Why Uber Fees Are More Expensive Depending On Location

Use of ride-hailing companies such as Uber and Lyft is so ubiquitous these days that it’s unusual to come across someone who doesn’t have at least one of the apps downloaded. Heck, even my mom, who regularly calls me for all sorts of tech support, recently became a driver as a post-retirement side hustle.

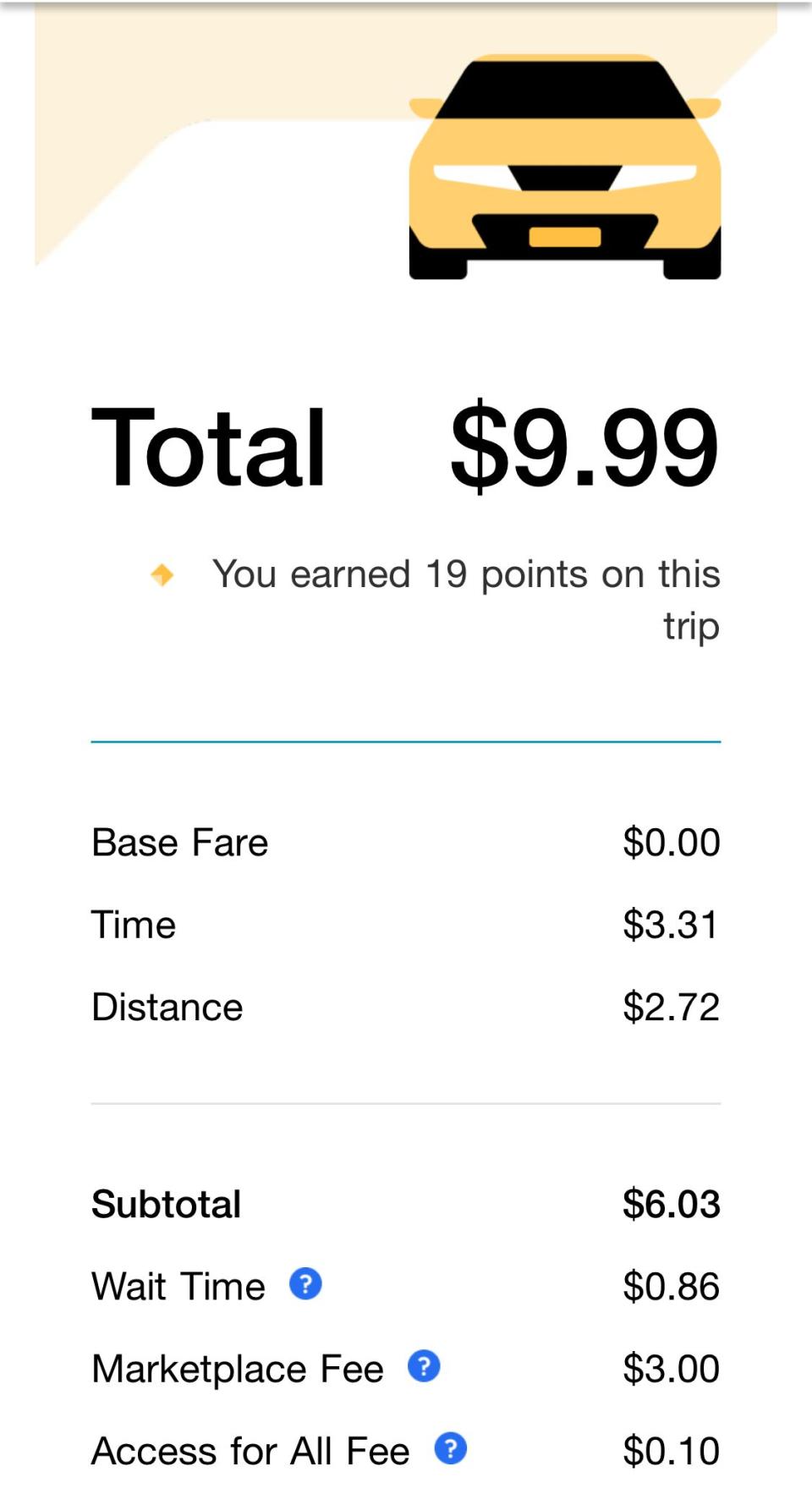

My own allegiance to Uber has always depended on whether it’s the cheapest option at the moment. Rarely did I examine the cost of riding beyond the final bill. Recently, however, I took a closer look at a ride receipt in Los Angeles and found there are a lot of fees comprising that total.

As it turns out, those fees would have looked a lot different if I had called a ride in, say, New York or Chicago. Here’s a closer look at some of the itemized fees Uber charges and why they differ depending on location. (The following generally applies to Lyft and other ride-hailing services as well.)

