Is It Worth Considering DocCheck AG (ETR:AJ91) For Its Upcoming Dividend?

Readers hoping to buy DocCheck AG (ETR:AJ91) for its dividend will need to make their move shortly, as the stock is about to trade ex-dividend. You can purchase shares before the 1st of June in order to receive the dividend, which the company will pay on the 4th of June.

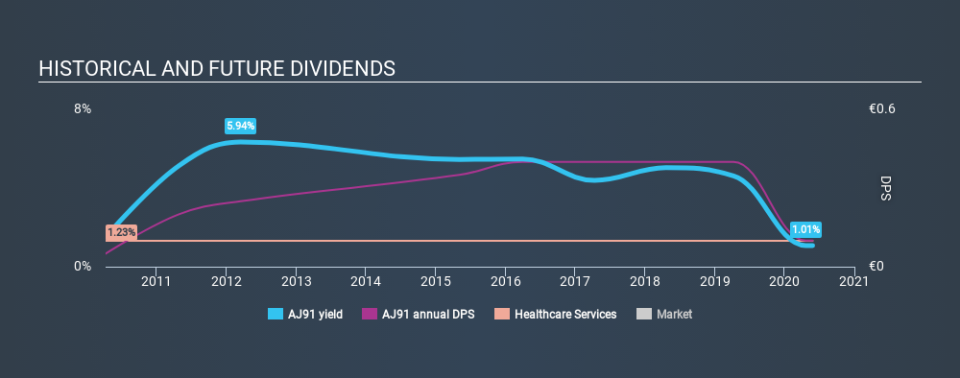

DocCheck's next dividend payment will be €0.10 per share, and in the last 12 months, the company paid a total of €0.10 per share. Based on the last year's worth of payments, DocCheck stock has a trailing yield of around 1.0% on the current share price of €9.9. We love seeing companies pay a dividend, but it's also important to be sure that laying the golden eggs isn't going to kill our golden goose! So we need to check whether the dividend payments are covered, and if earnings are growing.

Check out our latest analysis for DocCheck

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. DocCheck paid out just 16% of its profit last year, which we think is conservatively low and leaves plenty of margin for unexpected circumstances. Yet cash flows are even more important than profits for assessing a dividend, so we need to see if the company generated enough cash to pay its distribution. It paid out an unsustainably high 268% of its free cash flow as dividends over the past 12 months, which is worrying. Our definition of free cash flow excludes cash generated from asset sales, so since DocCheck is paying out such a high percentage of its cash flow, it might be worth seeing if it sold assets or had similar events that might have led to such a high dividend payment.

DocCheck does have a large net cash position on the balance sheet, which could fund large dividends for a time, if the company so chose. Still, smart investors know that it is better to assess dividends relative to the cash and profit generated by the business. Paying dividends out of cash on the balance sheet is not long-term sustainable.

DocCheck paid out less in dividends than it reported in profits, but unfortunately it didn't generate enough cash to cover the dividend. Cash is king, as they say, and were DocCheck to repeatedly pay dividends that aren't well covered by cashflow, we would consider this a warning sign.

Click here to see how much of its profit DocCheck paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Stocks in companies that generate sustainable earnings growth often make the best dividend prospects, as it is easier to lift the dividend when earnings are rising. Investors love dividends, so if earnings fall and the dividend is reduced, expect a stock to be sold off heavily at the same time. For this reason, we're glad to see DocCheck's earnings per share have risen 13% per annum over the last five years. Earnings have been growing at a decent rate, but we're concerned dividend payments consumed most of the company's cash flow over the past year.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. DocCheck has delivered 7.2% dividend growth per year on average over the past ten years. We're glad to see dividends rising alongside earnings over a number of years, which may be a sign the company intends to share the growth with shareholders.

The Bottom Line

Is DocCheck an attractive dividend stock, or better left on the shelf? We like that DocCheck has been successfully growing its earnings per share at a nice rate and reinvesting most of its profits in the business. However, we note the high cashflow payout ratio with some concern. Overall, it's hard to get excited about DocCheck from a dividend perspective.

While it's tempting to invest in DocCheck for the dividends alone, you should always be mindful of the risks involved. Be aware that DocCheck is showing 2 warning signs in our investment analysis, and 1 of those makes us a bit uncomfortable...

A common investment mistake is buying the first interesting stock you see. Here you can find a list of promising dividend stocks with a greater than 2% yield and an upcoming dividend.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

Yahoo News

Yahoo News