tag, pending approval from Snapdeal's shareholders.

Flipkart needs this merger as its growth has stagnated. Despite its market-leading position, Flipkart’s unique purchasers only grew 11% from Q1 2016 to Q1 2017, while Amazon’s increased 113% in India over the same period. On top of that, Flipkart saw its mobile app engagement fall 12% year-over-year (YoY) in Q1. Mobile accounted for 80% of web traffic for Flipkart and Snapdeal last year, so slowing mobile engagement is worrisome.

India poses unique challenges that may be making growth difficult for Flipkart:

A huge portion of India’s population, 67%, lives in rural areas, which are extremely difficult to access due to the country's poor infrastructure.

India has extremely slow internet connections compared with other countries. This results in slow page load times, which can harm conversion rates, particularly among mobile shoppers.

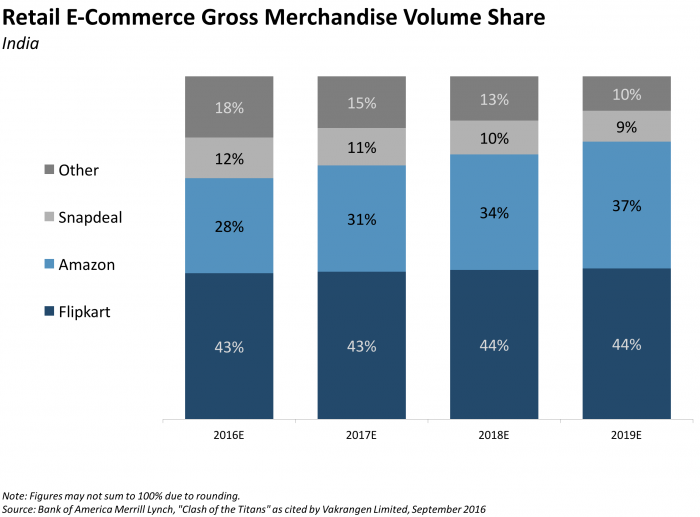

Snapdeal could provide a boost for Flipkart, but it may not be enough to stave off Amazon. Flipkart has previously used acquisitions to combat its problems, and seems to be sticking to that strategy with its most recent pursuit. Snapdeal, however, has seen its valuation plummet amid its own struggles in the Indian e-commerce market. Because of this, the merger may be more of a quick fix for Flipkart than a cure-all. Bank of America Merrill Lynch estimated that Flipkart’s market share will stagnate through 2019, while Amazon continues to close the gap. Merging with Snapdeal will bolster Flipkart’s lead in the near term, but the US company's long-term ascendance in India appears unavoidable.

To receive stories like this one directly to your inbox every morning, sign up for the E-Commerce Briefing newsletter. Click here to learn more about how you can gain risk-free access today.

See Also:

Yahoo News

Yahoo News