Stamp duty clogging up property ladder as first-time buyer sales overtake home movers

Stamp duty is clogging up housing market as figures show that more first-time buyers are buying homes than movers who already own for first time in over 20 years.

For the first time since 1995 the proportion of first-time buyers purchasing homes has overtaken the number of existing home-owners moving house, according to a Lloyds study.

Across the UK there were 170,000 home-movers in the first half of 2018, compared with 175,500 first-time buyers, it found.

Last night experts said the crippling cost of stamp duty was the main reason for the slow down in people moving house, and called for the Government to review the tax burden they currently face.

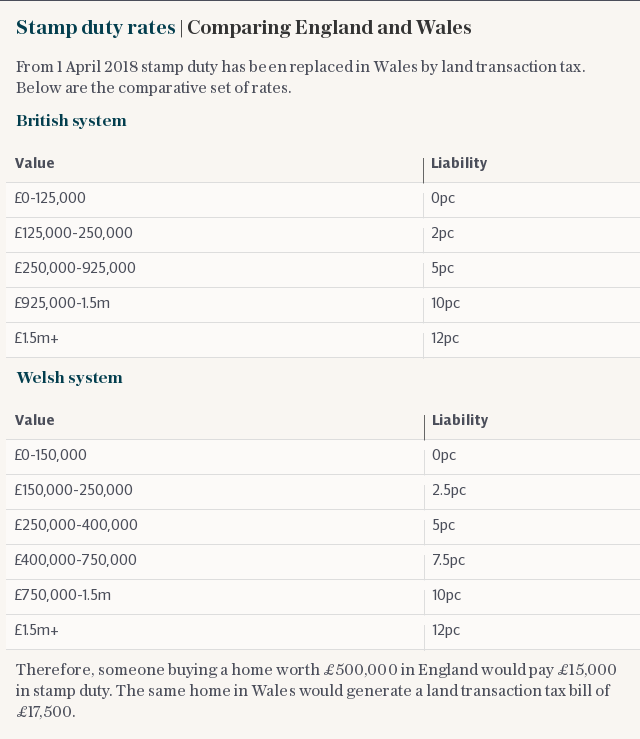

Last year the Government introduced a new stamp duty relief for first-time buyers designed to help more young people get a foot on the property ladder. But families wanting to upsize, move to a new area or downsize, are still being hit with huge stamp duty bills.

For example a young family moving from their first owned flat into a £400,000 family home must pay £10,000 in stamp duty upfront, in addition to estate agent, moving and legal fees.

Mark Hayward, chief executive at the National Association of Estate Agents, said: "Traditionally homeowners used to move once every 7-9 years but now they only move every 20 years.

"Changes in the market mean the property ladder now has less rungs than it used to, which are further apart. There has been a distinct change in the way people view a home. They would rather allow money for holidays and family than upsize. Its also now cheaper to extend, hence why its a popular option.

"People also find the cost of moving is increasingly prohibitive. The Government should look to remove some of the barriers to movement including stamp duty as it would help the economy by freeing up people to move towards new jobs.

"In the past stamp duty wasn't much of an issue and there was high wage inflation so people knew they could afford to move up. People would only expect to stay in a flat for two or three years. But now first time buyers are trying to buy 'second stepper homes' with two or three bedrooms."

Over the past five years, the average price paid by home-movers for a property has surged by more than a third (35 per cent) or £77,457 - from £219,479 in 2013 to a record high of £296,936 in 2018, Lloyds said.

The report is based on estimates from Lloyds, using its own housing statistics database as well as data from official sources.

Yahoo News

Yahoo News