Behind the Brawl Over Streaming Revenue Sharing for Actors

Striking actors and the media companies they work for remain far apart on negotiations for a new contract, with no talks taking place since SAG-AFTRA members took to the picket lines July 14. Both the union and the Alliance of Motion Picture and Television Producers, representing studios, seem dug in to their respective positions. One of the union’s proposals in particular — for a small cut of streaming service revenue from successful shows and movies — has generated a lot of pushback from the management side, with the AMPTP saying it has “fundamental objections” to the idea. SAG-AFTRA contends that it’s a necessary (if novel) step given the industry-altering changes in the streaming era.

SAG-AFTRA’s Proposal

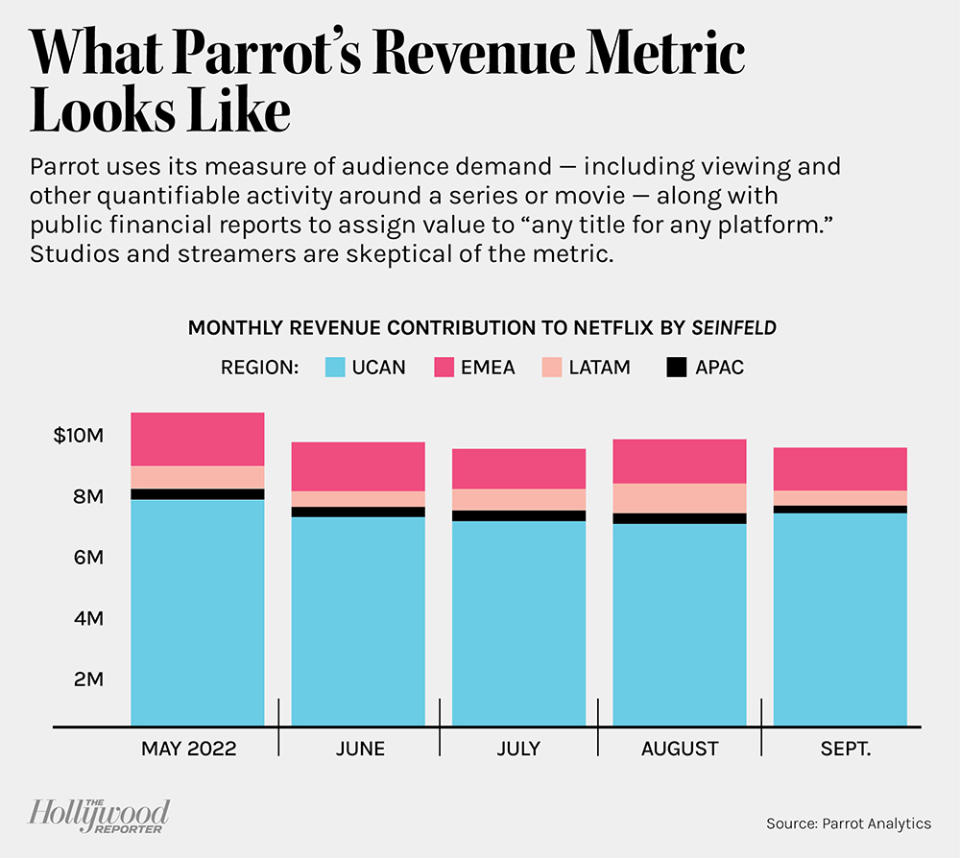

The union’s contract offer includes setting aside 2 percent of revenue generated by a series shown on a streaming platform to be shared with the show’s cast, in addition to existing base salaries and the residuals actors earn. To verify revenue generation, SAG-AFTRA suggested using the “content valuation” tool from measurement firm Parrot Analytics. It purports to show how much money a given title generated for its streaming platform based on Parrot’s proprietary audience demand metric — which includes several factors but gives video consumption the most weight — and publicly available revenue figures from streamers.

