Brazil Readying Another Half-Point Interest Rate Cut

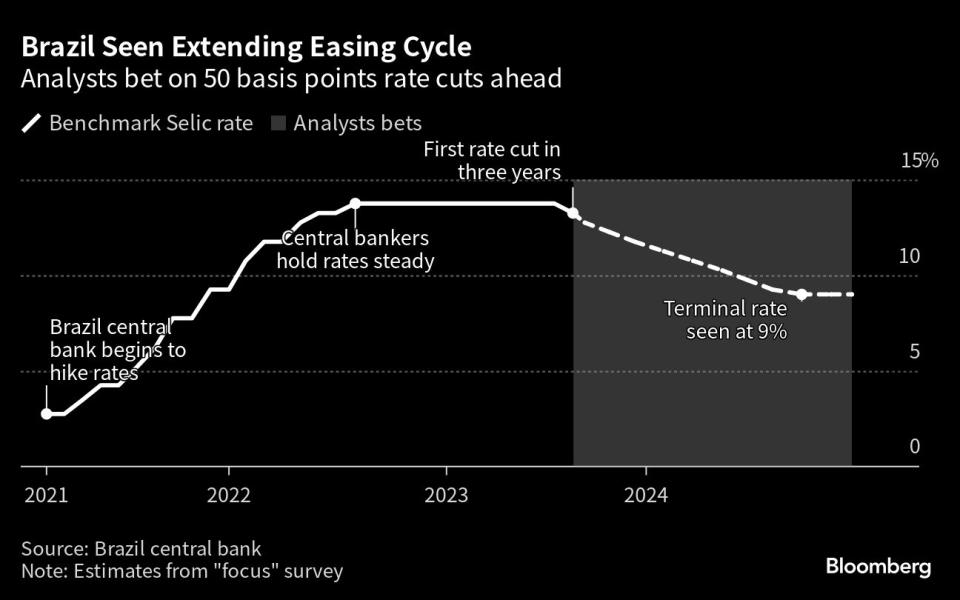

(Bloomberg) -- Brazil’s central bank will likely deliver its second straight interest rate cut of 50 basis points as services inflation recedes even as activity proves resilient to high borrowing costs.

Most Read from Bloomberg

Passalacqua in Italy’s Lake Como Is Named Best Hotel in the World

Vegas’ Newest Resort Is a $3.7 Billion Palace, 23 Years in the Making

‘Dead Space’ Co-Creator Departs Startup After Newest Game Flops

Fed Set to Pause Rate Hikes, But Don’t Count Out Another Increase

Stocks Fall as Yields Rise on Fed’s ‘Hawkish Skip’: Markets Wrap

All 40 economists surveyed by Bloomberg see the benchmark Selic falling to 12.75% on Wednesday. Only 3% of digital options traders at the local stock market see policymakers delivering a bigger-than-expected cut of 75 basis points.

