Stamp duty holiday extension will spark modest rise in house prices

An extension to the stamp duty holiday announced in the Budget will spark a modest rise in house prices and stimulate additional transactions, the Treasury’s independent forecaster has said.

Rishi Sunak announced on Wednesday that the tax relief would continue for another six months, in a boost to the housing market and a major victory for The Telegraph's Stamp out the Duty campaign.

As the Chancellor read out the measure, the Prime Minister, who was sitting beside him, gave a thumbs up signal to The Telegraph’s journalist present in the Press Gallery of the Commons.

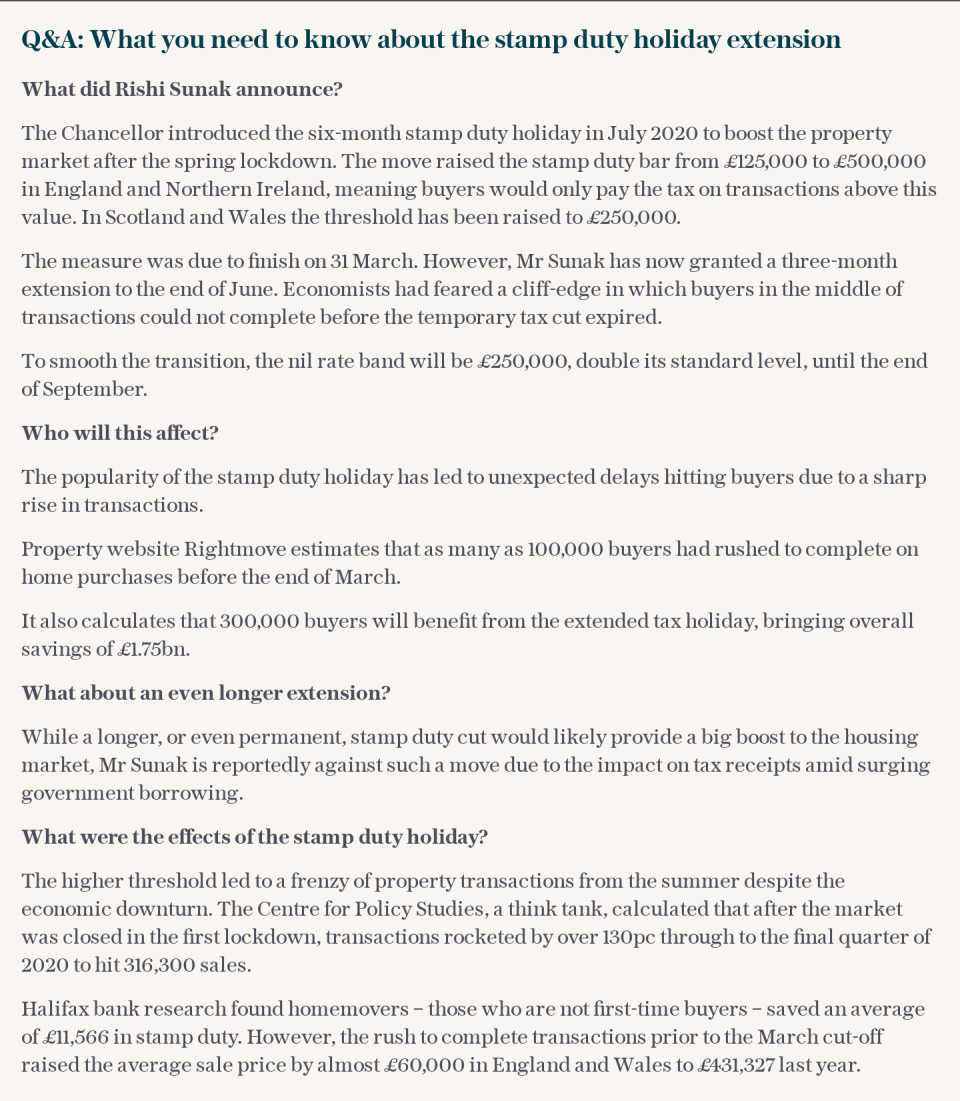

The Chancellor said the current holiday, which sees the nil-band rate apply up to a threshold of £500,000, would be extended for three months until June 30.

A tapered rate of support, which will see the nil-band rate apply up to a threshold of £250,000, will then be introduced for a further three months until Sept 30. Thereafter, the threshold for paying stamp duty will be reinstated at £125,000.

Mr Sunak’s announcement gives buyers who have been grappling with major logistical delays more time to take advantage of the tax break. The tapering of support will also help to prevent a cliff edge edge of demand.

The Office for Budget Responsibility (OBR) said the main effect of the tax holiday extension on the housing market forecast is “to shift transactions to just before the scheme’s new end date”. However, it added that the move will also “result in some additional transactions and raise house prices a little”.