More from The Hollywood Reporter

Ari Emanuel: Hollywood Strikes Will Cost Endeavor $25M a Month, But We "Stand With Our Clients"

Sylvester Stallone Netflix Doc 'Sly' to Close Toronto Film Festival

Directors Guild Approves New Medical Plan to Help Eligible Members Amid Strikes

The Arguments

SAG-AFTRA contends the revenue-sharing idea is necessary in part because of how much streaming has changed the structure of the business, including shorter seasons of TV series and longer gaps between seasons, putting stress on working actors who rely on residuals to help get them through leaner times. “The economic pressure that creates is really severe,” SAG-AFTRA national executive director Duncan Crabtree-Ireland tells The Hollywood Reporter.

Players unions in the major American pro sports leagues all have collectively bargained revenue sharing, with a roughly even split (give or take a couple of percentage points) between owners and players. Crabtree-Ireland said that while SAG-AFTRA’s proposal isn’t modeled on those in sports, those agreements “help us feel like this is not just possible, but very reasonable.”

The AMPTP declined to comment for this story beyond its July 21 rejoinder to the union’s messaging on sticking points in the negotiations. The companies also listed specific objections to the revenue-sharing proposal. The AMPTP said the idea “does not ‘follow the money’ ” in seeking revenue from streamers, implying that SAG-AFTRA is looking to capture revenue from a show’s producer, not its distributor. Not so, Crabtree-Ireland said: The union would capture that revenue from streamers via an existing part of SAG-AFTRA contracts called a distributor’s assumption agreement. Under those deals, when a studio licenses a movie or TV show to a distributor, the distributor takes on the responsibility of paying out residuals.

The AMPTP also characterizes the proposal as actors wanting to “share in the rewards of a successful show, without bearing any of the risk,” the July 21 rebuttal says, adding, “That is not sharing.” Crabtree-Ireland took exception to that notion, saying: “I would argue that our members are risking way more than your average executive. What risk are the streaming company executives personally taking to warrant the kinds of rewards that they generate from that?”

About That Third-Party Data

Lastly, the AMPTP lodged an objection to using Parrot Analytics as the arbiter of revenue. “So much of their data is based on social engagement, but there’s no scientific evidence that social engagement leads to viewership,” one studio exec whose company has a valuable piece of IP tells THR, speaking about Parrot’s demand metric. “We love Parrot at our studio because they love [our IP]. It always shows up way above any numbers we get from our own data about how these shows are doing.”

The AMPTP also says that Parrot Analytics’ content valuation metric is “not readily available to anyone who doesn’t pay the third-party analytics company.” (Several AMPTP members, including Amazon, Warner Bros. Discovery and Disney, do in fact pay Parrot for the company’s insights in other areas.)

Parrot’s demand metric does take into account social media activity around a show, but only as part of a weighted system that includes actual viewing of movies and TV shows, as well as other things like watching trailers and posting or watching videos related to a title. The company says that viewing carries the most weight in its demand metric and social media posting the least.

“Looking at viewership alone can no longer reflect the complexity of how content creates value,” a Parrot Analytics spokesperson said in a statement to THR. “Parrot Analytics’ content valuation system measures value according to a number of data points, including active consumption, that when combined sees a very strong correlation to key performance metrics such as subscriber growth and revenue. This allows the industry to calculate the revenue share contribution of every title, to every streaming service, in every market around the world.”

Crabtree-Ireland said SAG-AFTRA is more than willing to use another metric that both sides can agree on — or have AMPTP members open their books. “If we had confidence we would get that kind information from the source, that would of course have been our first choice,” he said. “But because we knew that was going to be hotly resisted because of their past actions, we felt like it would be smarter to provide an alternative, so that we weren’t just stonewalled on the basis of ‘No, we can’t share that information.’”

This story first appeared in the Aug. 9 issue of The Hollywood Reporter magazine. Click here to subscribe.

Best of The Hollywood Reporter

Yahoo News

Yahoo News