Stocks are finally flashing signs of a confirmed bottom, says analyst who called 25% rally

With the S&P 500 surging more than 10% for the week ending April 9 to wrap up its best weekly gain since 1974, investors might be giving more credence to the belief that the worst of the stock market rout is over.

If history is any indication, according to Fundstrat Global Advisors Managing Partner Tom Lee, stocks could be setting up for an even more “fierce recovery.”

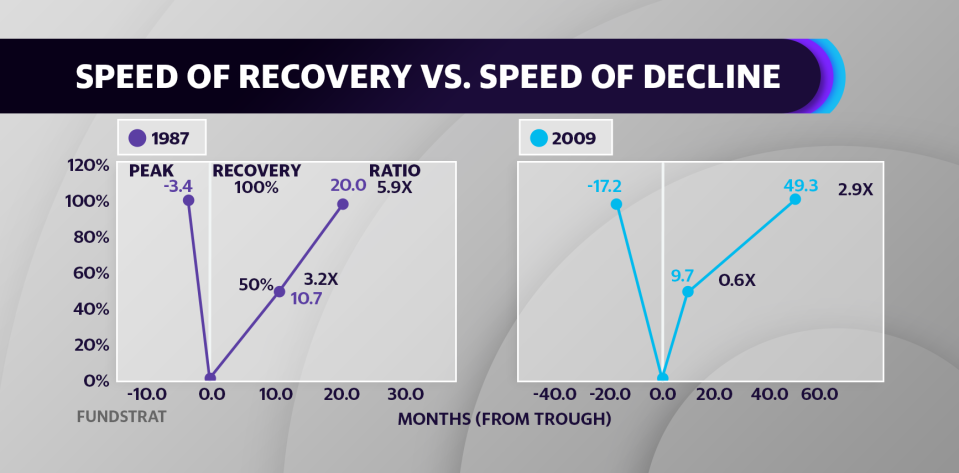

Central to Lee’s thesis is the historical performance of markets during prior 30% declines. Looking at the last 10 such occurrences stretching back over the past two centuries, Lee points out striking symmetries between the time to recover losses and how quickly stocks moved from top to bottom.

Using the average ratio of collapse-to-recovery times during prior bear markets, Lee hypothesized on March 24, just after losses totaled 33% at the short-term bottom, that the S&P 500 could recover 50% of those losses in just three weeks. On Thursday, the S&P 500 briefly achieved just that.

“The speed that you fall tells you how quickly you recovered half your losses and actually how long it takes to recover your full losses,” Lee said about his model on Yahoo Finance’s YFi PM. “That same model says we should be making all-time highs in three times the amount of time it took to fall, which means if we fell over six weeks, sometime in July, August, September, we may be back at all-time highs.”

Other investors concerned with record-high unemployment claims, like hedge fund manager Dan Niles, have warned investors about the recent rally being nothing more than a usual bear market trap. Emerging markets guru Mark Mobius echoed those concerns in warning about a looming double bottom. But defying those calls, Lee has drawn the 50% retracement line in the sand as the mark that has historically confirmed an “all clear” signal for investors. During this rout, that level in the S&P 500 is 2,793.

“The fact that it recovered 2,793, it's a big deal,” he said. “If you look back at 1987, 2002 or even '08 or '09, when the stock market recovered half its losses, it was already deep into a bull market recovery. I think the move today is pretty decisive.”

Conceding the counter-intuitiveness of a market bouncing back quicker if the news was so bad that it sent the market into bear market territory faster than ever in history, Lee pointed out that the stock market tends to bottom ahead of fundamentals turning higher.

“I know it sounds insane, and I know everyone's rolling their eyes, but we've already recovered half the losses in what history says should have taken place: half in three weeks,” he said. “Look back at every bottom, '87, '09, '02, '74, stock markets bottom before jobless claims peak. Stock markets bottom before consumer sentiment bottoms… I just think it's telling us we've already discounted the worst.”

After hitting the first part of his call for the S&P 500 to recover 50% of its losses nearly perfectly, hitting the second part of Lee’s call would entail a return to the S&P 500’s all-time high of 3,393 by the third quarter.

Zack Guzman is the host of YFi PM as well as a senior writer and on-air reporter covering entrepreneurship, cannabis, startups, and breaking news at Yahoo Finance. Follow him on Twitter @zGuz.

Read the latest financial and business news from Yahoo Finance

Read more:

The coronavirus just doubled the risk of mass bankruptcies

Obama economist on $2 trillion coronavirus stimulus: 'I'm still not sure if it's enough'

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

Yahoo News

Yahoo News