What drove user interest and what can we expect moving forward?

As we kick off 2020, we're taking a look at the past year's most popular stocks and the trends that fueled them. To do this, we took a peek within our award-winning technical analysis product Technical Insight to see which U.S. instruments yielded the highest search rate from our global investor base throughout 2019.

To compliment our “top five” list, we had our Head of North American Research, Gary Christie comment on key price levels and corporate news that drove this interest and what investors may want to keep an eye out for moving forward.

The top 5 U.S. stock searches in 2019:

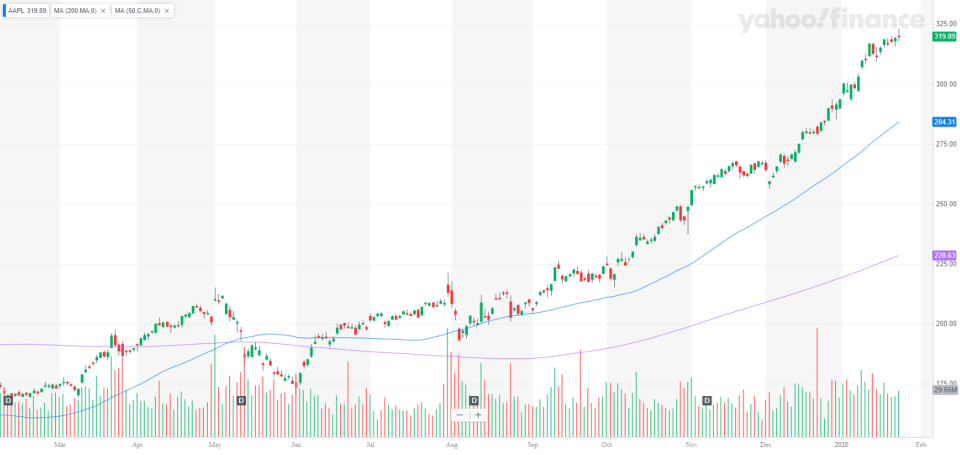

1. Apple Inc (NASDAQ:AAPL)

Apple was the stock with the most lookups in 2019 and it’s no surprise. Once Apple broke above key resistance at $233 back in October, the stock never looked back. The company has been successful in tapping into the service and wearables business, being less reliant on iphone sales. Air Pods were a smashing hit during this past holiday season, if you were lucky enough to find them in stock. Apple's "wearables, home, and accessories" segment saw revenue rise 41% year over year in fiscal 2019.

2. Amazon.com Inc (NASDAQ:AMZN)

Amazon price action remained relatively flat throughout the year failing to break above record highs posted back in 2018. If key support at $1820 remains in place we can expect a retest of record high resistance near the $2035 level and a possible continuation of the uptrend that started back in 2017.

3. Microsoft Corp (NASDAQ:MSFT)

Microsoft has maintained its impressive uptrend after breaking above its short-term consolidation back in October and hasn’t even looked back since. Microsoft has benefitted from strong growth in its cloud computing business amid tough competitors like Amazon and IBM. Analysts will be focusing on cloud revenue to see if the uptrend in earnings continues this earnings season. A lack of growth momentum could signal a reversal in some software giants as they are quite over extended above their key moving averages already.

4. Alibaba Group Holding Ltd (NYSE:BABA)

Alibaba has had an impressive up move in price action after breaking above a classic symmetrical triangle continuation pattern that technical analysts have been watching since 2018. The company has benefited from renewed U.S. - China trade optimism and a record singles day shopping event in China. The Co’s shares were successfully listed on the Hong Kong stock exchange at the end of November. Key support rests at the $207 level as the stock continues its rally.

5. Tesla Inc (NASDAQ:TSLA)

Tesla’s rocketing share price has been defying the bears and creating confusion among analysts on how to justify future price forecasts. Tesla’s market cap is around $96B which is higher than Ford and General Motor’s market cap combined. How much farther can the stock go? Well the sky's the limit. We see key support at $377.

Blazing a path for better decision-making...

Trading Central excels in supporting today's investors and online brokerages alike, through a unique combination of expert analyst research, and insightful analytics. Technical Insight forms a core part in our line of analytical products and its patented pattern recognition enables users to find, validate and time opportunities across 72,000 global instruments. Meanwhile, our global research desks are experts with chart patterns and market psychology and are here to complement our analytics with insightful commentary and facilitate educated trade decisions.

Another trending topic throughout 2019? Mobile.

According to a recent JD Power investor satisfaction survey, enhancing mobile research options resulted in the highest overall satisfaction increase. That’s why we’ve made it simple for today’s online brokers to harness our award-winning analytics within their mobile website and app, keeping their investors tuned in to the critical research impacting their investments in the moments that matter. Discover how to create long-lasting success for your investing customers with our proactive analytics, educational guidance and our beautiful user interfaces.

Yahoo News

Yahoo News