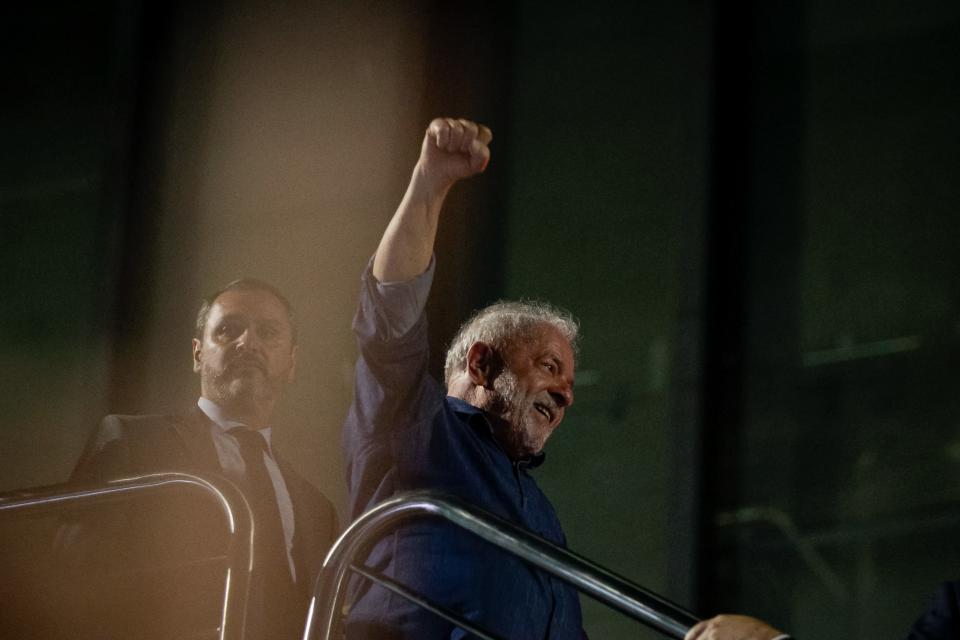

Brazil’s ‘Lula Basket’ Jumps While Currency Leads Global Gains

(Bloomberg) -- Brazilian stocks expected to benefit from Luiz Inacio Lula da Silva’s presidency rallied after the leftist leader won Sunday’s runoff ballot while the real reversed earlier losses to post the biggest gain among global currencies.

Most Read from Bloomberg

Chief Justice Temporarily Stops Release of Trump Tax Returns

Lottery Winner Keeps $30 Million Jackpot Secret From Wife and Child

Democrats Prepare for Loss of Congress as Voters Break Late to GOP

China Markets Rally After Unconfirmed Social Posts on Reopening

Shares of education companies, homebuilders that cater to lower-income Brazilians and retailers --- which form the so-called Lula basket -- were among the best performing on bets his presidency would boost their businesses.

A note of caution lingered in markets on concern that the defeated incumbent, President Jair Bolsonaro, may seek to discredit the results. He hasn’t made any public comment since election authorities announced he had lost in the closest presidential contest since Brazil’s return to democracy about 40 years ago. In the run-up to the vote, he had cast doubt on the integrity of the election.

“It’s too early to be negative,” said Dario Valdizan, the head of buy-side research at Credicorp Capital Asset Management in Lima. “The vote doesn’t alter our constructive view for Brazil, it just implies we need to pay close attention to political announcements rather than focus mainly on fundamentals.”

The real strengthened as much as 2.7% to 5.1553 per dollar, making it the best performer among all currencies tracked by Bloomberg. The currency had fallen 2% earlier in the session.

The Ibovespa equity benchmark rose 0.5% as of 4:25 p.m. in Sao Paulo. State-owned companies including Petroleo Brasileiro SA and Banco do Brasil SA were among the worst stocks, dragged down by speculation that a privatization push during Bolsonaro’s administration would be abandoned under Lula. Some investors also were seeking more details on Lula’s cabinet picks, particularly his economy minister, before buying in.

Education company Yduqs Participacoes SA rallied for a seventh session. Anima Holding SA jumped as much as 12% after Morgan Stanley upgraded it to the equivalent of buy from hold. Lula is expected to increase funding for education, providing a boost to the companies.

The retailer Lojas Renner SA added 6.9%, headed for its biggest gain in almost a month, amid speculation that Lula would seek to bolster aid to the poor, increasing their purchasing power.

The president-elect will face a divided country and a divided congress, with Bolsonaro’s allies having captured a large presence in both chambers on top of controlling the country’s three most populous states, Sao Paulo, Minas Gerais and Rio de Janeiro. Money managers saw the narrow margin of victory as a signal that Lula is unlikely to pursue the most radical version of his left-wing politics.

Randolfe Rodrigues, a Brazilian senator and aide to Lula, said the president-elect will soon unveil his pick to coordinate the government transition. He’s between tapping centrist running mate Geraldo Alckmin and leftist Aloizio Mercadante for that position, according to Rodrigues.

“Choosing Alckmin would suggest the ‘market-friendly’ group will have a say in a Lula administration,” said Andrew Reider, chief investment officer at Wealth High Governance in Sao Paulo. “The key signal traders are awaiting is Lula’s pick to head the economy.”

Money managers including Franklin Templeton and Robeco have been relatively optimistic about the outlook for Brazilian stocks no matter who won the presidency, figuring that the country was positioned better than peers, thanks in part to alluring valuations and a favorable outlook for interest rates. Its markets have outperformed other developing-nations this year.

“Assuming that an orderly transition of power duly unfolds, the effect should be to lower the political risk premium on deeply undervalued Brazilian assets,” said Udith Sikand, a senior emerging-markets analyst at Gavekal Research.

(Updates market moves throughout.)

Most Read from Bloomberg Businessweek

Yeezy Roller Coaster Ended With Two-Minute Phone Call at Adidas

These Five Women Are Helping Doctors Crack the Long-Covid Mystery

Can an Election-Denial Alliance Save Republican Senate Hopes in Arizona?

Basketball’s Top Shrink on How Finding Purpose Lifts Performance

©2022 Bloomberg L.P.

Yahoo News

Yahoo News