Brazil Set to Hold Key Rate Ahead of Runoff Vote: Decision Guide

(Bloomberg) -- Brazil’s central bank is widely expected to hold its key interest rate at the highest level since 2017 to ensure inflation continues easing to target after an aggressive monetary tightening cycle.

Most Read from Bloomberg

All 44 economists in a Bloomberg survey forecast the bank’s board to keep the benchmark Selic at 13.75% on Wednesday, four days before Brazil’s crucial presidential election. Last month, policymakers led by Roberto Campos Neto held rates after a year-and-half-long campaign that lifted borrowing costs from a record low of 2%.

Board members are standing pat even after three straight months of deflation prompted analysts to lower forecasts for price increases for this year and next. On the other hand, core metrics that strip out costs of volatile items still remain high, and the government recently boosted fiscal stimulus. Put together, the monetary authority has signaled it’s too early to ease policy.

What Bloomberg Economics Says

“Brazil’s central bank is broadly expected to stay put at its October meeting as prices continue to slow their gains or even fall, but there’s less certainty on its policy path ahead. We see the central bank starting to normalize monetary policy at the end of the first quarter of 2023 if inflation falls toward its target.”

-- Adriana Dupita, Brazil economist

Click here for the full report.

Wednesday’s decision will be published on the central bank’s website after 6:30 p.m. in Brasilia with a statement from its board. It is the last scheduled rate-setting meeting before the Oct. 30 runoff between incumbent Jair Bolsonaro and former President Luiz Inacio Lula da Silva.

Here’s what to look for:

Hawkish Tone

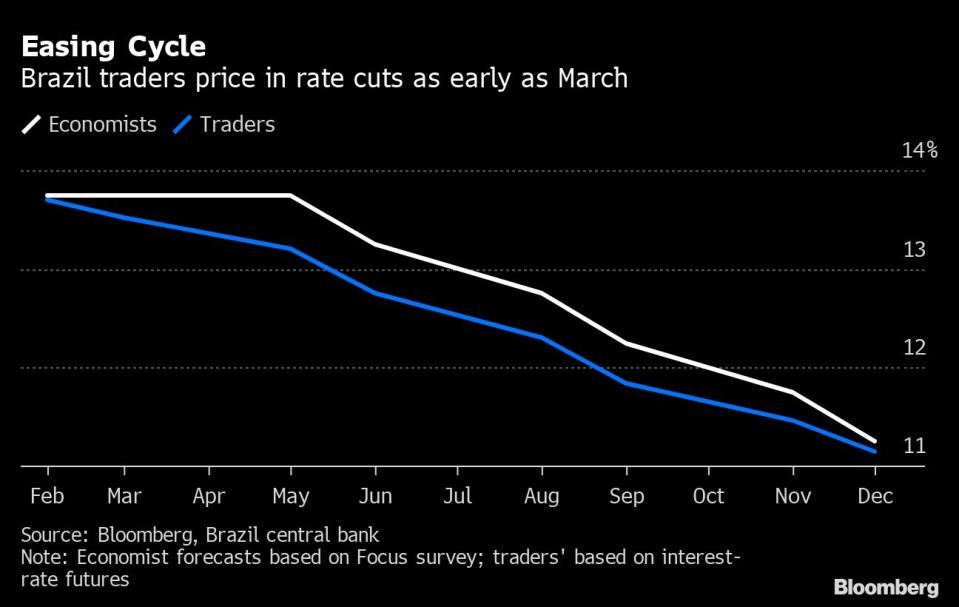

The central bank may step up efforts to get investors in line with its thinking on rates. It has signaled that cuts to borrowing costs may start next June, but traders are still pricing in the beginning of the easing cycle as early as March.

Policymakers will likely stress they remain vigilant and won’t hesitate to lift rates again if inflation doesn’t ease as forecast.

“Central bankers are trying to control bets for early rate cuts, especially because inflation estimates are slowing down only gradually,” said Tatiana Nogueira, economist at XP Inc.

A key reason for caution is Brazil’s fiscal outlook, which remains uncertain as both presidential candidates pledge to increase social spending without detailing how to pay for it. Economic activity has held up, and unemployment has dropped for six straight months, prompting some analysts to warn of price pressures stemming from wages.

“With that in mind, another rate hike is still possible, though not probable,” said Silvia Matos, economist at think tank Fundacao Getulio Vargas. “Central bankers have an inflation goal for 2024 that’s not yet secured.”

Inflation Forecasts

Investors will be especially attuned to any decline in the central bank’s own estimates for consumer price increases. Recent tax cuts and cheaper oil slashed Brazil’s annual inflation to 6.85% in mid-October from a high of 12.2% in mid-May, the national statistics institute reported on Tuesday.

After months of deflation, economists have lowered their estimates for consumer prices for this year and next to 5.6% and 4.94%, respectively. Both still remain above the bank’s tolerance range.

On top of that, forecasts for 2024, which are becoming increasingly relevant for policy makers, have risen further above the 3% goal.

Global Outlook

Investors will pay attention to the central bank’s balance of risks, amid tighter international financial conditions from rising US interest rates, as well as expectations of slower global growth ahead.

--With assistance from Giovanna Serafim.

Most Read from Bloomberg Businessweek

What the Alzheimer’s Drug Breakthrough Means for Other Diseases

From Bedrooms to Kitchens, Europe Ponders How Cold Is Too Cold

The Private Jet That Took 100 Russians Away From Putin’s War

©2022 Bloomberg L.P.

Yahoo News

Yahoo News