Chancellor blames 'eye-watering sums' spent on pandemic and energy bills support for hike in public sector borrowing

The chancellor has blamed the "eye-watering sums" spent on helping people through the coronavirus pandemic and energy crisis for an increase in public sector borrowing.

Public sector net borrowing was £21.5bn last month - the second-highest March borrowing since monthly records began in 1993.

This means that the public sector spent more than it received in taxes and other income, requiring it to borrow the shortfall.

The amount also capped off the fourth-highest borrowing for a financial year since records began - £139.2bn, or 5.5% of GDP.

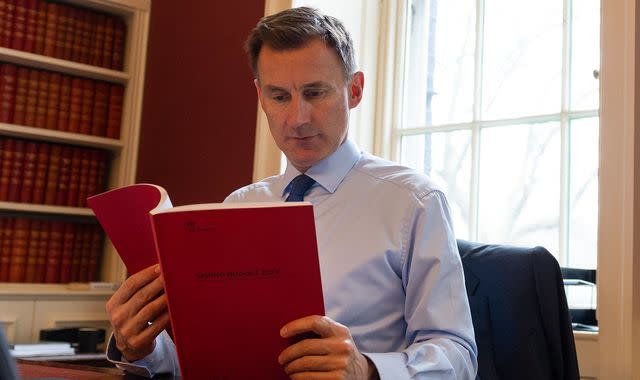

Chancellor Jeremy Hunt blamed the COVID-19 pandemic and the rise in energy prices, which was worsened by Russia's invasion of Ukraine.

He said: "These numbers reflect the inevitable consequences of borrowing eye-watering sums to help families and businesses through a pandemic and Putin's energy crisis.

"We were right to do so because we have managed to keep unemployment at a near-record low and provided the average family more than £3,000 in cost of living support this year and last.

"We stepped up to support the British economy in the face of two global shocks, but we cannot borrow forever. We now have a clear plan to get debt falling which will reduce the financial pressure we pass onto our children and grandchildren."

Read more:

Burberry chairman accuses PM of making UK 'least attractive' place to shop in Europe

CBI scandal: Chancellor declares there is 'no point' engaging with lobby group

The £21.5bn borrowed in March was £14.5bn more than the amount borrowed in March 2020, at the beginning of the pandemic.

Choppy waters ahead for the public finances

Michal Stelmach, senior economist at KPMG UK, said public sector net borrowing over the year was £18bn higher than in the previous year, but less than half of the borrowing seen at the peak of the pandemic.

This difference reflects "a relatively smaller package of measures to tackle the energy crisis", Mr Stelmach said.

"Year-to-date outturn has been revised down substantially following the ONS correction to student loans arrangements, which reduces the proportion of student loan spending recorded as government investment," he added.

"This brings the full-year borrowing figure £13.2bn below the OBR's latest forecast, which already accounted for the impact of that change.

"Following a rollercoaster of economic shocks, public sector net debt reached 99.6% of GDP, its highest level since 1960-61.

"While the UK is not unique in facing pressures on the public finances, with recent shocks being largely global in nature, we estimate that around a quarter of the increase in gilt yields over the past year could be attributed to UK-specific factors."

Yahoo News

Yahoo News