3 Reasons to Add Surmodics (SRDX) Stock to Your Portfolio Now

Surmodics, Inc. SRDX has been gaining on the back of its solid prospects in the thrombectomy business over the past few months. A robust third-quarter fiscal 2022 performance and consistent efforts to boost research and development (R&D) are expected to contribute further. Yet, concerns related to stiff competition and reliance on third parties persist.

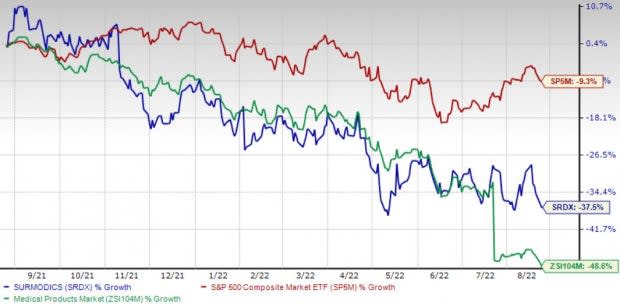

Over the past year, this Zacks Rank #2 (Buy) stock has lost 37.5% compared with 48.6% fall of the industry and 9.4% decline of the S&P 500 composite.

The renowned medical device and in-vitro diagnostics (IVD) technology provider has a market capitalization of $477.2 million. Surmodics projects 135.2% growth for fiscal 2023, expecting to maintain its strong performance. SRDX’s earnings surpassed the Zacks Consensus Estimate in all the trailing four quarters, the average earnings surprise being 41.9%.

Image Source: Zacks Investment Research

Let’s delve deeper.

Consistent Efforts to Boost R&D: Surmodics’ solid efforts to improve its R&D stature have been a key growth driver, which raises our optimism. The company’s whole product solutions pipeline and sirolimus-based below-the-knee drug-coated balloon (DCB) program deserve a mention here. Surmodics has been making progress using its internally developed .014 balloon platform.

On the third-quarter fiscal 2022 earnings call in July, Surmodics confirmed that currently it is assessing the next steps for the clinical development and future commercialization of the Sundance DCB, for which a multinational strategic partner has expressed interest.

Thrombectomy Prospects Bright: Surmodics’ aim to leverage its proprietary Pounce thrombectomy platform technology to develop products raises our optimism. Surmodics’ Product Sales of its medical devices in the fiscal 2022 third quarter grew 64% year over year, which includes contract manufactured balloon catheters, specialty catheters partnered with Cook and Medtronic, and its Pounce arterial Thrombectomy and Sublime Radial device products. Surmodics’ Medical Device business product revenue grew 23% on broad-based growth across Medical Device products and coating reagents with growing contribution from the Pounce Arterial and Sublime Radial commercialization efforts.

Strong Q3 Results: Surmodics’ better-than-expected earnings in third-quarter fiscal 2022 buoy optimism about the stock. Its quarterly revenues were also in line with management expectations. The company registered robust Product sales growth on the back of continued demand for its medical devices and IVD products. Surmodics confirmed making crucial progress on its SurVeil DCB pre-market approval submission. Gross margin expansion bodes well.

Downsides

Stiff Competition: Competition in the diagnostics market is highly fragmented, and in the product lines in which Surmodics competes, it faces an array of competitors ranging from large to small manufacturers. The company’s success depends partly upon its ability to maintain a competitive position in the development of technologies and products in the fields of medical device products and diagnostics, among others.

Reliance on Third Parties: A principal element of Surmodics’ business strategy is to enter into licensing arrangements with medical devices and other companies that manufacture products incorporating its technologies. The amount of revenues the company derives from such arrangements depends upon its ability or its licensees’ ability to successfully develop, obtain regulatory approval for, manufacture (if applicable), market and sell products incorporating Surmodics’ technologies.

Estimate Trend

Surmodics is witnessing a positive estimate revision trend for fiscal 2022. In the past 90 days, the Zacks Consensus Estimate for its earnings has narrowed from a loss of $1.15 to $1.08 per share.

The Zacks Consensus Estimate for the company’s fourth-quarter fiscal 2022 revenues is pegged at $24.9 million, suggesting a 4.2% improvement from the year-ago reported number.

Key Picks

Some other top-ranked stocks in the broader medical space are AMN Healthcare Services, Inc. AMN, Patterson Companies, Inc. PDCO and McKesson Corporation MCK.

AMN Healthcare, sporting a Zacks Rank #1 (Strong Buy) at present, has an estimated long-term growth rate of 3.2%. AMN’s earnings surpassed the Zacks Consensus Estimate in all the trailing four quarters, the average beat being 15.7%.

You can see the complete list of today’s Zacks #1 Rank stocks here.

AMN Healthcare has lost 5.8% compared with the industry’s 33.2% fall in the past year.

Patterson Companies, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 7.9%. PDCO’s earnings surpassed estimates in all the trailing four quarters, the average beat being 16.5%.

Patterson Companies has lost 1.3% compared with the industry’s 10.3% fall over the past year.

McKesson, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 9.9%. MCK’s earnings surpassed estimates in three of the trailing four quarters and missed the same in one, the average beat being 13%.

McKesson has gained 81.7% against the industry’s 10.3% fall over the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

McKesson Corporation (MCK) : Free Stock Analysis Report

Surmodics, Inc. (SRDX) : Free Stock Analysis Report

Patterson Companies, Inc. (PDCO) : Free Stock Analysis Report

AMN Healthcare Services Inc (AMN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo News

Yahoo News