Argentina Investors See Rally in YPF Bonds Running Out of Steam

(Bloomberg) -- A months-long rally in bonds from Argentina’s state-run oil driller YPF SA has run its course, with investors saying it’s time to sell ahead of presidential elections in October.

Most Read from Bloomberg

China’s Ultra-Rich Gen Zs Flock Home as Global Tensions Rise

Ex-Goldman Bankers Make a Fortune With Controversial Bet on Coal

McCarthy Ambushed as Republican Hardliners Change Course on Spending Plan

Open House: Seized HK Mansion Listed for $112 Million Traces Fall of Evergrande Tycoon

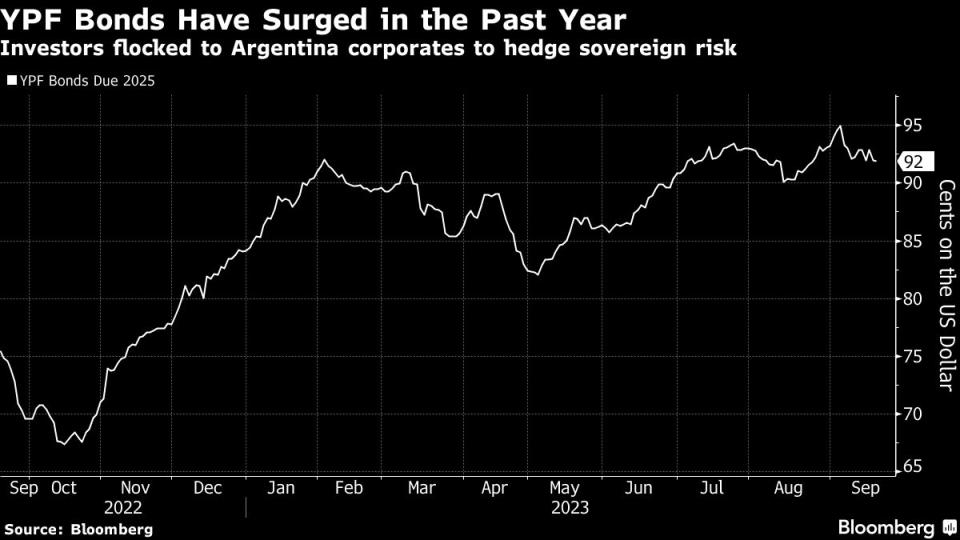

Notes due in 2025 have climbed about 20 cents on the dollar in the past year, delivering some of the best returns in emerging-markets corporates. The rally, combined with a lack of clarity about the incoming administration, have made the bonds — seen as safe havens from the country’s near-constant economic chaos — expensive, according to investors and analysts from local shops including TPCG Valores SA and Puente Hnos. SA.

“Now maybe looks like a good time to sell,” said Ray Zucaro, chief investment officer at RVX Asset Management LLC in Miami, who holds Argentina’s sovereign and corporate debt.

Paula La Greca, a corporate analyst at TPCG in Buenos Aires, agrees. “YPF bond prices lack the fundamental support to continue rising,” she said by email.

Outsider candidate Javier Milei — who wants to dollarize the economy — is the front-runner to win the upcoming presidential vote. He upended the race after coming ahead of Patricia Bullrich, the main opposition coalition’s candidate, and Economy Minister Sergio Massa in an August primary.

“The economic situation that the next administration will inherit, whether that is Milei, Bullrich or Massa, is what is creating uncertainty,” said Juan Manuel Vazquez, a fixed income sales trader at Puente, a brokerage in Buenos Aires. “Macro imbalances have mounted up to a point in which there are no easy ways out, and that’s what scares investors.”

Argentina is on the brink of its sixth recession in 10 years, with 40% of the population living below the poverty line. Consumer prices are surging nearly 125% annually as the central bank runs out of reserves and Argentines flock to US dollars to hedge against another devaluation of the peso.

While any of the three candidates are seen supporting further development of the Vaca Muerta shale field, key for YPF and the country’s energy sector, whoever wins the Oct. 22 vote will need to slash the fiscal deficit and rebuild dwindling international reserves in order to repay investors before large installments on the nation’s sovereign bonds come due in 2025.

“At these prices I prefer Argentina’s sovereign debt,” said Fabricio Gatti, a portfolio manager at Novus Asset Management in Buenos Aires. “If Argentina defaults on its sovereign bonds, the collapse in YPF’s bonds will be even greater.”

To be sure, YPF’s highly liquid notes are still offering better yields than other state oil firms in Latin America, according to Jaimin Patel, a senior credit analyst for Bloomberg Intelligence.

What Bloomberg Intelligence Says...

“YPF’s 7% notes due in 2033 have rallied since May, yet still trade at a discount to par of more than 23%. That’s almost the highest among actively traded 10-year emerging market dollar corporates with an outstanding amount above $500 million.”

—Jaimin Patel, senior credit analyst

For full report, click here

Investors are also watching to see if Milei — a firebrand libertarian economist who has little congressional support — will sell the government’s stake in YPF as promised. The plan throws the future of the company into question just weeks after a US judge ruled Argentina would have to pay $16 billion to investors including Burford Capital Ltd. after the government’s expropriation of the company a decade earlier.

“We’ve had all this noise in the US courts around the Burford case, so people are pretty aware of what the downside risks are,” said Siby Thomas, a portfolio manager at T Rowe Price Group Inc. in Baltimore, adding that Milei may have trouble finding buyers for the company. “The government would likely attach more value to YPF equity than investors would.”

Vazquez also has doubts about a potential government stake sale.

“YPF is a huge player in the Argentine energy sector, and does not receive any explicit subsidy from the Treasury, unlike other state-owned companies,” the Puente trader said. “Why would you get rid of a company that has such strategic importance?”

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.

Yahoo News

Yahoo News