Did Viela Bio's (NASDAQ:VIE) Share Price Deserve to Gain 20%?

The last three months have been tough on Viela Bio, Inc. (NASDAQ:VIE) shareholders, who have seen the share price decline a rather worrying 34%. Taking a longer term view we see the stock is up over one year. However, its return of 20% does fall short of the market return of, 21%.

Check out our latest analysis for Viela Bio

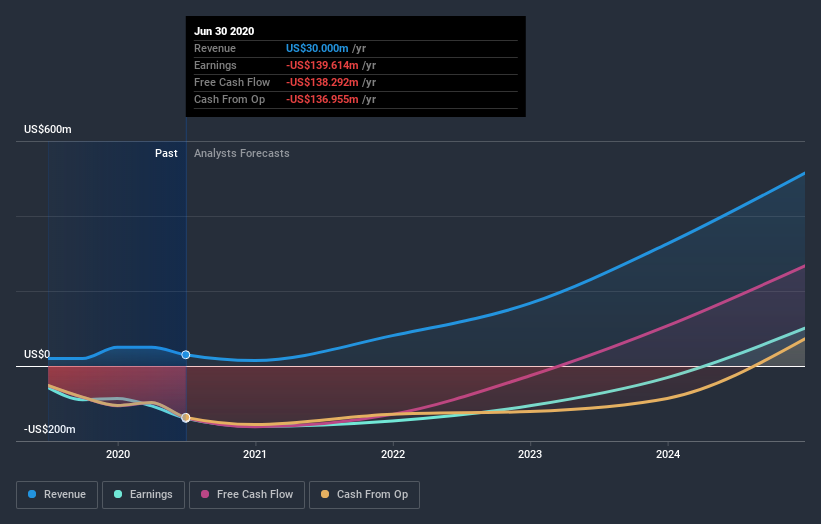

Given that Viela Bio didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Viela Bio grew its revenue by 50% last year. That's a head and shoulders above most loss-making companies. The solid 20% share price gain goes down pretty well, but it's not necessarily as good as you might expect given the top notch revenue growth. If that's the case, now might be the time to take a close look at Viela Bio. Human beings have trouble conceptualizing (and valuing) exponential growth. Is that what we're seeing here?

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

This free interactive report on Viela Bio's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Viela Bio shareholders have gained 20% over twelve months, which isn't far from the market return of 21%. Unfortunately the share price is down 34% over the last quarter. It may simply be that the share price got ahead of itself, although you might want to check for any weak results. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 2 warning signs for Viela Bio that you should be aware of before investing here.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo News

Yahoo News