Thousands knocked off pension incomes but Sunak delays changes until 2030

The Chancellor has slashed future pension incomes for more than 10m retirees and will not provide any compensation for an inflation switch that will cost investors above £100bn.

Britons with pension increases linked to the retail prices index (RPI) will lose thousands of pounds after Rishi Sunak pressed ahead with reforms that will save the Government around £2bn every year.

The Treasury revealed that RPI, a measure of inflation deemed flawed by the official statistics regulator, will be effectively scrapped in 2030 and losers from the changes will receive no compensation. However, the Chancellor resisted bringing in the changes as soon as 2025 following a consultation.

Watch: Chancellor defends decision to cut foreign aid budget

The move will tie annual increases in incomes from defined benefit pension schemes to a rate of inflation typically one percentage point lower than RPI, a blow to more than 10m present and future retirees.

Industry estimates suggest it will also cost buyers of index-linked gilts – government bonds that track inflation – more than £100bn while increasing the pressure on many company pension schemes.

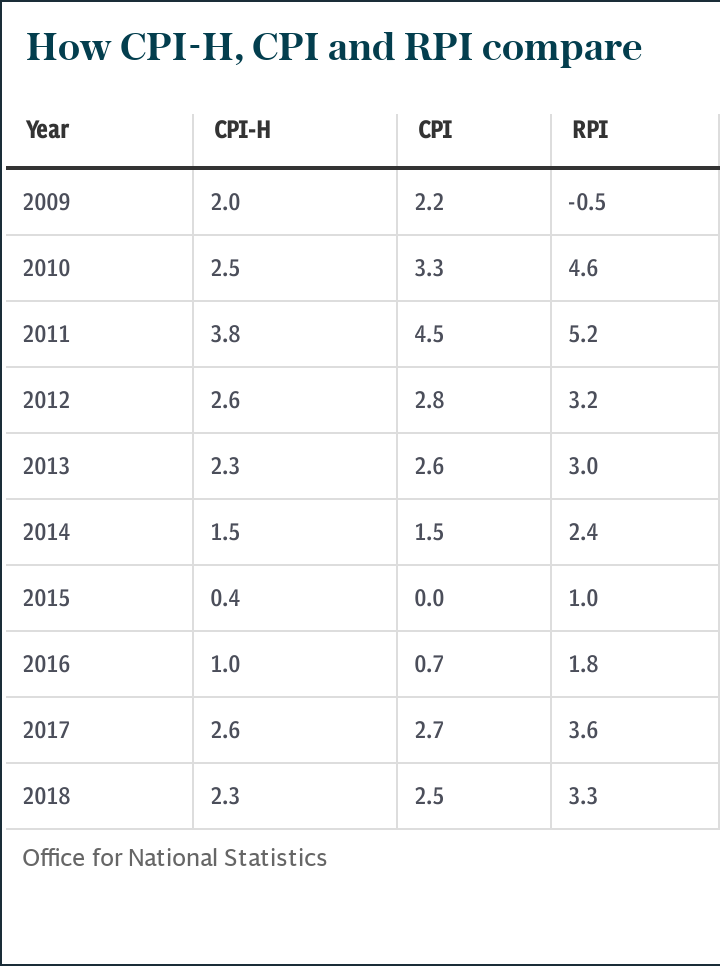

Investments and pensions linked to RPI will now track the lower consumer prices index including housing costs (CPIH).

The Pensions Policy Institute (PPI) estimates that a 55-year-old man today who took their pension at 65 would suffer a 12pc decrease in the average amount he would receive.

A 65-year-old man in 2020 would take a 4pc hit, a £6,000 blow, while a woman of the same age would face a 5pc drop, an £8,000 knock.

“Per £100m invested in RPI-linked assets, a change in 2030 would see a decrease of £13m,” said Daniela Silcock, head of policy research at the PPI.

“It’s a sad day for 10m pensioners and companies that have done the right thing to then find themselves with big holes in the pension schemes at a time when they are faced with other difficulties,” said Jos Vermeulen at Insight Investment, one of the largest buyers of index-linked gilts.

“I’m not sure this will be the last of it because it’s 10 years until it is aligned and clearly there are billions of pounds at stake.”

While many pensioners and investors will lose out, the changes will benefit some, including the taxpayer.

Rail prices will now rise at a slower pace, students face smaller loan repayments and the Government will save money from paying lower interest costs on the index-linked gilts – around a quarter of the country’s debt pile.

The Pensions and Lifetime Savings Association said the move will “raise the risk of insolvency for employers as they seek to address the shortfall in funding of their workplace pension schemes”. It estimated that the value of pension schemes’ investments will fall by £60bn.

“There was quite a lot of encouragement for schemes that were trying to fill deficits and meet future liabilities to invest in these assets,” Ms Silcock added.

“We continue to urge the Government and others to cease to use the RPI, a measure of inflation which the Government itself recognises is not fit for purpose,” said Sir David Norgrove, chairman of the UK Statistics Authority, the regulator that argued for a shift away from RPI.

“We are pleased that the Chancellor acknowledges the statistical case for our proposed change to the RPI but regret the Government’s decision that the change should not be made before 2030.”

Watch: Sunak says UK economy will contract this year by 11.3%

Yahoo News

Yahoo News