Amazon's hold on the smart speaker market is slipping (AMZN)

BI Intelligence

This story was delivered to BI Intelligence Apps and Platforms Briefing subscribers hours before appearing on Business Insider. To be the first to know, please click here.

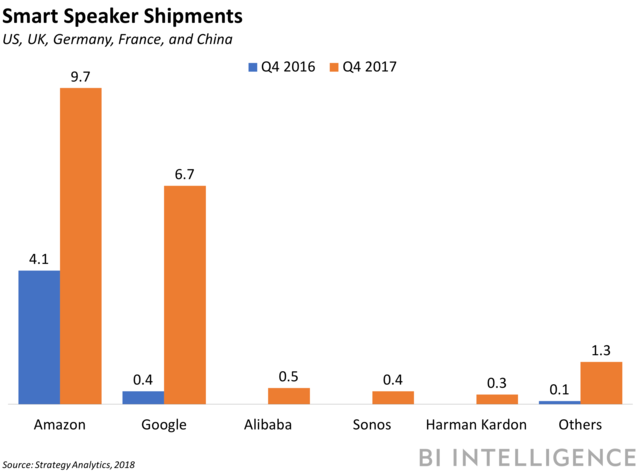

Shipments of smart speakers in the US, UK, Germany, France, and China grew 300% YoY in Q4 2017 to reach 18.6 million units, according to Strategy Analytics.

This is notable because smart speakers play a significant role in the adoption of voice assistants, and an uptick in smart speaker adoption indicates the voice interface is gaining footing with consumers.

Smart speaker shipments in 2017 highlighted that this nascent space is becoming more competitive, and Amazon’s early hold on the market is shakeable. Google, which is leveraging its Google Home smart speaker to expand the use of Google Assistant, made strides against Amazon in 2017.

Amazon captured 52% of the installed base of smart speakers in Q4 2017, marking a notable drop-off from the 88% share it commanded in Q4 2016. Meanwhile, Google edged up its share of the installed base of smart speakers to 36% in Q4 2017, up from 9% in the previous year. Google grew its installed base 1,575% YoY in Q4 2017, while Amazon grew its installed base 137%.

Overseas competitors are gaining, too. Chinese e-commerce giant Alibaba captured 2.6% of the market in Q4 after only entering the space in the prior quarter.

While this is a small share of total shipments, the potential of Chinese smart speaker vendors shouldn’t be underrated; North America currently dominates sales of smart speakers — the region captured nearly 75% global share of smart speaker shipments in Q3 — likely because North American consumers largely purchased their smart speakers from US tech giants. As Chinese vendors increasingly launch devices that target Asian-Pacific consumers, adoption of smart speakers will likely grow, as these devices are better suited for consumers in the region.

Peter Newman, research analyst for BI Intelligence, has put together a Smart Speaker report that analyzes the market potential of the Echo Look, Echo Show, and HomePod. Using exclusive survey data, this report evaluates each device's potential for adoption based on four criteria: awareness, excitement, usefulness, and purchase intent. Finally, the report draws some inferences from our data about the direction the smart speaker market could take from here.

Here are some of the key takeaways:

Amazon's new Echo Show is the big winner — it has mass-market appeal and looks like it will take off. The combination of usefulness and excitement will drive consumers to buy the Echo Show. The Echo Look, though, seems like it will struggle to attract that same level of interest.

Apple’s HomePod looks likely to find a place in the smart speaker market but won’t dominate its space like the iPhone or iPad did.

The smart speaker market will evolve rapidly in the next few years, with more devices featuring screens, a variety of more focused products emerging, and eventually, the voice assistant moving beyond the smart speaker.

In full, the report:

Showcases exclusive survey data on initial consumer reactions to the Echo Look, Echo Show, and HomePod.

Highlights the aims and strategies of major players in the smart speaker market.

Provides analysis on the direction this nascent market will take and the opportunity for companies considering a move into the space.

See Also:

Yahoo News

Yahoo News