Waste Connections (WCN) Tops Q2 Earnings & Revenue Estimates

Waste Connections Inc. WCN reported better-than-expected second-quarter 2020 results.

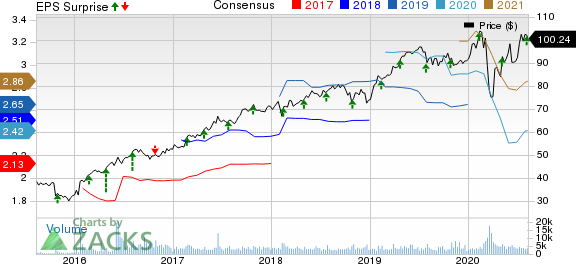

Adjusted earnings of 60 cents per share beat the Zacks Consensus Estimate by 9.1% but decreased 13% year over year. Revenues of $1.31 billion beat the consensus mark by 0.4% but declined 4.7% year over year.

Revenues by Segment

Solid Waste Collection segment revenues decreased 1.1% year over year to $944.64 million. The segment accounted for 72.4% of total revenues.

Solid Waste Disposal and Transfer segment revenues decreased 8.2% from the year-ago quarter to $278.40 million. The segment contributed 21.3% to total revenues.

E&P Waste Treatment, Recovery and Disposal segment revenues decreased 44.5% from the year-ago quarter to $35.51 million. The segment contributed 2.7% to total revenues.

Intermodal and Other segment revenues declined 9.3% to $27.67 million. The segment accounted for 2.1% of total revenues.

Solid Waste Recycling segment revenues improved 19.8% year over year to $19.56 million. The segment accounted for 1.5% of total revenues.

Operating Results

Adjusted EBITDA in the reported quarter was $394.3 million compared with $425.3 million in the year-ago quarter. Adjusted EBITDA margin came in at 30.2% compared with 31.1% in the year-ago quarter.

Operating loss totaled $232.4 million against operating income of $222.1 millionin the year-ago quarter.

Balance Sheet and Cash Flow

Waste Connections exited second-quarter 2020 with cash and cash equivalents of $790.55 million compared with $1.19 billion at the end of the prior quarter. Long-term debt was $4.69 billion compared with $5.16 billion at the end of the prior quarter.

The company generated $383.6 million of cash from operating activities in the reported quarter. Adjusted free cash flow was $258.8 million. Capital expenditure totaled $130.9 million.

Waste Connections paid out dividend of $48.9 million in the reported quarter.

2020 View

For the full year, Waste Connections expects revenues to be around $5.325 billion. Adjusted EBITDA is estimated to be around $1.610 billion. Capital expenditures are anticipated to be nearly $550 million. Net cash provided by operating activities is expected to be between $1.344 billion and $1.374 billion. Adjusted free cash flow is expected to be between $805 million and $835 million.

Currently, Waste Connections carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Business Services Companies

Equifax EFX reported better-than-expected second-quarter 2020 adjusted earnings of $1.60 per share, whichbeat the Zacks Consensus Estimate by 22.1% and improved 14.3% on a year-over-year basis. The reported figure exceeded the guided range of 78-88 cents.

IQVIA Holdings IQV reported second-quarter 2020 adjusted earnings per share of $1.18, which beat the consensus mark by 12.4% but decreased 22.9% on a year-over-year basis. The reported figure exceeded the guided range of $1.00-$1.09.

Robert Half RHI reported second-quarter 2020 earnings of 41 cents per share that beat the consensus mark by 17% but were down 58% year over year.

Zacks’ Single Best Pick to Double

From thousands of stocks, 5 Zacks experts each picked their favorite to gain +100% or more in months to come. From those 5, Zacks Director of Research, Sheraz Mian hand-picks one to have the most explosive upside of all.

With users in 180 countries and soaring revenues, it’s set to thrive on remote working long after the pandemic ends. No wonder it recently offered a stunning $600 million stock buy-back plan.

The sky’s the limit for this emerging tech giant. And the earlier you get in, the greater your potential gain.

Click Here, See It Free >>

Click to get this free report Equifax, Inc. (EFX) : Free Stock Analysis Report Robert Half International Inc. (RHI) : Free Stock Analysis Report Waste Connections, Inc. (WCN) : Free Stock Analysis Report IQVIA Holdings Inc. (IQV) : Free Stock Analysis Report To read this article on Zacks.com click here. Zacks Investment Research

Yahoo News

Yahoo News