Sumner Redstone obituary

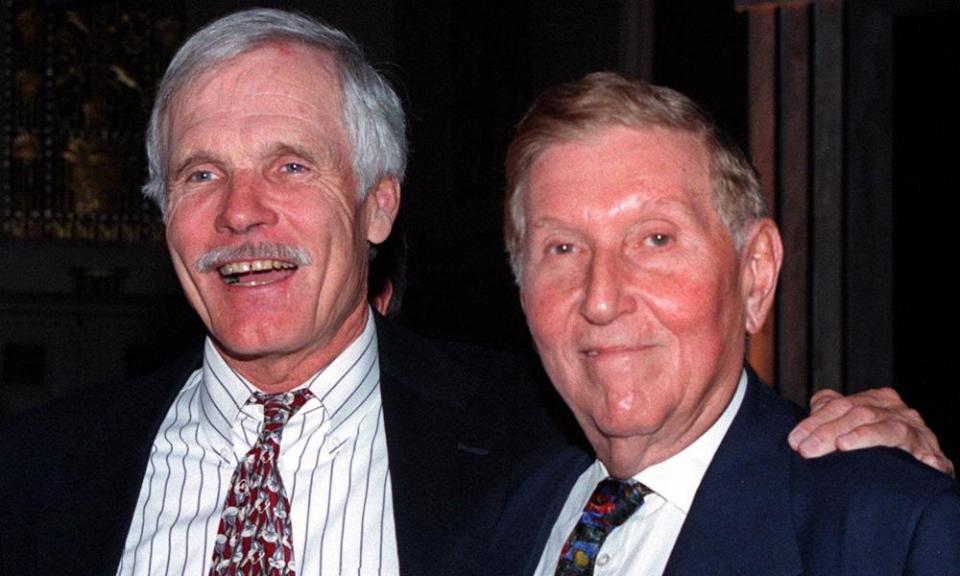

Controlling a major media conglomerate can be a glamorous task. Media moguls such as Ted Turner or Rupert Murdoch exist in the public eye, often basking in the perception that they are the creative forces behind their companies’ work. But others, such as Sumner Redstone, who has died aged 97, move much more quietly.

From the 1960s onwards, Redstone began to build a multimedia empire to rival Murdoch’s, amassing personal wealth that peaked above $8bn through ownership of Viacom and CBS. But it was not until he was in his 80s that he stepped into the spotlight. Once that happened, details of Redstone’s personal life and a series of lawsuits overshadowed any analysis of his business acumen and his last days were played out like a real-life version of Citizen Kane.

He was born Sumner Rothstein in Boston, the son of Jewish immigrants. His father, Michael, moved from peddling linoleum to liquor, then into owning nightclubs and, in 1934, to running one of America’s first drive-in movie theatres. Encouraged in his studies by his mother, Belle (nee Ostrovsky), Sumner finished top of his class at the prestigious Boston Latin high school and entered Harvard University at 17, by which point his father had changed the family name to Redstone.

Sumner graduated from Harvard in three years and, fluent in Japanese, served in the US army as a codebreaker during the second world war. In peacetime he returned to Harvard to take a law degree and in 1947 married Phyllis Raphael, whom he met at a local synagogue dance. He went to Washington as an assistant to the US attorney general, Tom Clark, then built a successful private law practice in San Francisco.

In 1954, realising that “the law was just a business”, he returned to Boston and went to work for his father’s company, Northeast Theatre Corporation, helping to turn it into National Amusements, coining the term “multiplex” to describe his strategy of offering multiple screens at each theatre, and becoming its chief executive in 1967. Redstone and his brother, Edward, were equal partners with their father, each owning a third of the company’s 300 shares. But the terms by which each brother was required to hold half his share in trust for Michael’s grandchildren would become the root of legal battles that spanned decades.

Owning theatres convinced Redstone that the future lay in content (his catchphrase became “content is king”), and he invested profitably in motion picture companies. However, in 1972 Edward accused his brother of trying to push him out of the business. A lawsuit was settled with a $5m buyout of Edward, which included handing Redstone the trusteeship of shares held for Edward’s children, Ruth and Michael.

