Britain's financial regulators need 'ambitious mindset', says industry leader

By Huw Jones

LONDON (Reuters) - British regulators need an "ambitious growth mindset" to implement post-Brexit financial sector reforms faster and stop business going elsewhere, an industry body said on Thursday.

Britain's "Edinburgh Reforms" - proposed by finance minister Jeremy Hunt over a year ago - aim to help London to remain a globally competitive financial centre after being largely cut off from the European Union, which this week approved a law to force a shift in euro clearing from London to the bloc.

New York is also attracting companies from Britain to list there.

Industry has welcomed the Edinburgh Reforms.

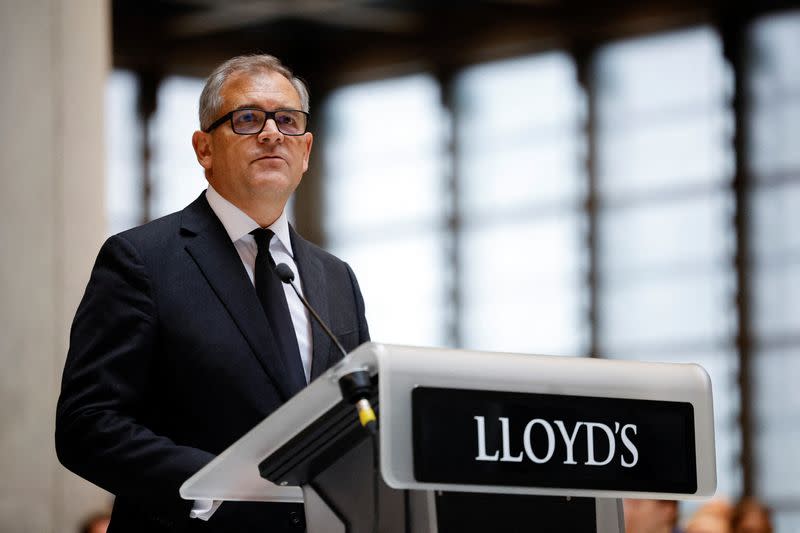

"However, government policy cannot be implemented without an equally ambitious growth mindset from our regulators," Bruce Carnegie-Brown, chair of TheCityUK's leadership council, told a dinner attended by Hunt.

This includes dealing with top hires approval applications faster, he said. Senior hires at banks and insurers must undergo "fit and proper" vetting by regulators.

"At Lloyd’s, we have the capacity and expertise to evaluate and approve a new underwriting syndicate within 30 days, but the external regulators require many months more before making a decision, causing businesses to set up outside the UK," said Carnegie-Brown, who also chairs the Lloyd's of London insurance market.

"In senior management appointments, a US financial services firm hiring a new Head of its UK operations – perhaps one of the top ten roles in their organisation – can make a decision within weeks, yet regulatory requirements on senior managers could prevent them being approved for at least three months and often longer."

The Bank of England and Financial Conduct Authority have a new secondary objective to consider the City's global competitiveness and growth when writing rules.

BoE Deputy Governor Sam Woods on Wednesday came under pressure from lawmakers to speed up the Edinburgh Reforms, but countered that regulators needed to stay in lockstep with related government actions to give industry the "full package".

"We are going at a good pace," Woods said, with the backlog in top hire approvals now "sorted", the Bank having dealt with 98% of applications within the three-month deadline in the last quarter of 2023.

(Reporting by Huw Jones; Editing by Emelia Sithole-Matarise)

Yahoo News

Yahoo News