Why Uber Fees Vary By City And State

Uber is officially considered a transportation network company (TNC), a label used by government entities to describe ride-hailing firms, limousine services, airport shuttles, charter buses and similar types of transportation. The TNC industry is mainly regulated by states, which vary in the breadth and cost of their rules, according to Harry Campbell, founder of The Rideshare Guy blog and podcast. Cities may also implement their own rules, such as business registration and airport permit requirements.

In my home state of California, for example, Uber is regulated by the California Public Utilities Commission. This agency oversees and enforces commercial insurance requirements for TNC drivers, licensing, driver background checks and more.

Last month, some major updates were made to how ride-hailing companies can operate in California. A new law known as AB5 seeks to reclassify Uber drivers as employees rather than contractors. As a result, Uber decided to change the way it sets its rates.

Then, there’s New York City, which has long had a contentious relationship with Uber (even suspending the company from operating its UberX service in 2012). City lawmakers recently approved several bills that regulate ride-hailing operations. Included in the legislation are minimum pay rates for drivers and a cap on the number of drivers allowed, rules the city has been attempting to institute since 2015.

Some of these state and local regulations, as noted, directly or indirectly affect the rates that Uber sets ― and probably don’t get a separate line on your ride receipt. But others add specific fees that drive up the cost of some or all rides ― and show up on your receipt.

A Look At Local Uber Fees

According to an Uber representative, there are so many unique local Uber fees that it would be impractical to list them all here. However, thanks to analysis by Avi Wilensky, founder and developer of the ride-hailing cost comparison app Up Hail, below are some examples of fees you’ll run across in a few major cities and states.

California

Access for All fee: A flat fee of $0.10 is added to every ride that originates in California, and the money goes into a fund that supports increasing the number of wheelchair-accessible vehicles available for on-demand transportation.

Marketplace fee: According to Uber, this fee is charged for connecting riders and drivers within “certain markets.” It’s already included in the upfront price or fare estimate presented before the ride.

Chicago

Ground transportation surcharge: Any trip that takes place in the city of Chicago gets a surcharge of $1.13 on UberX or UberXL rides and $0.53 on pool rides.

Accessibility surcharge: Every trip in a non-wheelchair-accessible vehicle includes a surcharge of $0.10, which goes toward the city’s Vehicle Accessibility Fund.

Congestion surcharge: Any trip that begins or ends in the city’s Central Business District between 6 a.m. and 10 p.m. on weekdays is subject to a $1.75 surcharge on UberX and UberXL rides or $0.60 on pool rides.

New Jersey

NJ surcharge: Any trip that crosses between New York City and New Jersey is subject to a $20 surcharge. That fee includes a toll.

New York

Congestion surcharge: Rides that start, end or pass through Manhattan below 96th Street are subject to a fee of $2.75 per solo trip or $0.75 for a pool ride.

Black Car Fund fee: The Black Car Fund is a nonprofit created by the state of New York that runs health and safety programs for and provides workers’ compensation insurance to for-hire drivers. To support the fund, a 2.5% fee applies to all Uber rider fares.

Out-of-town surcharge: An extra surcharge is applied to any UberX, UberXL, WAV or pool trip that originates in New York City and drops off outside the five boroughs. The amount of the fee varies depending on how far outside the city the trip ends.

TNC fee: Certain trips that begin outside New York City and end anywhere in the state are charged a 4% fee.

Washington, D.C.

Digital dispatch fee: Any non-taxi ride that originates in the District of Columbia is subject to a digital dispatch fee of 6%.

Again, these are just a sampling. You could be subject to fees other than those mentioned here. And note that Uber’s pricing is based on several factors, including route, time, demand and special services requested by the rider.

The convenience of ride-hailing services clearly comes at a price. You may not be able to get out of paying extra fees, but at the very least, it’s nice to know what you’re being charged and why.

Related...

Here's How Much You Should Really Tip An Uber Or Lyft Driver

Does Wrapping Your Car Key In Tin Foil Really Prevent Theft?

Why Concert Tickets Come With So Many Hidden Fees

Also on HuffPost

Earny

What it costs: Free

Raise

What it costs: Free (including shipping on physical cards)

Cardpool

What it costs: Free

Digit

What it costs: Free to try, then $2.99 per month

Qapital

What it costs: Free

Acorns

What it costs: Free to try, then $1 a month (or 0.25 percent a year for larger accounts); also free for college students and anyone under age 24

Love HuffPost? Become a founding member of HuffPost Plus today.

This article originally appeared on HuffPost.

Yahoo News

Yahoo News