In 1979 Redstone suffered a horrible accident, suffering 30% burns during a fire at the Copley Plaza hotel, Boston. He had to learn how to walk again. He later claimed that the experience was life-changing, and helped him focus on his future goals. But the seeds of his ambition and his pursuit of it at the expense of those close to him had already been sown in his takeover of the family business. In 1984 he negotiated a buyout of the shares he held in trust for Edward’s children and effectively sold them to himself.

Redstone’s rise to mogul status began in 1987, the year in which both his parents died. He spent $3.5bn on a hostile takeover of Viacom, a conglomerate originally spun off from the CBS broadcasting network by federal regulators. Viacom’s holdings included the cable television channels MTV, Nickelodeon and Showtime, most of CBS television’s early output, syndication rights to many classic programmes, including the Bill Cosby and Mary Tyler Moore shows, and cinemas in the US and UK, including the Empire Leicester Square.

Seven years later, he out-duelled the cable magnate John Malone and the media executive Barry Diller to buy Paramount Pictures for $10bn, then turned a merger with Blockbuster Video into an $8bn purchase.

He sold off around $4bn worth of Viacom’s holdings to help finance the two deals, winding up with an immensely profitable studio, UCI cinemas and – although Blockbuster’s rental business was falling – a handsome library of films and Aaron Spelling studios.

When the CBS president Melvin Karmazin then offered to buy Viacom in 1999, Redstone said no. Karmazin replied “so buy me”, and the companies were merged in 2000 in a deal worth nearly $40bn. The holdings of the merged company were massive, and while continuing to be under the umbrella of Redstone’s National Amusements, in 2005 control was split between the long-time CBS number two Leslie Moonves at CBS, and MTV’s Tom Freston at Viacom.

Although he was by now a big noise in the business world, it was not until 2006 that Redstone himself became the story. Apparently without consulting Freston, he refused to renew Tom Cruise’s production deal at Paramount, publicly saying: “His recent conduct has not been acceptable to Paramount.”

Soon afterwards he fired Freston after Viacom lost out on deals for both MySpace and the video game company IGN; in both cases Murdoch moved in quickly after Viacom had shown interest and trumped them with prohibitive offers.

Meanwhile, Redstone’s son, Brent, sued his father in a bid to release funds from his one-sixth holding in National Amusements; Brent eventually settled for $240m and gave up his seat on the board.

In 2006 Redstone’s nephew filed another lawsuit, stemming from the 1984 buyout, claiming Redstone’s accountant had undervalued the shares he had bought from Edward’s children. The suit was thrown out of court, mostly on grounds of it being too late.

By then National Amusements was being run by Sumner’s daughter, Shari, but the family feuds intensified as Redstone sold off assets to finance the debt on his acquisitions. Eventually he created a trust, on which Shari and her son would sit, to control the company.

In 2007 there was further legal confusion when Viacom, at Redstone’s behest, sued Google’s chief executive, Eric Schmidt, for $1bn over allegations that Google had been appropriating Viacom programmes on YouTube. Before the matter could definitively be adjudicated on by the courts, the parties settled in 2014, reportedly for no money.

During that legal battle, Schmidt accused Redstone of having built his company on lawsuits, but Redstone maintained: “I hate litigation. I’m a lover, not a fighter.”

But affairs of the heart were just as much a source of litigation as his business life. Redstone privately had a reputation as a womaniser and in 1999 Phyllis had sued for divorce. The settlement, which was not finalised until 2003, was estimated to be in the range of $2bn.

By then he had decided to marry Paula Fortunato, a teacher. They divorced in 2009, agreeing a settlement that included $1m for each of their five years of marriage and a $4.5m house in Beverly Hills.

His next partner, Sydney Holland, who ran a dating company, came on the scene in 2010, but that relationship also foundered and Manuela Herzer became his partner and, as his health deteriorated, his primary carer. When she was dismissed in 2016, she filed a lawsuit seeking to have him declared mentally unfit that took years to settle.

In 2016 Redstone resigned his chairmanships of CBS and Viacom, and took the title chairman emeritus, with Moonves taking over at CBS and Philippe Dauman at Viacom. Dauman stood down a few months later, reportedly with a £72m payout, and Moonves resigned in 2018 after allegations of sexual misconduct. In 2019 Viacom and CBS re-merged, with Shari appointed chairperson and her father still reportedly taking an interest in the business.

He is survived by Brent and Shari.

• Sumner Murray Redstone, businessman, born 27 May 1923; died 11 August 2020

Yahoo News

Yahoo News