China Proposes End to Punitive Wine Tariffs, Australia Says

(Bloomberg) --

Most Read from Bloomberg

Putin Says Ukraine Deal Requires Security Pledges for Russia

Ex-Wall Street Banker Takes On AOC in New York Democratic Primary

Australian vintners and lawmakers said China proposed lifting punitive tariffs on the nation’s wine, signaling the end is near to a three-year trade dispute as both countries seek to strengthen ties.

Treasury Wine Estates Ltd. referenced China’s plan in an exchange filing on Tuesday, adding that the final decision will be made in the “coming weeks.” The Ministry of Commerce in Beijing did not respond to a question about when they would release the report.

“The interim recommendation to remove tariffs on Australian wine is a welcome development,” Australia’s Trade Minister Don Farrell said in a statement on Tuesday. “It vindicates the government’s preferred approach of resolving trade issues through dialog rather than disputation,” he added. In a separate statement, Foreign Minister Penny Wong pledged to continue to push “for all remaining trade impediments to be removed.”

Removing the import taxes would help revive a billion-dollar Australian market and put an end to Beijing’s yearslong campaign of punitive trade actions to try to influence policy in Canberra. Before tariffs of up to 218% were imposed on Australian wine in March 2021, China was Australia’s largest market for vintners, accounting for A$1.1 billion ($728 million) in 2019.

“This is a positive step towards resuming trade with what was formerly our largest export market,” said Lee McLean, chief executive of Australian Grape & Wine Inc., who said the industry remains hopeful about Beijing’s proposed removal of the tariffs.

“We are optimistic yet cautious with this news as there is a very large job for Australian winemakers to re-invigorate this market after three years of being out of it,” said Mitchell Taylor, third-generation winemaker at Taylors Wines. Despite the challenge, Taylor said this is a “big win” for the industry which has been under enormous pressure as it sought to adjust to changing economic circumstances.

With the lifting of the wine tariffs now highly likely, China is on the brink of ending its trade campaign against Australia, as the interim plan unveiled on Tuesday becomes the latest in a slew of positive developments. China’s Ambassador to Australia Xiao Qian this week said “things are moving on right tracks with the right direction” on the wine tariff review. Last month, Farrell made similar remarks.

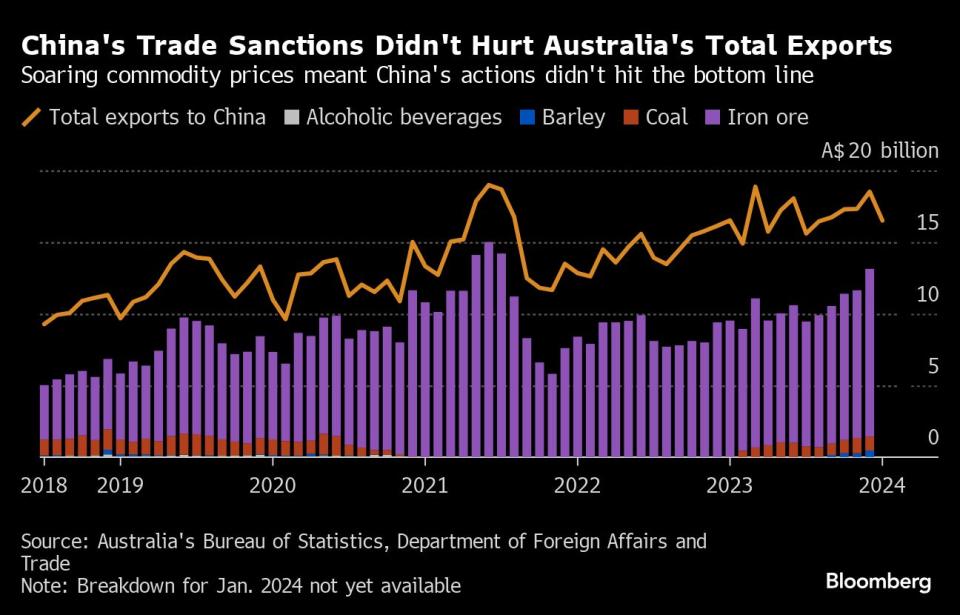

The wine tariffs were part of a series of trade curbs to punish Canberra for actions including calls by then-Prime Minister Scott Morrison for an international probe into the origins of Covid-19. Australia withstood the backlash from its largest trading partner, even as the specific industries targeted were hurt.

Australia’s ability to ride out the trade tensions, with effectively no public concessions to Beijing, raises questions about the effectiveness of China’s campaign.

The tariff news comes at a good time for local wine producers as Australia is struggling with historically high inventory levels, according to a report by Wine Australia.

In August, Rabobank estimated it would take at least two years to work through a glut. At the time, the bank estimated Australia had 2.8 billion bottles of wine in storage — enough to fill 859 Olympic-sized swimming pools.

“Before the trading issue, we exported 150 cases of wine a year,” said Alex Xu, a director of the Royal Star Wine Company. “Now we only export 10 containers to other countries like Vietnam, Cambodia and India. But these markets aren’t as profitable as the Chinese market.”

--With assistance from Janine Phakdeetham, Michael Heath and Evelyn Yu.

(Updates chart with latest data.)

Most Read from Bloomberg Businessweek

Gold-Medalist Coders Build an AI That Can Do Their Job for Them

Academics Question ESG Studies That Helped Fuel Investing Boom

Luxury Postnatal Retreats Draw Affluent Parents Around the US

Primaries Show Candidates Can Win on TikTok But Lose at the Polls

©2024 Bloomberg L.P.

Yahoo News

Yahoo News