Britain warned it's heading towards a housing bubble — again

Britain’s property market is “dangerously close to bubble territory” as sales and prices soar, housing industry figures have warned.

A flurry of news this week alone underlines the mini-boom in the market, with activity “off the Richter scale,” as one estate and letting agent put it.

But Britain’s economy has been plunged into a deep recession by the coronavirus. A combination of greater demand for moves post-lockdown and government measures, from furlough and mortgage support to stamp duty cuts, are fuelling the market.

Neither will last forever, and sales and price growth are widely expected to slow, if not go into reverse, in the not-too-distant future. Lenders are also increasingly tightening borrowing rules.

“Two words: reality check,” said Andrew Montlake, managing director of mortgage broker Coreco. “As strong as the property market is right now, it will not last.”

A mini-boom in UK property

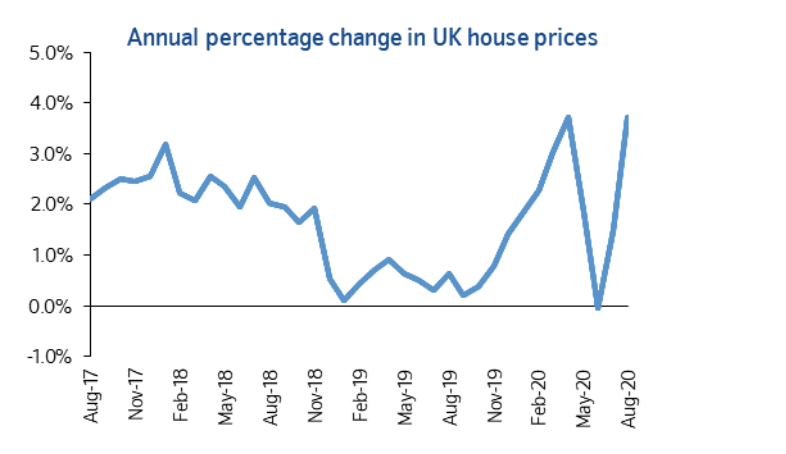

New data from leading lender Nationwide on Wednesday morning provided some of the starkest evidence yet of the mini-boom in UK property.

Mortgage data showed average prices hit a record high of £224,123 ($299,82) in August. It marked a 2% jump from the £220,935 average price in July, the biggest monthly rise in 16 years.

The news sent housebuilding stocks soaring, with Barratt Developments (BDEV.L), Taylor Wimpey (TW.L), and Persimmon (PSN.L) among the top five biggest daily risers on London’s FTSE 100 (^FTSE) on Wednesday.

Official data later on Wednesday bore out this picture of rising prices despite the pandemic, though they cover an earlier period. HM Land Registry said prices rose 0.3% month-on-month between April and May, even during a stricter period of national lockdown.

“English estate agents only reopened their doors halfway through May and they remained closed throughout the month in Scotland. But even while running at reduced capacity, the property market still delivered a respectable rate of price growth,” said Jonathan Hopper, CEO of Garrington Property Finders.

Jeremy Leaf, a north London estate agent, said the figures “underline the resilience” of the market, suggesting buyers had been determined to complete even at prices agreed pre-lockdown.

READ MORE: UK house prices at record high after biggest jump in 16 years

The latest corporate results from Barratt further underscored the sector’s revival. The company spoke of its “cautious optimism” as it starts a new financial year.

While its full-year pre-tax profits almost halved, they also showed customers had recently been “flocking back to showrooms,” noted Susannah Streeter, senior investment and markets analyst at Hargreaves Lansdowne.

Short-term stamp duty holiday boost

Robert Gardner, Nationwide's chief economist, said months of lockdown had left both pent-up demand for moves and also new interest in moving home. Many in the UK are reassessing their “housing needs and preferences” as a result of life under lockdown, he said.

But analysts are in little doubt that a temporary stamp duty holiday, announced by UK chancellor Rishi Sunak, is another major factor fuelling current demand. The tax cuts mean buyers can avoid a levy on the first £500,000 of a purchase in England or Northern Ireland.

Yet such a one-off surge in post-lockdown demand is likely to dwindle over time, and the stamp duty holiday only lasts until 31 March next year.

READ MORE: Stamp duty cuts risk ‘artificial’ spike then fall in property prices

“Once it comes to an end, the demand and therefore asking prices could fall considerably,” said David Hannah, founder of property tax specialists Cornerstone. “Stamp duty has always been a poor tool for dictating long-term market behaviours and this is likely to be the case again."

