Transocean's (RIG) Q2 Earnings Break Even, Revenues Rise Y/Y

Transocean Ltd. RIG reported break-even earnings for second-quarter 2020. The Zacks Consensus Estimate was pegged at a loss of 27 cents per share. Also, in the year-ago quarter, the company incurred a loss of 34 cents per share. This outperformance reflects improving utilization and higher revenue efficiency.

Meanwhile, the offshore drilling powerhouse generated total revenues of $930 million, beating the Zacks Consensus Estimate of $757 million and also the prior-year figure of $758 million, primarily on proceeds from a legal settlement with a customer.

Segmental Revenue Break-Up

Transocean’s Ultra-deepwater floaters contributed to 68.4% of total contract drilling revenues while Harsh Environment floaters and Midwater floaters accounted for the remainder. In the quarter under review, revenues from Ultra-deepwater and Harsh Environment floaters totalled $636 million and $293 million each, indicating a respective 31% and 16.7% improvement from the year-ago reported figures of $486 million and $251 million, respectively.

Revenue efficiency was 97.2%, higher than 94.4% reported sequentially. The figure, however, declined from the year-ago value of 97.8%.

Dayrates and Utilization

Average dayrate in the quarter fell to $307,800 from the year-ago level of $314,900. The company witnessed weak year-over-year average revenues per day from both Midwater floaters and Harsh environment floaters. Overall, fleet utilization was 66% during the quarter, up from the prior-year utilization rate of 56%.

Backlog

Transocean’s backlog record at $8.9 billion as of July reflects a decline of $2.5 billion from the year-ago figure.

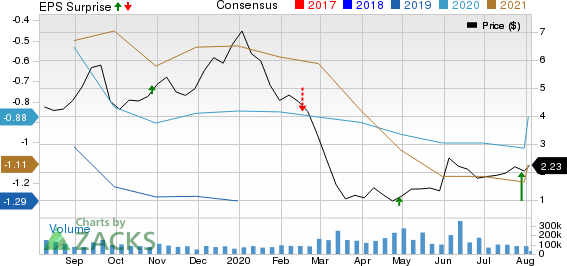

Transocean Ltd. Price, Consensus and EPS Surprise

Transocean Ltd. price-consensus-eps-surprise-chart | Transocean Ltd. Quote

Costs, Capex & Balance Sheet

Operating and maintenance costs increased to $525 million from $510 million a year ago. The company spent $46 million as capital investment in the second quarter. Cash provided by operating activities totalled $87 million. The company had cash and cash equivalents worth $1.51 billion on Jun 30, 2020. Long-term debt was $8.48 billion with debt-to-capitalization of 43.6% as of the same date.

Guidance

For the third quarter, the company expects adjusted contract drilling revenues to be $800 million with a revenue efficiency of 95%.

Third-quarter operating and maintenance expense is projected to be approximately $500 million. Further, the company projects its G&A expense for the current quarter to be approximately $45 million.

Meanwhile, capital spending for the third quarter comprising capitalized interest is predicted to be almost $80 million, consisting of roughly $50 million for the newbuild drillships under construction and the remaining $30 million for maintenance. Further, management added that it eliminated certain onshore positions — expecting lower activity for this year and the next — to save $80 million in annual costs.

Zacks Rank & Key Picks

Transocean currently has a Zacks Rank #3 (Hold). Some better-ranked stocks in the energy space are Halliburton Company HAL, Core Laboratories NV CLB and Pembina Pipeline Corp PBA, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft in the 1990s. Zacks’ just-released special report reveals 8 stocks to watch. The report is only available for a limited time.

See 8 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Transocean Ltd. (RIG) : Free Stock Analysis Report

Halliburton Company (HAL) : Free Stock Analysis Report

Core Laboratories N.V. (CLB) : Free Stock Analysis Report

Pembina Pipeline Corp. (PBA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo News

Yahoo News