Wolverine's (WWW) Q2 Earnings & Sales Beat, Decline Y/Y

Wolverine World Wide, Inc. WWW delivered better-than-expected second-quarter 2020 results. However, both earnings and sales declined on a year-over-year basis. The majority of the company’s physical stores were shut for most of the quarter.

Going forward, management expects a challenging second half and projects third-quarter revenues to decline less than 25% based on current trends. Although the company has been managing costs, it expects SG&A expenses in the third and fourth quarters to increase from the second quarter on higher business demands and growth investments. Nevertheless, its strategic efforts and diversified business model, along with the e-commerce business, remain encouraging.

In the past three months, shares of this Zacks Rank #3 (Hold) stock have increased 23.2% compared with the industry’s 14.4% rally.

Q2 Highlights

Wolverine reported second-quarter adjusted earnings of 8 cents per share in contrast to the Zacks Consensus Estimate of a loss of 13 cents. However, the metric significantly plunged from 52 cents earned in the year-ago quarter. On a constant-currency (cc) basis, adjusted earnings were 9 cents per share.

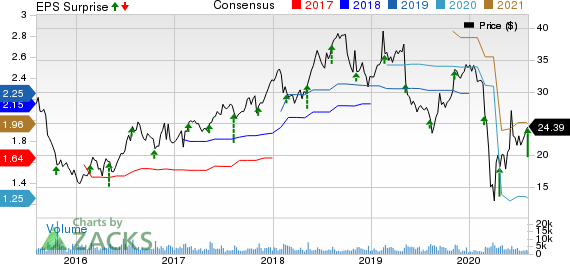

Wolverine World Wide, Inc. Price, Consensus and EPS Surprise

Wolverine World Wide, Inc. price-consensus-eps-surprise-chart | Wolverine World Wide, Inc. Quote

Moreover, revenues of $349.1 million came above the Zacks Consensus Estimate of $321 million but fell 38.6% year over year. On a cc basis, revenues declined 38.3%. The year-over-year downside can mainly be attributed to the ill impacts of the pandemic. However, the company’s e-commerce business excelled in the quarter, surging 96% year over year on accretive margins. Notably, the digital and e-commerce platforms accounted for nearly two-thirds of the overall U.S. sales in the second quarter.

Gross profit amounted to $147.2 million, down 36.1% year over year. However, gross margin expanded 170 basis points (bps) year over year to 42.2%, mainly driven by its full-priced wholesale business and the increased mix of e-commerce business. The majority of its brands recorded impressive gross-margin expansion in the quarter.

Further, adjusted selling, general and administrative expenses plunged 22.5% to $129.6 million owing to reduced sales and immediate action undertaken to adjust to the downturn in the global economy. Furloughs and compensation changes for its management team made up for almost half of these savings. Lower traditional marketing and travel expenses also contributed to the decline. However, adjusted operating profit tumbled nearly 72% to $17.7 million, with adjusted operating margin contracting 600 bps to 5.1%.

Segmental Performance

Revenues at Wolverine Michigan Group decreased 31.7% (or 31.2% at cc) year over year to $217.4 million, owing to adverse impacts of COVID-19 and related retail-store closures.

While Merrell and Cat Footwear were down over 30%, Wolverine, which gained from many essential retail consumers remaining open, declined less than 30%. Also, Chaco declined mid-teens, reflecting a tied digital penetration and its latest Chillos product’s success. The smaller brands declined in double digits. However, e-commerce remained sturdy with merrell.com growing roughly 140% in the quarter and almost tripling new-customer acquisition on a year-over-year basis.

Wolverine Boston Group’s revenues tumbled 46.9% (or 46.7% at cc) to $122.5 million from the year-ago quarter. The segment’s Sperry and Keds brands were hurt by the stay-at-home realities owing to the pandemic and sluggish trends in casual-footwear sales. However, Saucony.com revenues almost tripled, primarily buoyed by product innovation and new-customer acquisition.

Other Financials

The company ended the quarter with cash and cash equivalents of $422.6 million, long-term debt of $715.9 million and stockholders' equity of $735.9 million. Net inventories in the reported quarter decreased 4.9% to $386.5 million.

Notably, Wolverine recorded nearly $116 million of cash flow from operations in the second quarter, which significantly exceeded management’s expectations. Net cash generated from operating activities was $39 million during the first half of 2020.

Furthermore, net interest expenses grew $3.8 million owing to the proactive liquidity actions, and raised $471 million of new debt in the reported quarter.

Don’t Miss These Solid Bets

Cimpress CMPR has an expected long-term earnings growth rate of 20% and currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Deckers DECK, also a Zacks Rank #1 stock having an expected long-term earnings growth rate of 16.9%.

Crocs CROX has a long-term expected earnings growth rate of 15% and presently displays a Zacks Rank #1.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2021.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Deckers Outdoor Corporation (DECK) : Free Stock Analysis Report

Wolverine World Wide, Inc. (WWW) : Free Stock Analysis Report

Crocs, Inc. (CROX) : Free Stock Analysis Report

Cimpress plc (CMPR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo News

Yahoo News