Spotify backs out of SoundCloud acquisition

BI Intelligence

This story was delivered to BI Intelligence Apps and Platforms Briefing subscribers. To learn more and subscribe, please click here.

Spotify is abandoning a merger with SoundCloud after months of negotiations between the two companies, TechCrunch reports.

The breakdown in the deal reportedly came down to a reluctance on Spotify’s part to commit to a purchase in a potential IPO year.

Spotify and SoundCloud were said to be in advanced discussions, based on a Financial Times (FT) report in September. The report came a couple months after whispers in the Summer that SoundCloud was looking to sell itself for $1 billion. Spotify reportedly backed down from buying SoundCloud on two separate occasions in the last two years, according to the FT.

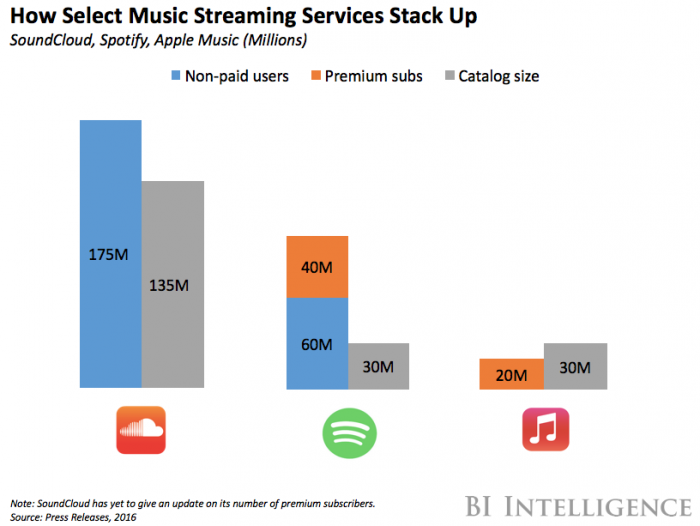

The companies could have made a powerful couple. As previously described by BI Intelligence, the former is the global leader in music streaming, while the latter is a fellow titan in the space with a massive 175 million-strong user base of mostly members, and a highly differentiated music library and listening experience.

But Spotify was wary of destabilizing its plans for an IPO. A $1 billion debt-funding round in March puts pressure on Spotify to go public as soon as possible. If an IPO occurs next year, investors can convert the debt to equity at a 20% discount to the offering price. However, the discount goes up by 2.5% every six months after the end of 2017.

Consolidation is on the horizon for the streaming industry. We’ve yet to see major merger activity among large music streaming services because the space is relatively new, but this will change as incumbents like Spotify establish themselves. And some of the reports that have circulated this year –such as Spotify’s interest in SoundCloud, and Apple Music’s purported interest in Tidal – are early indicators of forthcoming activity.

Many digital media companies have embraced monthly and annual subscriptions. This business model allows digital media companies to provide a premium experience that offers more than the basic, often ad-supported service level.

Subscriptions are enjoying a new prominence as a revenue model for digital content and apps. Internet companies are exploiting the opportunity to boost ARPU (average revenue per user), thanks to recurring payments from a subscriber base.

BI Intelligence, Business Insider's premium research service, has compiled a detailed report on subscription revenue that looks at how prominent players in five separate categories have tried to build a subscription-based revenue stream alongside ad-based businesses: the categories are video, music, news publishing, social networks/messaging, and dating apps.

Here are some of the key takeaways:

Most companies operate on a "freemium model." Subscriptions typically operate alongside an advertising business.

Success in freemium boils down to offering a core audience exclusive value that can only be accessed beyond a paywall. The key is to target the most loyal audiences, and sell them on an expanded offering — bundles of features or content — that they find irresistible.

Some publishers and apps have had mixed results with subscriptions, and vary in terms of how hard they have pushed them. Part of the problem is that ad-dependent companies are worried about limiting audience if they pack away too much value into a subscription tier.

The proportion of paying subscribers within the total user base varies considerably across digital media industries. Each category is obviously different, and won't face the same challenges and opportunities in dialing up the percentage of subscribers and subscription revenue. Here are some of the proportions of subscribers in apps' user bases: Spotify (25%), WhatsApp (21%), Pandora (5%), Match Group (5%), The New York Times (3%), and LinkedIn (2%).

In full, the report:

Analyzes the most common subscription-based digital media revenue models

Explores the drivers that allows some subscription or freemium business models succeed

Explains the revenue mix and business opportunity in several key digital media industries

Outlines companies that have succeeded with subscription-based business models

To get your copy of this invaluable guide, choose one of these options:

Subscribe to an ALL-ACCESS Membership with BI Intelligence and gain immediate access to this report AND over 100 other expertly researched deep-dive reports, subscriptions to all of our daily newsletters, and much more. >> START A MEMBERSHIP

Purchase the report and download it immediately from our research store. >> BUY THE REPORT

The choice is yours. But however you decide to acquire this report, you’ve given yourself a powerful advantage in your understanding of subscription revenue models.

See Also:

Yahoo News

Yahoo News