EUR/USD Daily Forecast – February Losses Nearly Wiped in Six-Day Rally

The week started with a decline of 3.3% in the S&P 500 (SPY), but unlike other times the index dropped sharply, buyers have failed to step in to support the index. Rather, the downside momentum has been accelerating and risk sentiment has been deteriorating across the markets on concerns that the Coronavirus has become a real threat this week for countries aside from China.

Gold has been an exception to the shift in sentiment as the yellow metal peaked after a notable rally to start the week. In the Forex market, however, currencies are showing a textbook shift to risk aversion. The Japanese yen, known as a safe-haven currency, has advanced nearly 3% against the greenback in the week thus far. The Swiss franc also falls into this category and has made notable gains.

The euro showed a somewhat delayed reaction to the recent shift but has advanced as market participants wind down risky trades for which the single currency is often used for funding. Further aiding EUR/USD is a weaker dollar after the futures market signaled that a US rate cut might come as soon as next month.

At the start of the week, the CME FedWatch Tool indicated a roughly 50% chance of a rate cut in June. The data now shows a quarter basis point fully priced in for the March meeting and a roughly one in five chance of a 50 basis point cut.

Meanwhile, European Central Bank President Christine Lagarde downplayed the potential impact of the virus on Thursday. Lagarde commented that policymakers need to determine if the virus will become a “long-lasting shock” and further said, “we are certainly not at that point yet.” Her view was confirmed by ECB member Vasiliauskas earlier today who added that the ECB could set an extraordinary meeting if need be.

Technical Analysis

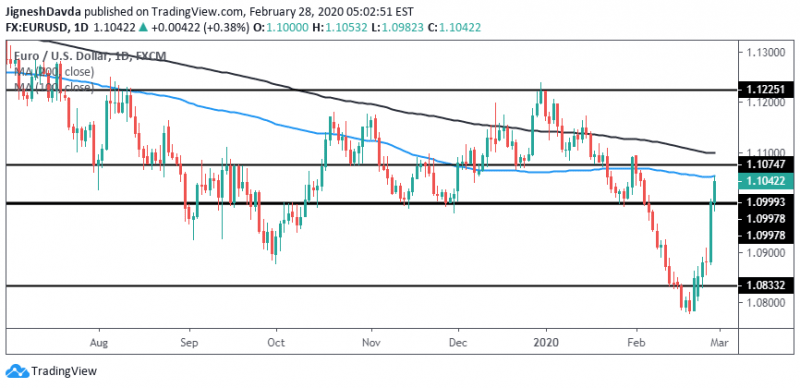

Two things stand out in the current rally in EUR/USD. First, there is a lot of momentum behind the move, and second, the rally follows a momentum-driven decline that dominated most of the month.

Implied volatility is at a one-year high and the fact that most of the losses from the first three weeks of the month have been wiped out suggests there is a strong conviction behind the upward move. Combine that with developments in other markets, and the general shift to risk aversion, and there is little reason to step in the way of the current bullish trend in the currency pair.

Having said that, there are some notable technical hurdles that bulls may face in the session ahead. The 100-day moving average comes into play at 1.1052 and the 200-day moving average currently falls at 1.1098. In between the two moving averages, a horizontal level is seen at 1.1075.

To the downside, support is found at 1.1000 which is a level that acted as major support between November and January.

Bottom Line

Developments in other markets point to an acceleration in risk aversion while EUR/USD implied volatility has reached a one-year high. This type of scenario favors trend continuation strategies rather than mean reversion strategies.

Several areas of technical resistance come into play in the session ahead, buyers might look to step in at 1.1000 if the resistance areas trigger a pullback.

This article was originally posted on FX Empire

Yahoo News

Yahoo News