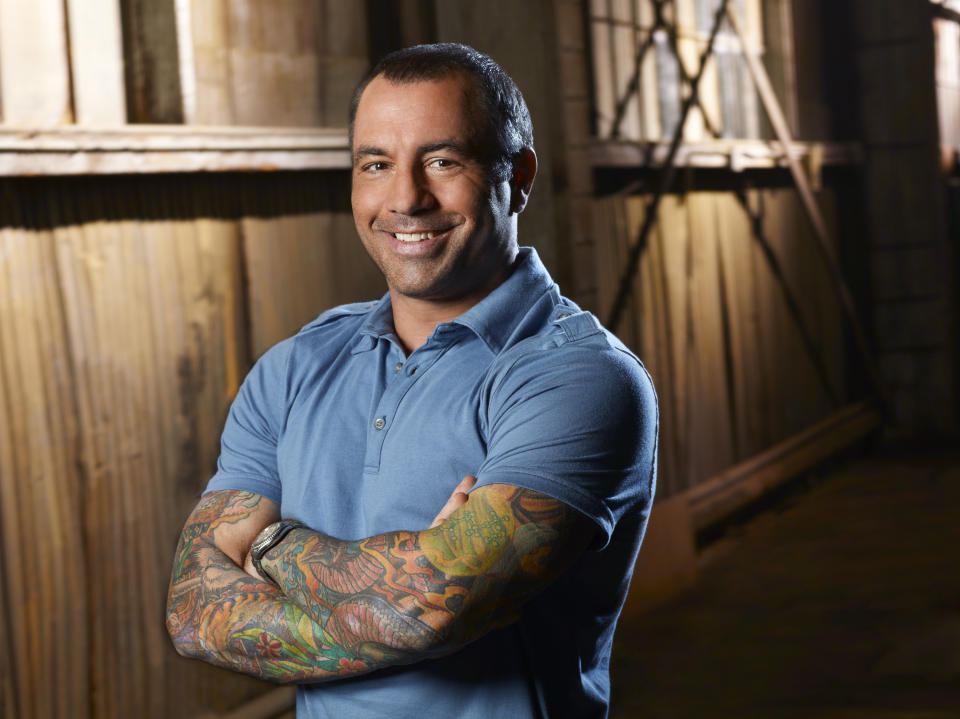

Spotify CFO: Joe Rogan podcast off to strong start

Investors are tuning into Spotify’s (SPOT) earnings day.

Shares of the music streaming platform fell as much as 5% on Thursday as the company came up short on the bottom line amid investments in podcasts from stars such as media personality Joe Rogan and former first lady Michelle Obama, and ongoing enhancements to the business.

Spotify CFO Paul Vogel told Yahoo Finance’s The First Trade he is pleased with how the quarter shook out.

“The quarter was fantastic,” said Vogel. He added Rogan’s start on the platform has been ahead of expectations. And, the podcast could see another bump when it goes exclusive to Spotify at year’s end.

The early reaction to Spotify’s results overlooks several strong points in the quarter. For one, monthly active users rose 7% sequentially to 320 million. That beat analyst estimates for 316 million and marked a recovery from earlier in the year when the COVID-19 pandemic took a toll on audio consumption. Both premium subscribers and ad-supported monthly active users rose from the second quarter.

Further, Spotify’s investments in podcasts continued to gain hold. The company called out that 22% of its monthly active user base engaged with podcasts in the third quarter. In the second quarter, that number was 21%. The company’s free cash flow also spiked to 103 million euros from 27 million euros in the second quarter.

Here’s how Spotify performed compared to Wall Street estimates:

Net Sales: 1.98 billion euros versus estimates for 1.93 billion to 2.2 billion euros

Diluted EPS: 58 cents a share euro loss versus estimates for a loss of 36 cents

The market has been logged into Spotify shares all year as a twofold play. First, that Spotify’s major podcast push would lead to a surge in users and by extension profits. And two, that the pandemic means Spotify has a captive audience for its content — an audience that could be traded up to the premium tier. Spotify’s stock had gained about 87% ahead of Thursday’s earnings results, according to Yahoo Finance Premium data.

“This is a pretty in-line quarter with Spotify continuing to show strong MAU and gross profit growth, despite margins down a bit y/y on investments. We think the key debates remain the long-term efficacy of podcasting investments and expect it to be the #1 item for the call and the follow-through,” wrote Wells Fargo media analyst Steve Cahall moments after earnings.

But now Spotify has to deliver on that twofold thesis with profits. Those profits may not be on tap for the fourth quarter — the company sees an operating loss of 112 million to 32 million euros. With the profit timeline uncertain, it’s logical that investors pare their gains on earnings day.

Brian Sozzi is an editor-at-large and co-anchor of The First Trade at Yahoo Finance. Follow Sozzi on Twitter @BrianSozzi and on LinkedIn.

What’s hot from Sozzi:

Watch Yahoo Finance’s live programming on Verizon FIOS channel 604, Apple TV, Amazon Fire TV, Roku, Samsung TV, Pluto TV, and YouTube. Online catch Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, and reddit.

Yahoo News

Yahoo News