Vertex (VRTX) Beats on Q3 Earnings & Sales, Ups Sales View

Vertex Pharmaceuticals Incorporated VRTX reported third-quarter 2020 adjusted earnings per share of $2.64, which beat the Zacks Consensus Estimate of $2.39. Moreover, earnings rose 115% year over year. Strong cystic fibrosis (“CF”) product revenues led to higher earnings in the reported quarter.

Vertex markets four medicines to treat CF, namely Kalydeco, Orkambi, Symdeko (called Symkevi in Europe) and Trikafta (called Kaftrio in Europe).

Revenues of $1.54 billion also surpassed the Zacks Consensus Estimate of $1.49 billion comprising almost fully of CF product revenues. The company recorded minimal collaborative revenues during the reported quarter. Total revenues rose 62% year over year, driven by the rapid uptake of Trikafta, a triple combination regimen, in the United States. Moreover, higher international revenues due to the reimbursement approvals received for Orkambi and Symkevi in some international markets in 2019 also drove revenues.

Quarter in Detail

Trikafta generated sales worth $960 million, compared with $918 million in the second quarter of 2020. The drug has seen solid uptake in the United States since its launch in October last year and has been a key growth driver for Vertex’s growth. Trikafta was approved by the brand name of Kaftrio in Europe in August, which is expected to contribute to international revenues in the fourth quarter and beyond.

Symdeko/Symkevi registered sales of $156 million in the quarter, down 61.4% year over year.

Kalydeco recorded sales of $194 million in the quarter, reflecting a 22.1% decrease year over year. Orkambi generated sales of $226 million in the reported quarter, down 23.9% year over year. Sales of Kalydeco, Symdeko/ Symkevi and Orkambi were hurt by patient switching to Trikafta.

Costs Rise

Adjusted operating income rose 112% to $854 million in the quarter driven by higher revenues.

Adjusted research and development (R&D) expenses rose 20.7% to $350 million in the quarter due to expansion of CF and non-CF pipeline.

Adjusted selling, general and administrative (SG&A) expenses increased 15.8% to $147 million in the reported quarter due to investments made to support the expansion of the CF business.

2020 Revenue Guidance Raised

Vertex raised its revenue guidance for the year primarily based on Trikafta’s continued strong performance year to date and the potential impact of the Kaftrio launch on fourth-quarter revenues.

The company now expects total revenues from CF products in the range of $6.0-$6.2 billion compared with the previous range of $5.7-$5.9 billion. The new guidance, at the midpoint, reflects approximately 52% growth over 2019.

Moreover, combined adjusted R&D and SG&A expense guidance for 2020 was maintained in the band of $1.95-$2 billion, which is higher than the 2019 level due to Trikafta launch-related costs and the expansion of the R&D pipeline. Adjusted tax rate is expected in the range of 20%-21% (previously 21%-22%).

Pipeline & Other Updates

In October 2020, Vertex stopped dosing and discontinued the phase II study on its investigational oral small molecule corrector, VX-814, for the treatment of alpha-1 antitrypsin deficiency (AATD), an inherited condition that raises risk for lung and liver disease. The decision was based on the liver enzyme elevations observed in some patients and the determination that it would be difficult to safely achieve targeted exposure levels and thereby meaningfully increase levels of alpha-1 antitrypsin, a protein mainly produced by the liver. The pipeline setback had hit the stock hard back then.

In September, Vertex announced a new strategic research collaboration and licensing agreement with Moderna MRNA to develop lipid nanoparticles (LNPs) and mRNAs to treat CF using gene editing.

Our Take

Vertex beat estimates for both earnings and sales and also raised its revenue outlook for the year. However, shares of Vertex were down 1.8% in after-hours trading, despite the strong earnings results probably on broader market pressure. Vertex’s stock has declined 5.4% this year so far compared with a decrease of 6.9% for the industry.

In 2021, approval of Trikafta/Kaftrio in additional geographies, reimbursement agreements for Kaftrio in EU countries, and approval of all CF medicines for younger patient populations could bring additional revenues for Vertex. Trikafta/ Kaftrio is crucial for Vertex’s long-term growth as it has the potential to treat up to 90% of CF patients. Vertex’s non-CF pipeline is progressing rapidly with data in multiple diseases expected in 2020/2021.

Zacks Rank and Stocks to Consider

Vertex currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

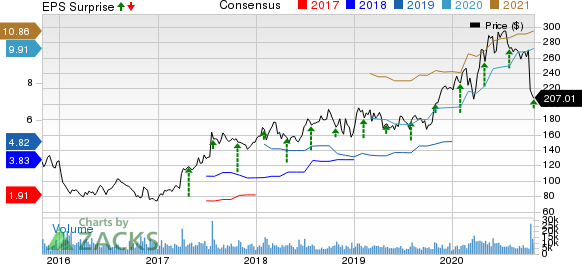

Vertex Pharmaceuticals Incorporated Price, Consensus and EPS Surprise

Vertex Pharmaceuticals Incorporated price-consensus-eps-surprise-chart | Vertex Pharmaceuticals Incorporated Quote

Some better-ranked stocks from the biotech sector include Emergent Biosolutions EBS and Horizon Therapeutics HZNP. While Emergent has a Zacks Rank #1, Horizon Therapeutics has a Zacks Rank #2 (Buy).

Emergent Biosolutions’ earnings per share estimates have moved up from $6.17 to $8.42 per share for 2021 in the past 60 days. The stock has risen 68.3% so far this year.

Horizon Therapeutics’ earnings per share estimates have increased from $2.86 to $2.94 per share for 2020 and from $4.29 to $4.50 for 2021 in the past 60 days. The stock has surged 114.7% so far this year.

Have You Seen Zacks’ 2020 Election Stock Report?

The upcoming election could be a massive buying opportunity for savvy investors. Trillions of dollars will shift into new market sectors after the election. The question is, which sectors will soar for each candidate? Zacks has put together a new special report to help readers like you target big profits.

The 2020 Election Stock Report reveals specific stocks you’ll want to own immediately after the results are announced – 6 if Trump wins, 6 if Biden wins. Past election reports have led investors to gains of +71%, +83%, even +185% in the following months. This year’s picks could be even more lucrative.

Check out Zacks’ 2020 Election Stock Report >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Moderna, Inc. (MRNA) : Free Stock Analysis Report

Vertex Pharmaceuticals Incorporated (VRTX) : Free Stock Analysis Report

Emergent Biosolutions Inc. (EBS) : Free Stock Analysis Report

Horizon Therapeutics Public Limited Company (HZNP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo News

Yahoo News