Should US Foods Holding (NYSE:USFD) Be Disappointed With Their 43% Profit?

Vanguard founder Jack Bogle helped spearhead the low-cost index fund, putting average returns within reach of every investor. But you can make better returns by buying undervalued shares. For example, the US Foods Holding Corp. (NYSE:USFD) share price is up 43% in the last three years, slightly above the market return. Zooming in, the stock is up a respectable 13% in the last year.

See our latest analysis for US Foods Holding

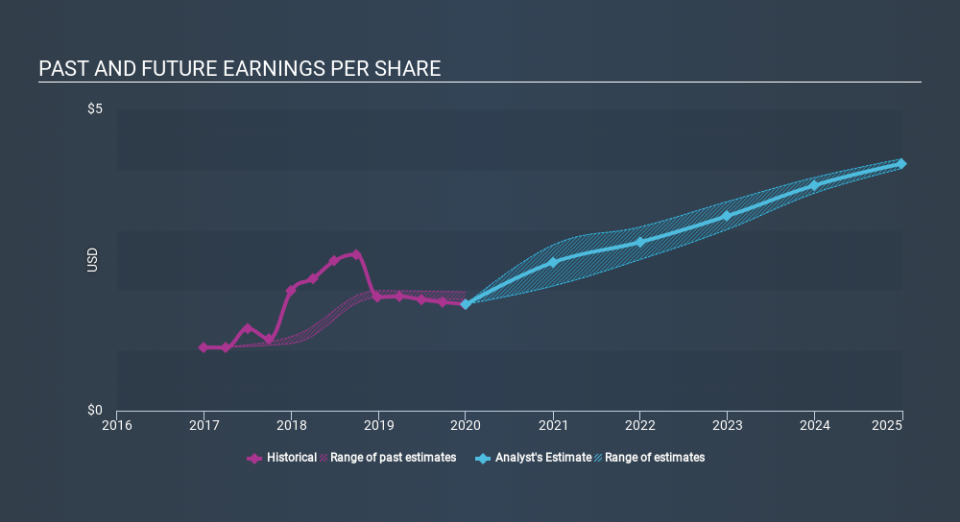

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During three years of share price growth, US Foods Holding achieved compound earnings per share growth of 19% per year. This EPS growth is higher than the 13% average annual increase in the share price. So it seems investors have become more cautious about the company, over time.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

Dive deeper into US Foods Holding's key metrics by checking this interactive graph of US Foods Holding's earnings, revenue and cash flow.

A Different Perspective

US Foods Holding shareholders are up 13% for the year. It's always nice to make money but this return falls short of the market return which was about 22% for the year. But the (superior) three-year TSR of 13% per year is some consolation. Even the best companies don't see strong share price performance every year. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - US Foods Holding has 1 warning sign we think you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo News

Yahoo News