Why Investors Shouldn't Be Surprised By Smartgroup Corporation Ltd's (ASX:SIQ) Low P/E

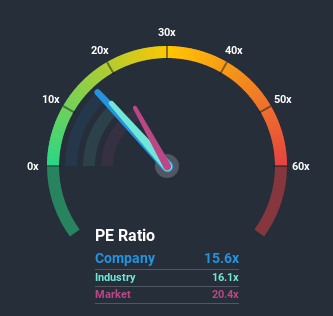

When close to half the companies in Australia have price-to-earnings ratios (or "P/E's") above 21x, you may consider Smartgroup Corporation Ltd (ASX:SIQ) as an attractive investment with its 15.6x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

Smartgroup has been struggling lately as its earnings have declined faster than most other companies. The P/E is probably low because investors think this poor earnings performance isn't going to improve at all. You'd much rather the company wasn't bleeding earnings if you still believe in the business. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Check out our latest analysis for Smartgroup

Keen to find out how analysts think Smartgroup's future stacks up against the industry? In that case, our free report is a great place to start.

Is There Any Growth For Smartgroup?

The only time you'd be truly comfortable seeing a P/E as low as Smartgroup's is when the company's growth is on track to lag the market.

Retrospectively, the last year delivered a frustrating 21% decrease to the company's bottom line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 22% overall rise in EPS. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been mostly respectable for the company.

Shifting to the future, estimates from the five analysts covering the company suggest earnings should grow by 9.6% per year over the next three years. That's shaping up to be materially lower than the 18% per year growth forecast for the broader market.

With this information, we can see why Smartgroup is trading at a P/E lower than the market. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Key Takeaway

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Smartgroup maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Smartgroup, and understanding should be part of your investment process.

If P/E ratios interest you, you may wish to see this free collection of other companies that have grown earnings strongly and trade on P/E's below 20x.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo News

Yahoo News