The TIMIA Capital (CVE:TCA) Share Price Is Up 231% And Shareholders Are Boasting About It

When you buy shares in a company, it's worth keeping in mind the possibility that it could fail, and you could lose your money. But when you pick a company that is really flourishing, you can make more than 100%. For instance, the price of TIMIA Capital Corp. (CVE:TCA) stock is up an impressive 231% over the last five years. Also pleasing for shareholders was the 19% gain in the last three months.

See our latest analysis for TIMIA Capital

Given that TIMIA Capital didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

For the last half decade, TIMIA Capital can boast revenue growth at a rate of 57% per year. Even measured against other revenue-focussed companies, that's a good result. Meanwhile, its share price performance certainly reflects the strong growth, given the share price grew at 27% per year, compound, during the period. So it seems likely that buyers have paid attention to the strong revenue growth. TIMIA Capital seems like a high growth stock - so growth investors might want to add it to their watchlist.

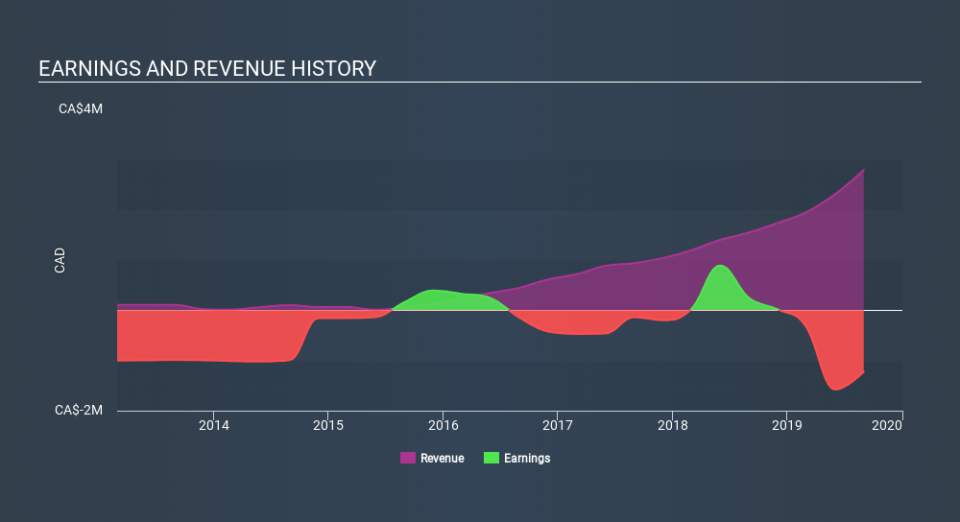

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. Dive deeper into the earnings by checking this interactive graph of TIMIA Capital's earnings, revenue and cash flow.

A Different Perspective

It's nice to see that TIMIA Capital shareholders have received a total shareholder return of 26% over the last year. However, the TSR over five years, coming in at 27% per year, is even more impressive. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Like risks, for instance. Every company has them, and we've spotted 5 warning signs for TIMIA Capital (of which 2 are a bit concerning!) you should know about.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo News

Yahoo News