Chile Set to Slow Rate Hikes as Inflation Crests: Decision Guide

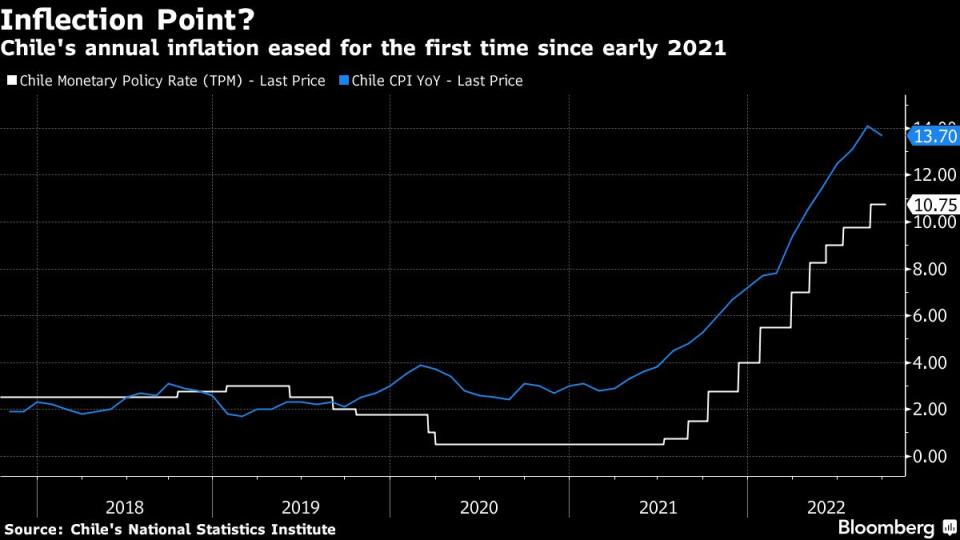

(Bloomberg) -- Chile’s central bank will likely raise its benchmark interest rate by half of a percentage point Wednesday, toning down the pace of tightening as inflation begins its descent from a 30-year high.

Twelve economists in a Bloomberg survey of 16 experts see policy makers raising borrowing costs to 11.25%, extending a cycle that’s added 10.25 percentage points to borrowing costs since July 2021. One expects an increase of 75 basis points, two predict a quarter-point increase and one forecasts no change.

The bank, led by Rosanna Costa, will temper hikes after inflation showed signs of peaking in September, albeit well above the 3% goal. Fuel price increases have moderated and consumer spending is cooling as Chileans deplete leftover cash from last year’s fiscal stimulus and early pension withdrawals. Still, a recent drop in the peso added to price pressures, and investors see cost of living increases above target for the foreseeable future.

What Bloomberg Economics Says...

“We expect the central bank to increase its benchmark rate by 25 basis points to 11% following a 100-basis-point hike in September. It may say the tightening cycle is over, but signal it is ready to raise rates if there are any inflation surprises.”

--Felipe Hernandez, Latin America economist

Click here for full report

The decision will be published on the central bank website at 6 p.m. in Santiago, together with a statement from the bank’s board. Here’s what to watch out for:

Cycle’s End

Investors will scan the statement for any concrete sign that rate hikes are over. Costa said on Oct. 4 that the tightening cycle is starting to affect the economy, while Finance Minister Mario Marcel said slower price rises ahead mean relief is on its way.

Regionally, Brazil paused its aggressive tightening cycle last month while warning that it could resume increases if consumer prices take a turn for the worse. Chile may follow a similar path.

Some in financial markets are striking a more hawkish tone. Traders surveyed by the central bank see policy makers extending borrowing cost hikes to December after a half-point increase this week, forecasting inflation will remain above target for at least another two years.

“The recent peso depreciation reduces the likelihood of a fast drop in local inflation, especially in the short term,” Credicorp Capital economists Samuel Carrasco and Daniel Velandia said in a report. “In this context, we expect a 50 bps increase in the policy rate amid an inflationary process that seems hard to die.”

Easing Inflation

Economists will be eager for policy makers’ latest views on the consumer price outlook. The annual inflation rate slid to 13.7% in September, its first decline in 19 months, and investors will be on the lookout for any indication of how quickly it will fall from here.

There were points of concern in September’s inflation report. For instance, there were marked price drops in goods that have shown volatility in the past, such as tourism packages and airfare prices, according to Nathan Pincheira, chief economist at Fynsa.

When stripping out volatile components, inflation showed continued supply-side pressures, he said.

Policy makers may also comment on a weaker peso, as well as their closely-watched gauge of economic activity, which unexpectedly increased in August on rising services.

Global Economy

Investors will seek out central bank comments on the international economy, including prospects of a global slowdown, consequences of Russia’s prolonged invasion of Ukraine and monetary tightening in the US and Europe.

The policy decision will come one day after the International Monetary Fund cut its 2023 global economic growth forecast on factors including rampant inflation and a downturn in China.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

Yahoo News

Yahoo News