Is It Worth Considering Provident Bancorp, Inc. (NASDAQ:PVBC) For Its Upcoming Dividend?

Readers hoping to buy Provident Bancorp, Inc. (NASDAQ:PVBC) for its dividend will need to make their move shortly, as the stock is about to trade ex-dividend. You can purchase shares before the 4th of November in order to receive the dividend, which the company will pay on the 19th of November.

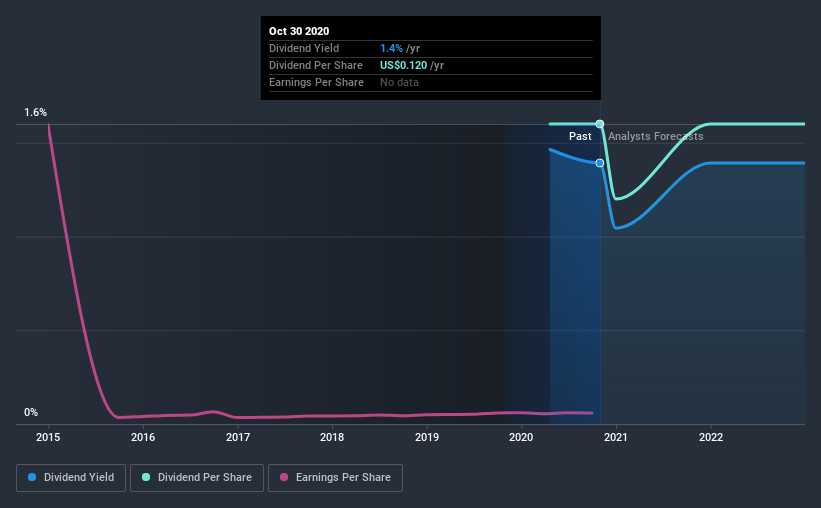

Provident Bancorp's upcoming dividend is US$0.03 a share, following on from the last 12 months, when the company distributed a total of US$0.12 per share to shareholders. Last year's total dividend payments show that Provident Bancorp has a trailing yield of 1.4% on the current share price of $8.62. Dividends are an important source of income to many shareholders, but the health of the business is crucial to maintaining those dividends. So we need to check whether the dividend payments are covered, and if earnings are growing.

See our latest analysis for Provident Bancorp

Dividends are usually paid out of company profits, so if a company pays out more than it earned then its dividend is usually at greater risk of being cut. Provident Bancorp paid out just 5.1% of its profit last year, which we think is conservatively low and leaves plenty of margin for unexpected circumstances.

Generally speaking, the lower a company's payout ratios, the more resilient its dividend usually is.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Businesses with shrinking earnings are tricky from a dividend perspective. If business enters a downturn and the dividend is cut, the company could see its value fall precipitously. Provident Bancorp's earnings per share have plummeted approximately 48% a year over the previous five years.

Provident Bancorp also issued more than 5% of its market cap in new stock during the past year, which we feel is likely to hurt its dividend prospects in the long run. Trying to grow the dividend while issuing large amounts of new shares reminds us of the ancient Greek tale of Sisyphus - perpetually pushing a boulder uphill.

Given that Provident Bancorp has only been paying a dividend for a year, there's not much of a past history to draw insight from.

Final Takeaway

Is Provident Bancorp worth buying for its dividend? Provident Bancorp's earnings per share are down over the past five years, although it has the cushion of a low payout ratio, which would suggest a cut to the dividend is relatively unlikely. We think there are likely better opportunities out there.

Wondering what the future holds for Provident Bancorp? See what the two analysts we track are forecasting, with this visualisation of its historical and future estimated earnings and cash flow

A common investment mistake is buying the first interesting stock you see. Here you can find a list of promising dividend stocks with a greater than 2% yield and an upcoming dividend.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo News

Yahoo News