Starbucks tests a cashless store in Seattle (SBUX)

BI Intelligence

This story was delivered to BI Intelligence "Payments Briefing" subscribers hours before appearing on Business Insider. To be the first to know, please click here.

Starbucks is running a single-location cashless pilot in a store located in the lobby of a Seattle-based office building, according to The Seattle Times.

That location won’t accept cash for transactions — tips are still fine — for an unspecified period of time. The store reportedly isn’t using signage to notify customers that it isn't taking cash, instead letting baristas explain it to customers who try. Starbucks is using the pilot, which isn’t planned to expand at this point, to evaluate customer response and garner employee feedback.

Going cashless, especially in high-volume locations, could help Starbucks boost growth.

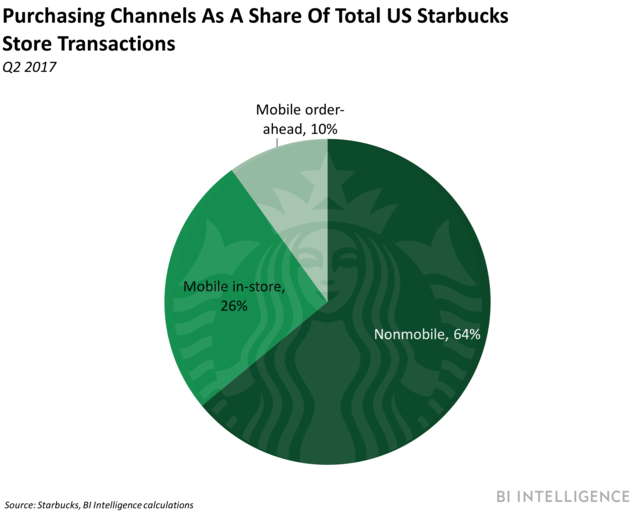

It could further mobile payment popularity. Mobile payments comprised 36% of Starbucks' total US transactions in Q3 2017, a figure that will likely continue to increase. And about a quarter of that group comes from the mobile order-ahead offering. That’s great for Starbucks in the big picture, because mobile payers, who are enrolled in the firm’s loyalty and rewards program by default, tend to return more often and spend more, which frequently helps lift sales. As such, incentivizing mobile payments by removing a top payment option for low-ticket purchases makes sense.

And doing so could help resolve some of the residual issues that mobile payments cause. Though rising mobile spend is beneficial overall, it hasn’t come without drawbacks. At other chains with popular mobile ordering programs, for example, high volume leads to long waits for beverages and in-store congestion that discourages customers from entering to make a purchase. Eliminating cash can help increase efficiency, which in turn might shorten lines, resolve congestion, and free up staff to help fill mobile orders as volume continues to surge.

Starbucks’ pilot could point to an industry-wide paradigm shift. A number of restaurants and retailers are going fully cashless, though they're mostly located in major metropolitan areas. It’s unlikely that Starbucks would eliminate cash in the near-term due to the adjustment it would require on the part of the consumer, and because of the 27% of un- and underbanked users who would be alienated by such a move.

But the fact that the chain is even considering it could bring the idea to the mainstream, and push more retailers to make similar moves. This would delight card networks, which see cash rather than each other as their biggest competition, and open up an opportunity for platforms like Apple Pay Cash or Square Cash’s physical card, which make it easier for un- or underbanked users to pay at these locations.

Dan Van Dyke, senior research analyst for BI Intelligence, Business Insider's premium research service has written a detailed report that explores the digital payments ecosystem today, its growth drivers, and where the industry is headed. The report also:

Traces the path of an in-store card payment from processing to settlement across the key stakeholders.

Forecasts growth and defines drivers for key digital payment types through 2021.

Highlights five trends that are changing payments, looking at how disparate factors, such as surprise elections and fraud surges, are sparking change across the ecosystem.

Interested in getting the full report? Here are two ways to access it:

Subscribe to an All-Access pass to BI Intelligence and gain immediate access to this report and over 100 other expertly researched reports. As an added bonus, you'll also gain access to all future reports and daily newsletters to ensure you stay ahead of the curve and benefit personally and professionally. >> Learn More Now

Purchase & download the full report from our research store. >> Purchase & Download Now

See Also:

Yahoo News

Yahoo News