The independent forecaster added that house prices will fall back again as the labour market deteriorates. House prices are set to grow by 5.1 per cent this year, then fall by -1.7 per cent next year.

The market is then set to pick up with a modest growth in prices of 0.8 per cent in 2023, followed by more robust growth of 3.9 per cent in 2024 and 4.3 per cent in 2025, the OBR predicted.

It noted that house prices had proven resilient during the pandemic, in part “due to the smaller impact of the pandemic on the incomes of high earners, who typically account for an outsized share of home purchases”.

Housing may have provided an outlet for people who have built up large unanticipated savings due to restrictions on social consumption, the OBR said, adding that the tax holiday for property is also likely to have supported house prices.

The extension applies to all transactions in England and Northern Ireland, meaning buy-to-let investors will continue to benefit from the tax savings, paying just the three percentage point surcharge on top.

The deadline for buyers to take advantage of the higher £500,000 nil-rate band has been extended by three months. This means that buyers in England and Northern Ireland can save up to £15,000 in tax if they can complete their sales by June 30.

After this date, the nil-rate band will drop to £250,000 until Sept 30. This means the maximum tax savings will fall to £2,500 during this period.

The property industry had been warning for months that thousands of buyers would pull out of deals or renegotiate if they could not transact in time for the tax benefit.

Tapering the end of the tax holiday will create breathing room for overloaded conveyancers, who have been hit with soaring demand caused by the tax break. It will also reduce the number of buyers pulling out of sales because they suddenly have to source an extra £15,000 when transactions do not complete on time.

Just by extending the stamp duty holiday to the end of June, Mr Sunak will allow an additional 300,000 sales in England to benefit from tax savings, according to property website Rightmove.

Buyers completing their purchases during this period will save a collective £1.75 billion in tax, with 80 per cent of these sales paying no stamp duty at all.

The policy will help boost confidence in the property market and hold off forecast house price falls.

Andrew Wishart, of consultancy Capital Economics, said: "The mortgage guarantee scheme and stamp duty holiday extension will sustain demand, and the more generous furlough scheme will reduce forced selling. As a result, we no longer think that house prices will fall this year." Previously, Capital Economics had forecast a five per cent price drop in 2021.

The Office for Budget Responsibility, the fiscal watchdog, has now forecast that house prices at the beginning of 2025 will be 13.5 per cent higher than at the start of 2020. Back in November, the forecast was only for 11.4 per cent growth over the same period.

The OBR has also forecast that there will now be 41,700 more transactions between April and June than it had expected back in Nov.

Lucian Cook, of Savills estate agents, said: “The extension of the stamp duty holiday and the furlough scheme should mitigate the risk of the housing market softening in the middle part of the year."

But there will still be a drop in sales after the nil-rate band drops to £250,000. The OBR has now forecast there will be 29,700 fewer sales overall this year that it expected in November.

"Savings for buyers in the middle and upper tiers of the housing market will be much reduced," said Mr Cook. "The Chancellor is banking on the fact that these households have the most security in their household finances and the strongest resolve to move.”

'It’s brought our dream of buying our first home that little bit closer'

For first-time buyers Jade Sims, 31, and Michael Farrelly, 32, getting a 95pc mortgage will help them stop renting and secure their footing on the property ladder, Rachel Mortimer writes. “The timing is great for us. It has taken some of the pressure off and given us something to look forward to,” Ms Sims said. “It’s brought our dream of securing our first home that little bit closer.”

The couple, who are engaged, want to settle down and start a family in a village location close to where they currently live in Marlborough, Wilts. They have a budget of around £250,000.

The goal of owning a home seemed to be slipping out of their reach last year during the pandemic. Mr Farrelly, a bricklayer, had to pause work at various points. “We had to dip into our savings throughout the crisis last year and it was really demotivating to see them going down, rather than up as we had originally planned,” said Ms Sims, a commercial planning manager.

Their efforts to get on the ladder were also stymied by the hardening market for first-time buyers, with risk-averse lenders pulling low deposit mortgages from the market.

As a result of the new mortgage guarantee scheme, Ms Sims and Mr Farrelly can buy a £250,000 home with a 5pc deposit of £12,500. Without the Government’s programme, they would have needed to save up a further £25,000 for an average first-time buyer deposit of 15pc, to put down £37,500.

The fact that the scheme is open to all properties, not just new-builds like in the previous version under the Help to Buy umbrella, is an added bonus. Ms Sims said. “We had our hearts set on holding out for the right first home, which for us would be an older cottage-style property. While the goal is to get on the property ladder, we would also like a first home with a bit of character and to a certain extent this ruled out the Help to Buy scheme and new-build homes.”

Yahoo News

Yahoo News