What's in Store for Twilio (TWLO) This Earnings Season?

Twilio TWLO is slated to release third-quarter 2020 results on Oct 26.

In a SEC filing, the company said on Oct 1 that its third-quarter revenues will come in above the previously-guided range of $401 million to $406 million. The Zacks Consensus Estimate for quarterly revenues is pegged at $404.5 million, suggesting 37.1% growth from the $295.1 million reported in the year-ago period.

Twilio forecasts non-GAAP loss per share between 5 cents and 9 cents. The Zacks Consensus Estimate for the quarter under review is pegged at a loss per share of 5 cents. Notably, Twilio had posted earnings of 3 cents per share in the third quarter of 2019.

Let’s see how things have shaped up for the upcoming announcement.

Factors at Play

Twilio’s third-quarter results are likely to have benefited from the accelerated digital transformation projects across a number of industries in the wake of the pandemic-induced lockdown. Organizations are reconfiguring their set-up for a work-from-home operational environment in a bid to make nearly 100% e-commerce a reality.

The company is expected to have witnessed soft demand from ride-sharing, hospitality and travel industries, which have been hit hard by the global lockdown. However, increased demand from health care, education, retail and crisis management organizations are likely to have more than offset the negative impact of the aforementioned factors.

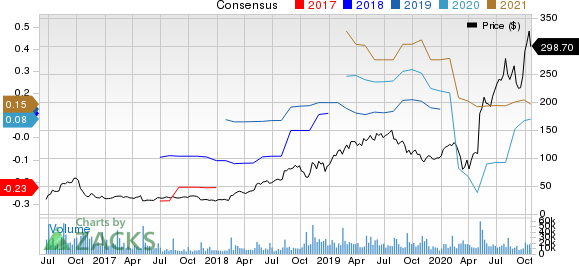

Twilio Inc. Price and Consensus

Twilio Inc. price-consensus-chart | Twilio Inc. Quote

Twilio’s quarterly performance is likely to have benefited from an increasing clientele and the Sendgrid buyout. Growing adoption of Twilio Flex is also expected to have been a tailwind.

The company’s expanding foothold among leading enterprises is also likely to have been a key catalyst. Remarkably, in the last reported quarter, the company had added more than 10,000 new clients, taking the total active customer count to more than 200,000.

Moreover, Twilio’s solid efforts to fortify its global footprint will likely reflect on the quarterly results. Further, the introductions of Twilio Conversations, SendGrid Ads and SendGrid’s Email Validation API are anticipated to have been conducive to the company’s performance.

Nonetheless, Twilio’s rising investments in lower-margin international regions might have dampened its profitability. Also, the firm is stepping up investments in its systems and infrastructure, go-to-market team and Flex, as well as in R&D, which is likely to have clipped the company’s profitability during the July-September period.

What Our Model Says

Our proven model does not predict an earnings beat for Twilio this season. The combination of a positive Earnings ESP, and Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold), increases the chances of an earnings beat. But that’s not the case here. You can uncover the best stocks to buy or sell, before they’re reported, with our Earnings ESP Filter.

Twilio currently carries a Zacks Rank of 4 and has an Earnings ESP of +42.11%.

Stocks With Favorable Combinations

Here are some companies, which, per our model, have the right combination of elements to post an earnings beat in their upcoming releases:

Vishay Intertechnology, Inc. VSH has an Earnings ESP of +6.45% and flaunts a Zacks Rank of 1, at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

CDW Corporation CDW has an Earnings ESP of +6.76% and currently sports a Zacks Rank of 1.

Alphabet GOOGL has an Earnings ESP of +7.40% and carries a Zacks Rank of 2, currently.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +50%, +83% and +164% in as little as 2 months. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Vishay Intertechnology, Inc. (VSH) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

CDW Corporation (CDW) : Free Stock Analysis Report

Twilio Inc. (TWLO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo News

Yahoo News