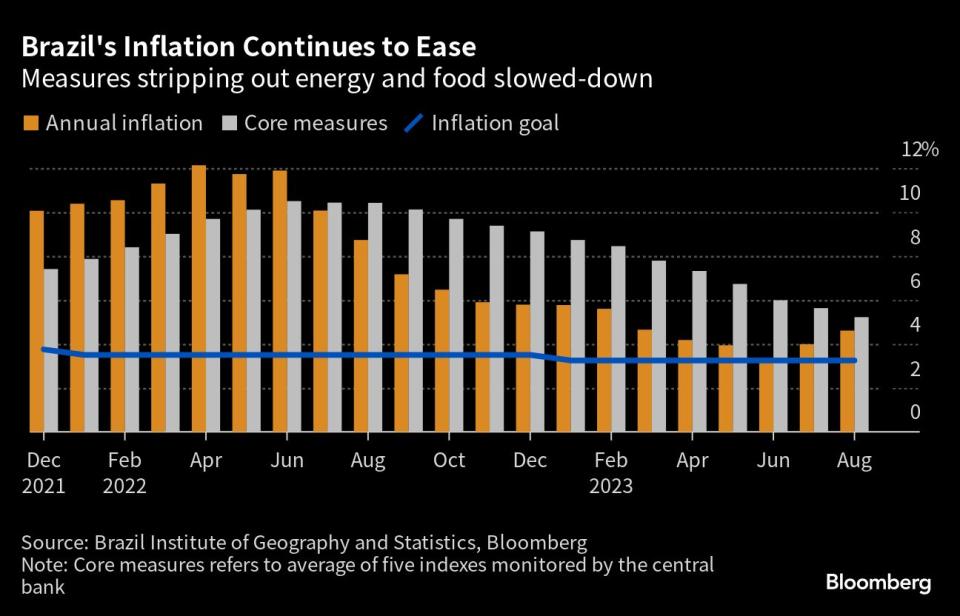

Central bankers led by Roberto Campos Neto kicked off their monetary easing campaign in August after holding rates steady at a six-year high for 12 months. Annual inflation is now back in single digits, and closely-watched services prices are rising at a slower pace. Still, a firm labor market and an outlook for above-target cost-of-living increases are making it hard for policymakers to speed up rate cuts.

Brazil’s move to continue relaxing monetary policy will come hours after the Federal Reserve is expected to hold its interest rate unchanged, while penciling in one more hike.

What Bloomberg Economics Says

“Tame underlying inflation and stable expectations will allow Brazil’s central bank to cut the Selic rate by another 50 bps to 12.75% at its September meeting, in line with forward guidance. We expect the decision will be unanimous, after a 5-4 split at the previous meeting. Currency weakening since the August gathering, a stronger-than-expected 2Q GDP print and lingering doubts about the government’s ability to deliver on its balanced-budget target argue against a faster pace of cuts.”

— Adriana Dupita, Brazil and Argentina economist

— Click here for full report

Brazil’s decision will be published on the central bank website after 6:30 p.m. in Brasilia together with a statement from its board. Here’s what to look for:

Easing Pace

Investors will be sensitive to any changes to the central bank’s guidance that the bar to accelerate rate cuts is very high, though details on board members’ thinking will likely be kept for the minutes of the meeting.

Policymakers have said a “substantial” positive surprise on inflation would be needed for faster easing, together with a “solid” reanchoring of forecasts for consumer price increases and a “sharp” contraction of activity.

“Nothing in current inflation dynamics points in the direction they said they are looking for,” said Eduardo Jarra, chief economist at Santander Asset Management in Brazil.

Activity expanded slightly more than expected in July after two straight quarters of better-than-expected growth boosted by a bumper harvest, a firm labor market and a strong services sector.

Meanwhile, annual inflation accelerated to 4.61% in August on the back of higher transportation and energy costs. Estimates for future consumer price increases remain above the central bank’s target, with medium-term bets steady at 3.5% for roughly two months.

The central bank targets inflation at 3.25% this year and then 3% through 2026, with a tolerance range of plus or minus 1.5 percentage points.

Service sector price growth is easing, along with core measures that exclude energy and food items, said Silvia Matos, an economist at Fundacao Getulio Vargas. “But we have yet to see that improvement affect inflation estimates,” she said.

Fiscal Worries

Investors will be curious to see if central bankers refrain from commenting on Brazil’s fiscal outlook, especially after congress approved a bill to shore up public finances and also advanced discussions on tax reform.

There’s some speculation that policymakers could nod to investor skepticism toward President Luiz Inacio Lula da Silva’s pledges to eliminate the primary budget deficit next year, which doesn’t take into account interest payments. Those doubts represent one of main the reasons why inflation estimates remain above target.

“Overall, the components of the central bank’s balance of risks worsened,” said Caio Megale, chief economist at XP Investimentos Inc.

Global Scenario

Brazilian central bankers could comment on rising US Treasury yields and the impacts of the recent slowdown in China, both of which pose risks for Latin America’s largest economy.

--With assistance from Giovanna Serafim.

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.

Yahoo News

Yahoo News