The holiday is the latest in a string of reforms to the tax by UK chancellors over the past decade, with mixed consequences for the market. George Osborne introduced new rates and thresholds, and added higher rates for second-home and buy-to-let properties, which was widely seen to curb market growth in the late 2010s, on top of Brexit uncertainty.

His successor Phillip Hammond announced a new tax on non-resident buyers, but also introduced a relief that helped first-time buyers. The tax has been devolved in Scotland and Wales.

‘Economic storm clouds gathering’

The latest figures suggest buyers appear determined to move “irrespective of the potential economic storm clouds gathering,” said Leaf.

The rebound could hit a wall even before the stamp duty holiday runs out, given the state of the UK economy and the wave of job losses and pay cuts hitting the headlines.

“The real question is how long will this [boom] last, given that the UK is still reeling from a brutal 20.4% economic contraction between April and June,” said Russ Mould, AJ Bell investment director.

Leading forecasters expect Britain’s GDP to shrink by 10% this year, according to analysis of independent predictions by the government. Their August estimates marked a deterioration on the previous month, when the estimated decline averaged 9.2%.

Meanwhile the official unemployment rate is expected to hit 8.3% in the final three months of the year, having stood near record lows before the crisis hit. The figure stood at 3.8% in February.

READ MORE: HSBC limits 10% deposit mortgages for first-time buyers

Most property analysts expect the gradual wind-down of the furlough scheme, which has kept millions of workers in jobs during the crisis, to spill over into the housing market later this year. “No-one quite knows what that will mean,” added Mould.

Rising joblessness could hit consumer confidence and would-be buyers’ ability to meet mortgage payments, he noted.

Zoopla has said it expects prices to hold firm this year. But Montlake expects a reversal in price growth trends at least in the final few months of 2020, “as the true impact of COVID-19 on the economy shows through.”

Other ‘storm clouds’ on the horizon

An expected rise in unemployment, the lapse of the stamp duty holiday and natural slowing in post-lockdown demand are not the only headwinds facing the market, however.

Guy Harrington, CEO of residential lender Glenhawk, noted a second spike of COVID-19 could heavily curb activity, with the market brought to a near-standstill during the first wave earlier this year.

READ MORE: UK households take on more debt after months of repayments

Streeter noted mortgage holidays and a ban on evictions are also both being unwound this year. One in six homeowners with a mortgage had deferred payments in June. The full scale of borrowers’ financial troubles remains to be seen as blanket three-month holidays come to an end.

The UK government’s Help to Buy support for new homes, which has fuelled significant activity over the past decade, is being tapered off too from next March. Barratt staff told investors and analysts almost half its completions through the scheme last year would not be eligible under the new terms, according to Mould.

Tighter bank lending

The bleak economic climate is already weighing on mortgage lending, as lenders’ concerns grow about whether existing and potential borrowers can repay their loans.

Average household incomes have taken a significant hit, and evidence is mounting of widespread financial troubles.

A survey by Citizens Advice found one in nine people have already reported falling behind on their bills, and the number could grow if unemployment keeps rising.

Meanwhile new data shows households borrowing more than they paid off on credit cards and overdrafts in July, after several months where lockdown curbed borrowing. Surveys suggest household debt hit a record high last year even before the crisis, alarming campaigners.

READ MORE: UK households take on more debt after months of repayments

UK banks have set aside billions to cover potential bad loans, including mortgages. Mortgage approvals jumped in July, but a recent tightening of lending rules by many banks may cap them and further constrain the market.

Data from Moneyfacts.co.uk shows only around 60 loans with 10% deposits are now available, compared to more than 700 in early March.

Average deposit requirements for first-time buyers rose to 20% in the wake of the global financial crisis. UK banks are seen to have entered this crisis in a stronger position, but many lenders have still limited low-deposit deals, limiting many first-time buyers’ ability to get on the ladder.

HSBC announced it would no longer offer loans to buyers with a deposit below 15% on Wednesday, other than existing customers switching rates. But some banks describe stricter conditions as only a temporary measure, and a result of prioritising other demands on their staff, such as handling existing customers’ moves and mortgage holidays.

READ MORE: UK mortgage approvals soar 66% as stamp duty slashed

There are few signs of the property boom losing steam yet, but Harrington said a slowdown now looked inevitable.

“The speed of the market’s recovery is almost jaw-dropping, with the recent stamp duty holiday and whimsical consumer behaviour seemingly turbo-charging a market that looks increasingly disconnected from economic reality.

“The market looks dangerously close to bubble territory; it’s a matter of if, not when, it bursts.”

Yahoo News

Yahoo News