Czechs Plan Debate on Euro Entry Path as Coalition Bickers

(Bloomberg) -- The Czech government will wade into a fraught debate on adopting the euro, a prospect that divides the ruling coalition and remains deeply unpopular in the public.

Most Read from Bloomberg

Citadel Among Hedge Funds That Got Morgan Stanley’s Block-Trading Leaks

China Replaces Top Markets Regulator as Xi Tries to End Rout

Haley Loses Nevada Primary to ‘None of These Candidates’ Option

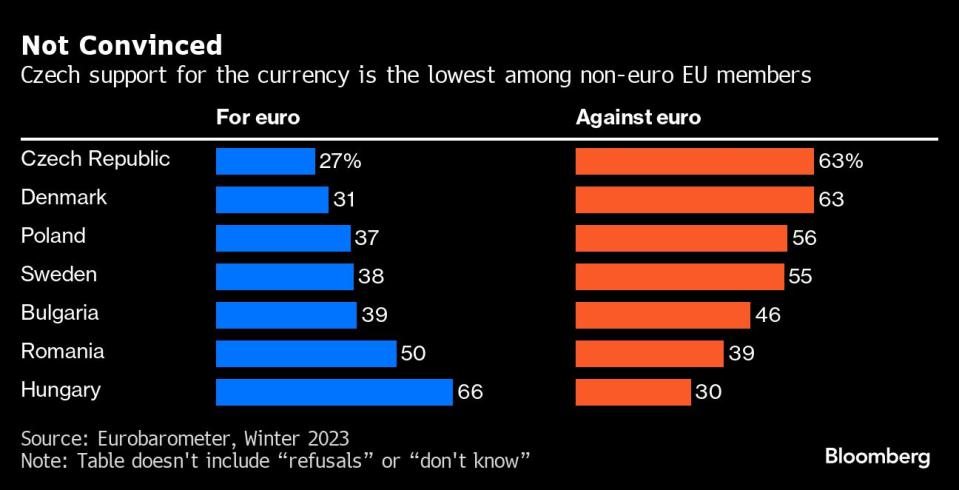

Nearly two decades after joining the European Union, the nation of 11 million doesn’t have a formal timetable for adopting the single currency, now shared by 20 members of the bloc. While about two-third of Czech exports go to the euro area, a majority of Czechs remains in favor of keeping the koruna.

Four out of five coalition parties have been pressuring the dominant ruling party, Prime Minister Petr Fiala’s Civic Democrats, to set a target date for joining the currency union — or at least entering an exchange rate mechanism that serves as a waiting room for the move.

With parliamentary elections due next year, the Mayors’ party, a junior member advocating adoption, hailed the decision as a major step toward the switch. Civic Democrats fired back, calling it political posturing.

“It’s not about the euro as such,” said Civic Democrat Jan Skopecek, a deputy speaker of parliament. “It’s about showing muscles in the coalition.”

The largest opposition party ANO, a group led by billionaire former premier Andrej Babis that has a wide lead in opinion polls, opposes euro adoption.

Read more: The Euro Is Creeping Into One of the Most Euroskeptic Countries

To ease the tensions, the coalition agreed that the cabinet’s advisory councils will prepare a review of the euro pros and cons — and of legislative issues related to entering the exchange rate mechanism, known as ERM-2, Fiala said. The assessments should be ready by October.

“The government will decide how to proceed further based on these analyses and on economic results of 2024,” he said on social media platform X.

The ERM-2 is one of the conditions for joining the euro area designed to test the candidate state’s currency stability before entry. The Czech Republic’s debt is one of the EU’s lowest relative to the size of the economy, and the country is on track to meet the inflation and budget deficit requirements.

While the decision is in the hands of the government, the central bank in Prague has argued that an independent monetary policy works as a buffer against global shocks. Those risks for now overshadow the potential benefits of adoption, such as the elimination of the conversion costs or currency risks for businesses, it says.

Any realistic plan for adopting the euro would need a broad consensus across the political spectrum, central bank Vice Governor Eva Zamrazilova said last month. Starting a formal process and then abandoning it could cause turmoil on financial markets, she said.

“There is nothing worse than making a commitment to something, while, in our election system, there is a high probability that someone will scrap it two years later,” she said. “Because it certainly isn’t possible to accomplish an entry to the euro zone in one election term.”

--With assistance from Zoe Schneeweiss and Andrea Dudik.

(Updates with context throughout, comments from fourth paragraph.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Yahoo News

Yahoo News