Data Fraud Is Focus to Bolster China’s Carbon Market

(Bloomberg) -- Authorities in China will crack down on carbon data fraud as they try to strengthen the nation’s ailing emissions trading system ahead of a planned expansion.

Most Read from Bloomberg

US Banks Are Finally Being Forced to Raise Rates on Deposits

Tesla Slashes Model S and X Prices for the Second Time This Year

Trump’s Threat of a Third-Party Run Is Undercut by ‘Sore Loser’ Laws

Holding Cash Will Be a Winning Strategy in 2023, Investors Say

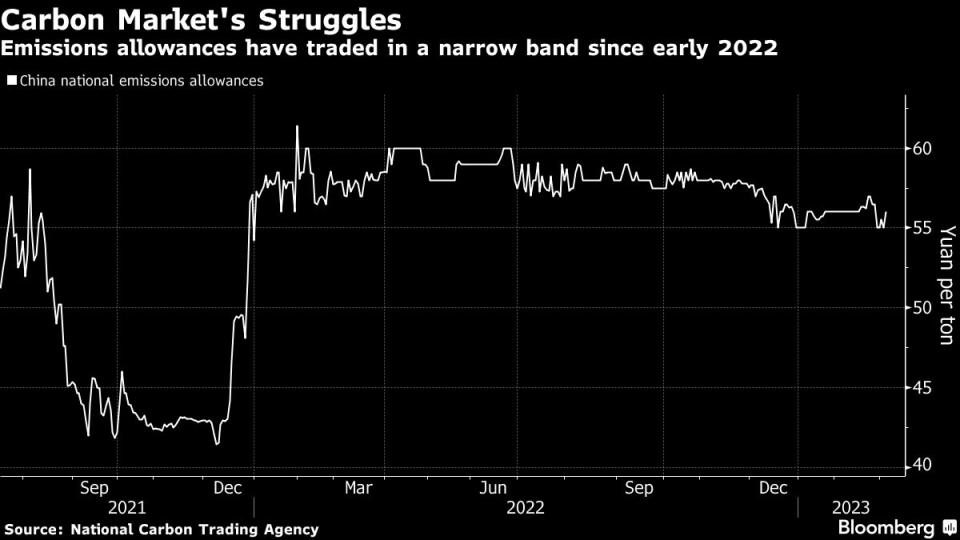

The market, which currently includes more than 2,000 major power plants and covers more emissions than any other trading system, has been beset by low prices, thin liquidity and accusations of data fabrication.

Officials will improve statistics and accounting of carbon emissions “and crack down on data fraud,” the National Development and Reform Commission said in a report to the annual parliamentary gathering in Beijing on Sunday. The government also plans to integrate the carbon market with systems for trading renewable power to help increase clean energy investments, it said in the report.

Read more: Carbon Prices in Asia Are Too Cheap to Help Curb Emissions

China’s national market for emissions allowances, which suffered several delays before launching in 2021, is intended to be extended over the coming years to add more industries, with large aluminum and cement producers expected to be included from this year.

The market is also expected to expand to steel and oil in the next two years. The steel sector, which is the biggest industrial source of China’s CO2 releases, faces European Union carbon border taxes. To counter the levy, the China Iron and Steel Association has proposed committing to a 40% cut in emission by 2040 from 2020 levels.

Environment inspections carried out in 2022 found inaccuracies with emissions data submitted by power plants, who have to pay for every ton of carbon dioxide they generate that exceeds an allocated amount. Four consulting firms which assist utilities with submissions have also faced criticism over alleged negligence or falsifying data.

Meanwhile, Asia’s biggest refiner Sinopec Group has lobbied the government to reopen the country’s separate carbon credit system, seeking changes that could help fund carbon capture and geothermal projects, and offer better tools to collect CO2 data for oil processing.

Mo Dingge, chairman of Sinopec’s Zhenhai Refining & Chemical Co. and a delegate of the Chinese political advisory body, said oil companies need to track carbon footprints for all oil products through their entire lifespan, and apply advanced cloud computing tools to help set fairer allowance allocation plans.

(Updates with steel and oil industry proposals in fifth and sixth paragraphs)

Most Read from Bloomberg Businessweek

Yellowstone Backers Wanted to Cash Out—Then the Streaming Bubble Burst

Female Execs Are Exhausted, Frustrated and Heading for the Exits

FBI Documents Show Leonardo DiCaprio, Kim Kardashian Grilled for 1MDB Secrets

How Countries Leading on Early Years of Child Care Get It Right

The Debt Ceiling Is the Risk Wall Street Doesn’t Want to Think About

©2023 Bloomberg L.P.

Yahoo News

Yahoo News