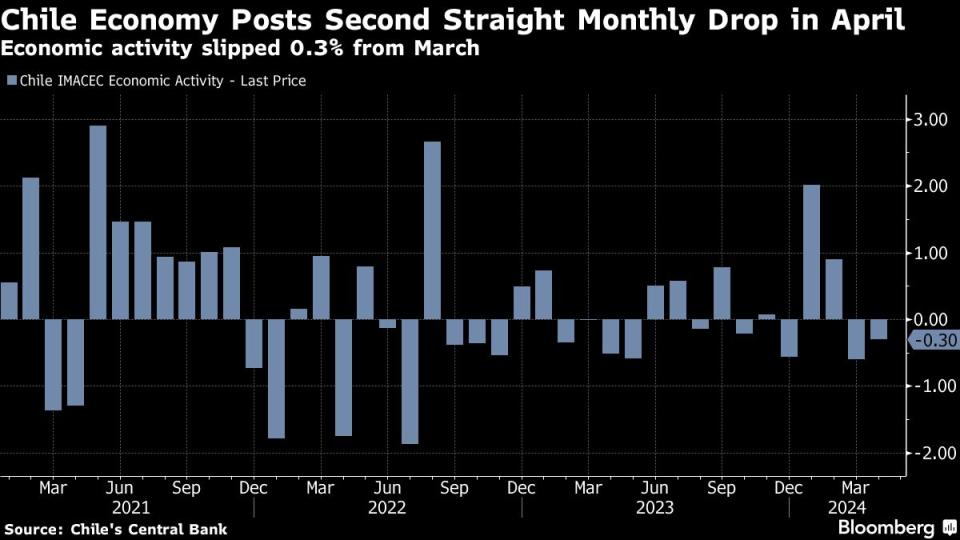

Chile’s Economy Contracts for Second Month as Rebound Fades

(Bloomberg) -- Chile’s economic activity fell for the second straight month on declines in mining and commerce, adding to evidence that the jump in growth at the start of the year was short-lived.

Most Read from Bloomberg

Key Engines of US Consumer Spending Are Losing Steam All at Once

Mnuchin Chases Wall Street Glory With His War Chest of Foreign Money

Homebuyers Are Starting to Revolt Over Steep Prices Across US

AMLO Protege Sheinbaum Becomes First Female President in Mexico

The Imacec index, a proxy for gross domestic product, fell 0.3% in April from the prior month, less than the -0.6% median forecast in a Bloomberg survey. From a year ago, activity gained 3.5%, the central bank reported on Monday.

Chile’s economy is slowing down this quarter after gross domestic product jumped by the most since 2021 at the start of the year. The growth outlook is being supported by interest rate reductions as well as higher prices for copper, the nation’s top export. Still, mining output has been volatile and high job informality points to continued weakness in the labor market.

What Bloomberg Economics Says

“April data show Chilean activity and domestic demand have lost momentum in the second quarter after a sharp increase in 1Q. The figures are consistent with central bank forecasts for a small quarterly decline and narrowing positive output gap. They also keep interest-rate cuts in line with policymakers’ baseline scenario on the table.”

— Felipe Hernandez, Latin America economist

— Click here for full report

Mining activity fell 2.4% in April from the month prior, while commerce declined 1.4%, according to the central bank.

Separate data published Friday had shown retail sales posting a year-on-year increase in April that was in line with analyst expectations. On the other hand, the output of copper, manufacturing and industry all disappointed.

Read more: Copper Leader Chile Posts Worst Monthly Output in Over a Year

While it takes time for the full impact of higher copper prices to bolster activity, there are some immediate effects such as an improving current account balance and increased fiscal revenue, Finance Minister Mario Marcel said in a May 30 interview. The economy is in a period of expansion, he added.

In May, Chile’s government raised its 2024 economic growth forecast to 2.7% from 2.5% on stronger-than-expected activity across sectors at the start of the year and higher copper prices. Analysts surveyed by the central bank have lifted their estimates to 2.5% from 1.7% in February.

In the medium and long term, Chile’s government has said there are economic opportunities in industries including copper, lithium and green hydrogen.

On Friday, state-owned Codelco signed a definitive agreement for a public-private partnership with SQM that will ramp up lithium production at the Atacama salt flat from less than 200,000 metric tons a year toward 300,000 tons.

--With assistance from Giovanna Serafim.

(Updates with Bloomberg Economics quotes in fourth paragraph)

Most Read from Bloomberg Businessweek

Disney Is Banking On Sequels to Help Get Pixar Back on Track

The Budget Geeks Who Helped Solve an American Economic Puzzle

Israel Seeks Underground Secrets by Tracking Cosmic Particles

How Rage, Boredom and WallStreetBets Created a New Generation of Young American Traders

©2024 Bloomberg L.P.

Yahoo News

Yahoo News